The good, the bad and the unknown: What’s happening to Bitcoin?

Should we be optimistic or pessimistic about Bitcoin’s future? If someone gives you a one word answer to that question – then beware. So, in trying to answer this question, we have to jump into the weeds, but we are confident that you will gain some important insights into the future of Bitcoin.

On-chain cost basis: Three implications

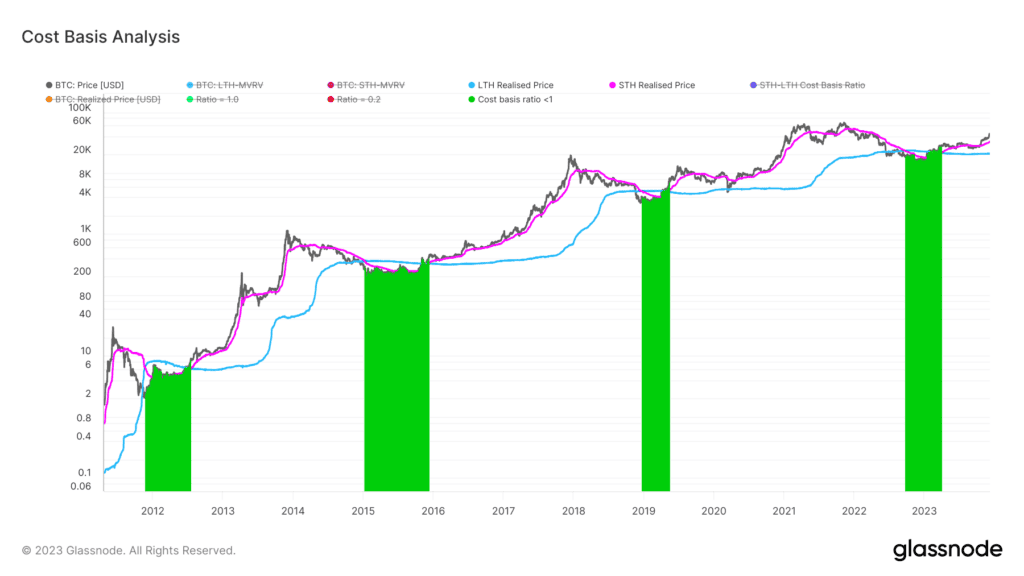

One of the on-chain valuation methodologies that we’ve talked about in previous reports is the utilization of realized price or on-chain cost basis’. In the chart below we can see Bitcoin’s price, overlayed with long term holders and short-term holders’ respective cost basis. This can be utilized in a few ways.

Momentum Indicator

Short term holders’ cost basis has historically served as a high time frame momentum indicator, serving as support in bull markets and resistance in bear markets.

Opportunity to invest in Bitcoin

In addition, whenever long term holders’ cost basis is below short-term holders’ cost basis has historically marked prudent opportunities to accumulate Bitcoin on a multi-year timeframe.

Short term traders feeling the heat?

While we saw short term holder cost basis reclaim that of long-term holders back in March 2023, which indicated that the multi-year lows may be in, Bitcoin broke below its short-term holder cost basis back in August, meaning those shorter-term market participants were under water and under pressure.

Past performance is not an indication of future results.

Long-term traders sticking with Bitcoin

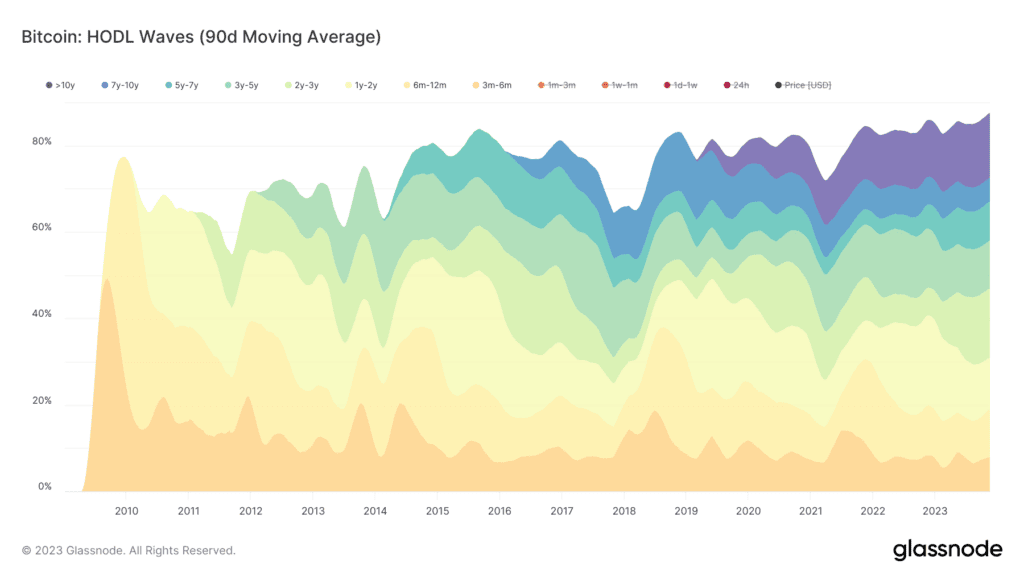

When we look at long term holders, the percentage of supply held by this cohort has continued to rise, and the amount of supply that hasn’t been moved in at least a year hit all-time time highs towards the end of 2023. This shows that despite the short term price decline that happened, longer term market participants were unshaken.

Past performance is not an indication of future results.

Mine baby, mine

The upcoming Bitcoin halving marks a pivotal moment for Bitcoin from a scarcity standpoint, as its stock to flow ratio will surpass that of gold.

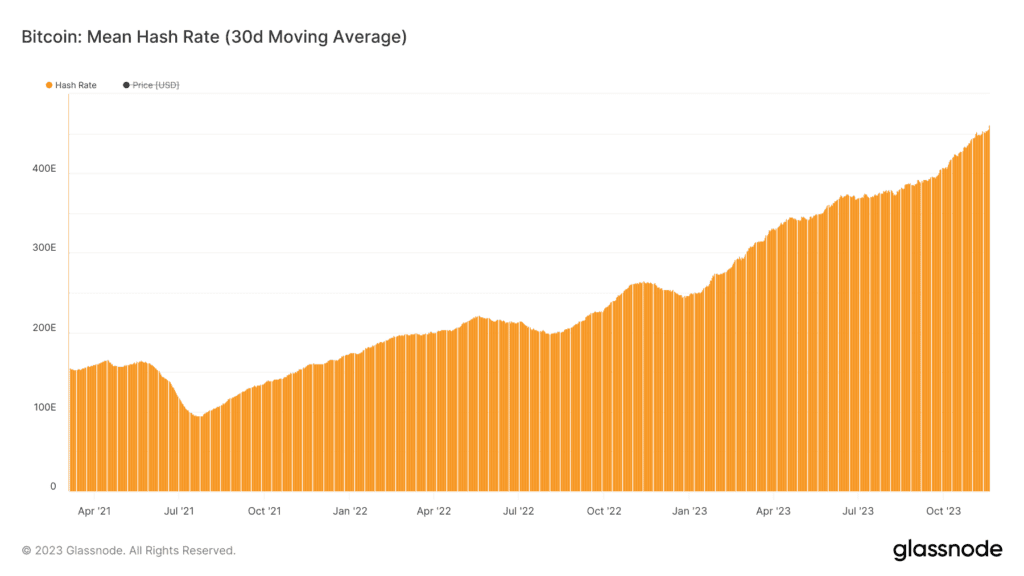

Looking at other fundamental metrics to gauge the health of the Bitcoin network, we can see that Bitcoin’s hash rate set another all-time high in July 2023, indicating increasing demand to mine the leading digital asset as well as more efficient mining rigs being plugged in.

Past performance is not an indication of future results.

Lastly, ordinal inscriptions, which exploded in March 2023, and surpassed the $15 million mark in August 2023, generated over $50 million in fees for the Bitcoin network.

While the initial excitement around ordinals (and transaction fees as a by-product) died down, ordinals are an interesting trend to keep an eye on for the Bitcoin network as a way to utilize Bitcoin’s block space.

Learn more about the Bitcoin Halving.

The material in this blog post was created exclusively for eToro by Reflexivity Research.