There is gold and there is Bitcoin

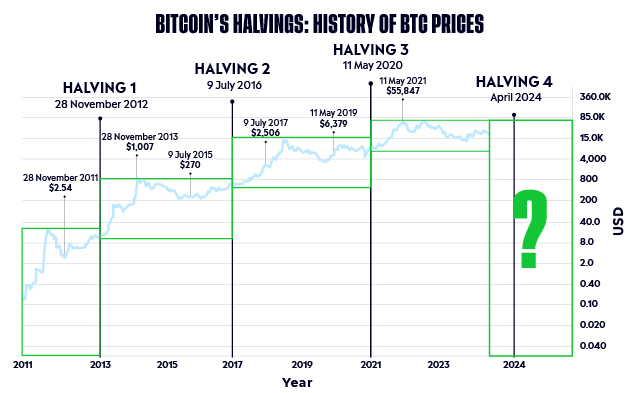

The Bitcoin halving will be sometime in mid-April; just a few months away.

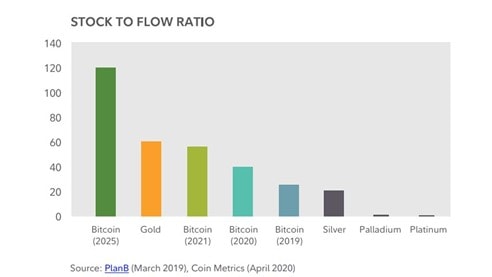

Bitcoin’s supply halving will cause Bitcoin’s stock to flow ratio, which is a comparison of an assets supply issuance relative to its current circulating supply, above that of gold. This reflects just how scarce Bitcoin is becoming as a decentralized alternative to gold. This chart below from a Fidelity report on Bitcoin shows how Bitcoin will be superior to gold on a stock to flow basis after its upcoming halving.

Past performance is not an indication of future results.

The Up-Cycle of Bitcoin

Looking at Bitcoin’s price performance broken down by year, we can see a clear pattern to date. Bitcoin’s down years have all come two years after the halving (2014, 2018, 2022) with the year before the halving, of the halving, and after the halving all being positive. The year after the halving has been the best performing set of years on average.

Past performance is not an indication of future results.

What is realized capitalization?

Given the transparent nature of blockchains as an immutable ledger, we can gain insights into the activity/behavior of network/market participants in ways that are not possible when analyzing traditional assets.

One of the most important concepts to understand when analyzing the Bitcoin blockchain is realized capitalization. As opposed to traditional market capitalization which is calculated by taking the current marginal trading price multiplied by the total outstanding supply of Bitcoin, realized capitalization is calculated by multiplying each Bitcoin by the price that they were last moved. This allows us to get a more accurate measure of the amount of value that is stored in the network and capital flows more broadly.

Basically, there is a high likelihood that the halving will have a major impact on the crypto market.

Learn more about the Halving.

The material in this blog post was created exclusively for eToro by Reflexivity Research.