Are AI and crypto made for each other?

Boosted by turmoil in the banking sector and falling inflation, Bitcoin has ripped more than 30% higher to make one of its biggest weekly gains in recent years.

The world’s largest cryptocurrency is now sitting proudly back above $27K, having successfully outperformed both the US stock market and the majority of altcoins in the last few days.

Close behind, Ethereum is also sitting on double-digit weekly gains ahead of the Shapella upgrade, while The Graph and Fetch.ai have both been lifted more than 10% by the release of ChatGPT4.

Read more after the jump.

This week’s focus

– Banking turmoil boosts Bitcoin 30% — is this the perfect macro backdrop?

– The Graph gains 15% as GPT4 release triggers AI token rally

– Ethereum up 10% as Shanghai date set — will the upgrade be bullish?

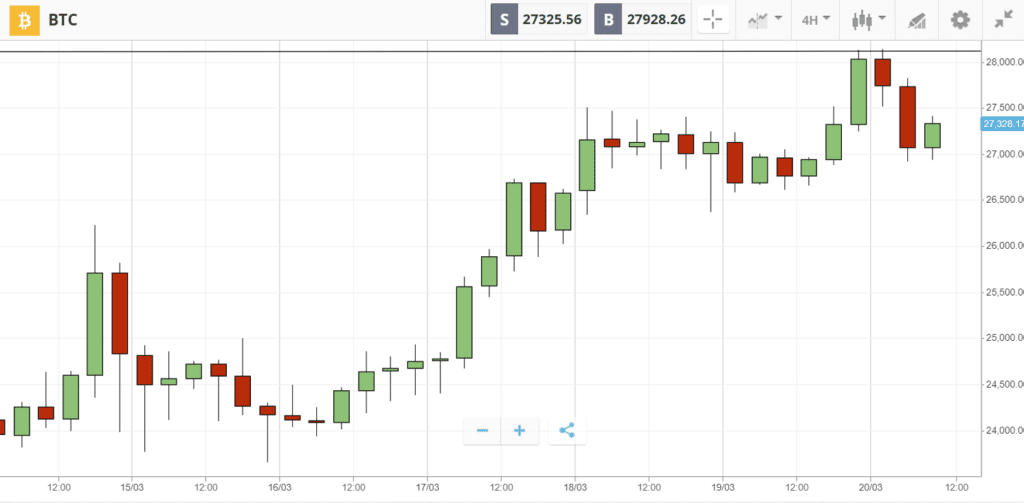

Banking turmoil boosts Bitcoin 30% — is this the perfect macro backdrop?

BTC is tapping against $28K

As cracks appear in the banking system across the US and Europe, Bitcoin is enjoying fresh appeal as a valuable safe haven asset.

The leading crypto leaped 30% higher last week, as Credit Suisse faced financial difficulties after a trio of American banks were shut down.

On Tuesday, the Swiss bank warned of “material weaknesses” in its finances, sending its shares tumbling to an all-time low. Yet they soon recovered as the Swiss central bank stepped in with a $54 billion loan.

Across the Atlantic Ocean, the Federal Reserve is also supporting banks with $300 billion in emergency funds — prompting widespread speculation that Chairman Jerome Powell will stop hiking interest rates to avoid further destabilizing the banking system. As Mechanism Capital analyst Andrew Kang points out, such a change in monetary policy would be likely to support the crypto market. He tweeted on Wednesday that “the macro backdrop for Bitcoin has never been more perfect”.

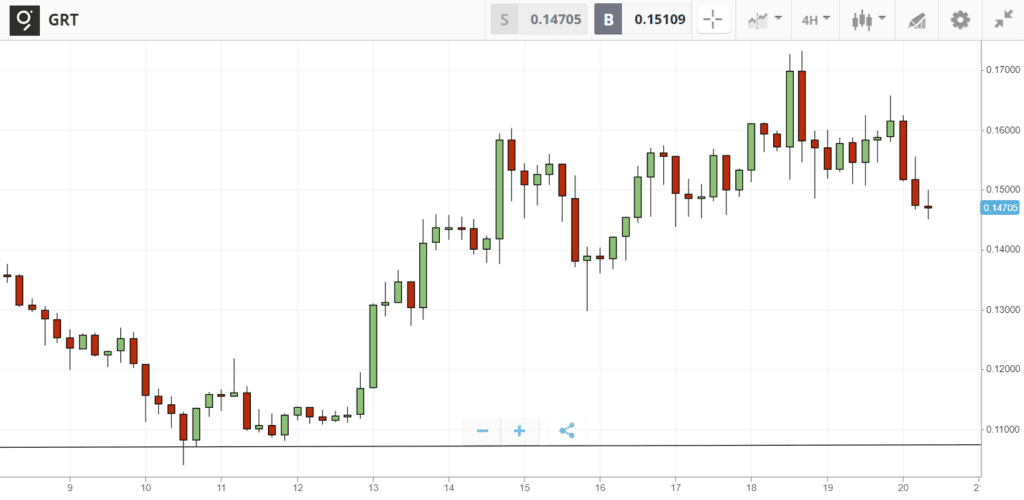

The Graph gains 18% as GPT4 release triggers AI token rally

GRT has rallied from just over $0.11 to 0.15 in the last week

The battle for artificial intelligence supremacy intensified last week, as Open AI released its latest chatbot tool, and Microsoft and Google announced AI integrations for Office365 and Google Docs.

At the same time, AI tokens are also picking up the pace. The Graph, a crypto project that uses machine learning to search blockchains, gained almost 20% last week on the growing interest in AI. This was matched by similar gains for Fetch.ai, a decentralized machine learning platform that uses artificial intelligence to help people automate everyday tasks.

Looking ahead, these projects could be at the center of what is widely expected to be a complementary relationship between AI and crypto. According to law professor Antonio Merchán Murillo, this could see blockchain being used as a single source of trusted knowledge to underpin AI-assisted legal activity.

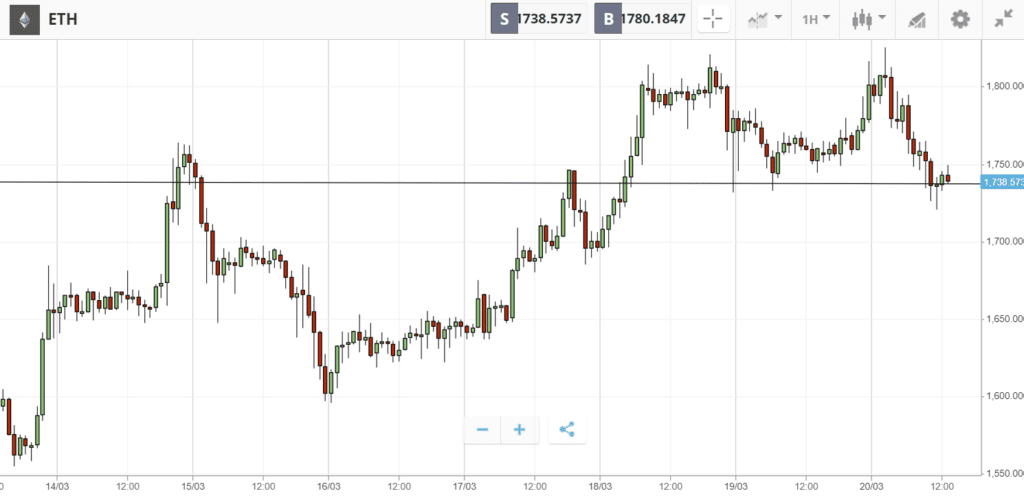

Ethereum up 10% as Shanghai date set — will the upgrade be bullish?

ETH briefly surpassed $1,800 before testing support around $1,750

Ethereum has risen 10% to tap $1,800, after the final dress rehearsal for the Shanghai-Capella (Shapella) upgrade was successfully executed on the Goerli test network last Tuesday.

Shortly afterwards, the developers set the date of April 12th for the final upgrade to be executed on the Ethereum mainnet.

At this moment, the blockchain is supposed to begin processing unstaking requests, enabling anyone to withdraw previously locked ETH. This is expected to reduce the risk of staking on the network, which according to Placeholder VC partner Chris Burniske, could ultimately increase the amount of ETH staked, helping to support the price.

Ethereum currently has a relatively low staking ratio, at ~15% compared to other top proof-of-stake networks such as Solana and Cardano with around 70%, according to market data provider Staking Rewards.

In the weeks ahead, Burniske expects this to change as more ETH holders lock up a greater percentage of the supply. He tweeted on Friday that we could “expect the % of $ETH staked to 2-4x in the quarters following [Shanghai].”