Major Crypto Developments for the week

- Solana Pay integrates with Shopify

- Critical vulnerability discovered in DeFi protocol Balancer’s V2 pools

- US government arrests Tornado Cash developers Roman Storm and Roman Semenov

- Stablecoin supplies reach lowest level since September 2021

- Opensea has made creator royalties optional

- Crypto SocialFi application Friend Tech crosses 4 million in fees generated, but transaction activity slumps down over 90% from its peak last week

- Coinbase acquires stake in USDC issuer Circle

Market Structure

The theme of this week’s weekly market update is stablecoins. Stablecoins are arguably the clearest product market fit of crypto to date, providing access to digital dollars for those around the world without access to banking infrastructure and/or regions of the world with rapidly devaluing currencies.

Today there are roughly $120 billion of stablecoins still in circulation. However, outside the use case of these digital dollars, stablecoin dynamics can also provide some interesting insight into the crypto market overall as well.

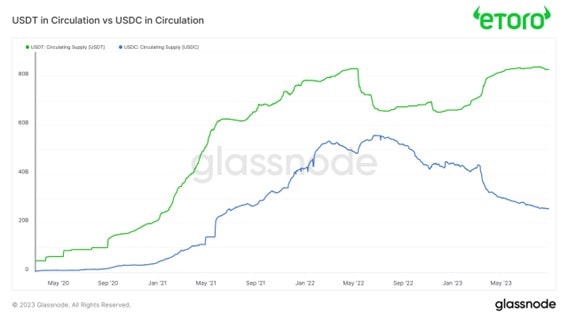

First, let’s set the stage by looking at the two largest stablecoins in crypto; USDT, issued by Tether, dominates the market at just shy of 70% of all stablecoins in existence, meanwhile, USDC, issued by Circle, sits at just 20%. Since the SVB banking crisis, when Circle ran into trouble as they held roughly 8% of their USDC reserves at SVB, there has been an interesting divergence between the circulating supplies of USDC and USDT.

Outside of the SVB scare for USDC, another factor that may be contributing to this divergence is the ease of access to US treasuries for US based firms using USDC, that are currently at multi-year high yields as yields in DeFi sit at par or lower. In other words, there is no risk premium for taking on the protocol risk of having stablecoins in DeFi; and until treasury yields come down or sustainable DeFi yields come about, this is unlikely to change for the foreseeable future. Last week Coinbase announced they strategically invested in Circle, which may potentially influence the trend in USDC’s circulating supply.

Past performance is not an indication of future results.

Paypal’s recently launched stablecoin crossed $40 million in circulating supply this week, which is still not even in the same ballpark as USDT or USDC; but given their massive distribution and role as a payment hub for the internet, is worth keeping an eye on.

Past performance is not an indication of future results.

As mentioned in the description of the first chart of USDT relative to USDC, stablecoins can be viewed as a liquidity gauge for the crypto market. When there are more stablecoins in circulation there is generally more capital on the sideline looking to purchase crypto assets and vice versa. Some may argue this is less true as funds/individuals may be choosing to hold dollars as dry powder instead of stablecoins, but the biggest driving factor is likely just a decrease in interest around the crypto market. Down from over $150 billion to $120 billion today, one metric to watch for a trend reversal in capital inflows represented through stablecoins is the 90 day change in aggregated stablecoin supplies.

Past performance is not an indication of future results.

While we have highlighted several metrics over the last few weeks that point to a high likelihood of the multi-year bottom being in for Bitcoin and other digital assets, one metric that paints a bearish picture is comparing the total crypto market capitalization to the market capitalization of USDT and USDC. In other words, this compares the size of the crypto market to the amount of dry powder looking to allocate to it on the sideline.

Over the last few years this metric has served as a prudent high time frame indication based on where it stands relative to the ascending channel that it has traded throughout the last few years. Currently at the bottom of the channel, this suggests that the total crypto market is large relative to the amount of dry powder on the sidelines represented by stablecoins. For the metric to push off of the lower bounds of this channel we need to either see the total crypto market cap decline or stablecoin market cap increase.

Past performance is not an indication of future results.

We hope you enjoyed this week’s crypto market update and look forward to touching base again next week! Thanks for reading.

The material in this blog post was created exclusively for eToro by Reflexivity Research.