Major developments for the week:

- Launch date of spot ETH ETF moves up to July 2

- SushiSwap introduces Sushi Labs and multi-token ecosystem

- Arbitrum gaming grant proposal passes

- Bitcoin ETF products see net outflows of approx $600M

- SEC’s head of cryptoassets and cyber unit leaves after 9 years

- Sol Foundation removes operators from its delegation program following sandwich attack involvement

- MicroStrategy to buy yet more BTC: announces private offering plan of $500M

Anticipated spot Ether ETF launch date moves up to July 2

One of the major news updates of the week came from Bloomberg analyst Eric Balchunas in which he stated the estimated launch date for the spot ETH ETF has been moved up to July 2nd. The SEC staff has sent comments on the S-1 filings to issuers, which are relatively minor, with a one-week turnaround requested. Based on this he suspects there is a possibility that the SEC will finalise the filings the following week, before the holiday weekend. This update follows Gary Gensler’s previous indication of a “sometime in summer” launch, offering a more specific timeline.

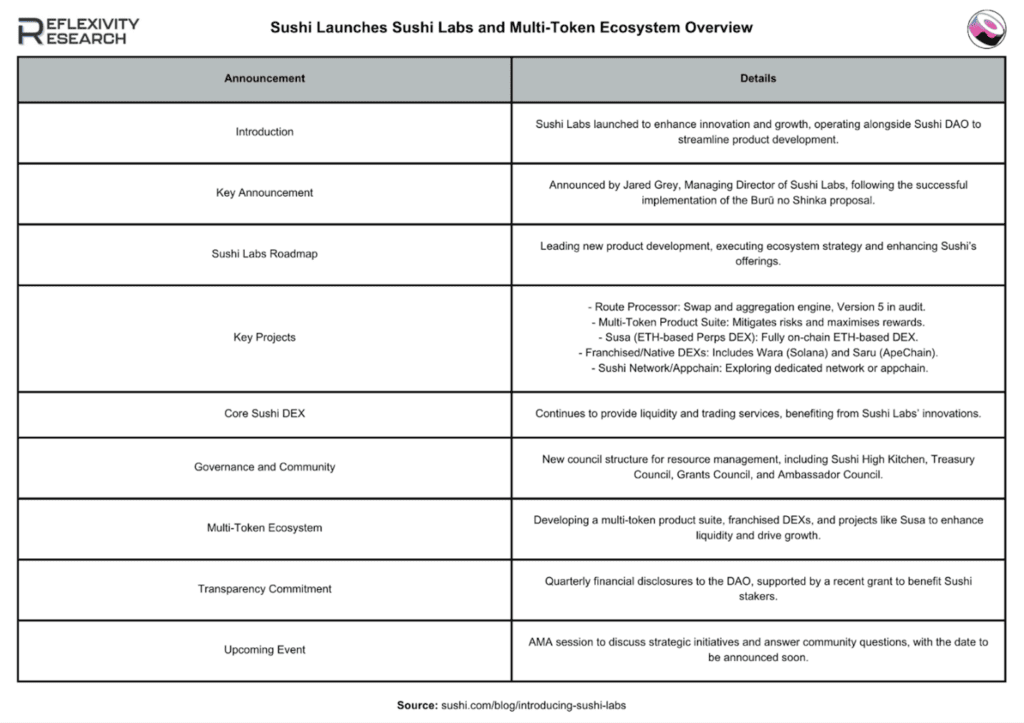

SushiSwap introduces Sushi Labs and a multi-token ecosystem

In other news last week, Sushi has launched Sushi Labs and a multi-token ecosystem to drive innovation and efficiency alongside the Sushi DAO. Announced by Managing Director Jared Grey, following the Burū no Shinka proposal, Sushi Labs will lead product development with key projects like the Route Processor (Version 5 in audit), a multi-token product suite and Susa, an ETH-based perpetuals DEX. Additionally, Sushi is developing tailored DEXs for specific blockchains, such as Solana and ApeChain and exploring a dedicated network for DeFi products. A new council structure will manage resources and quarterly financial disclosures will enhance transparency.

The Arbitrum gaming grant proposal has been passed

Another interesting development came from Arbitrum last week in which an approval to spend 225 million $ARB over three years to support gaming projects passed.

- Proposal Overview: Initiated by Vela Exchange co-founder Dan Peng, the Gaming Catalyst Program (GCP) aims to boost the visibility and adoption of Arbitrum, Orbit and Stylus among developers and gamers.

- Voting Outcome: The proposal was approved with over 75% support, backed by entities such as L2Beat, Wintermute and Treasure DAO.

- Funding Allocation: The program will provide grants and investments up to 500K ARB (approximately $484K) for both new and established developers, infrastructure bounties and operational costs. Up to $25M is allocated for the GCP team’s daily operations.

SEC’s head of cryptoassets and cyber unit leaves after 9 years

Head of the Cryptoasset and Cyber unit at the SEC’s Division of Enforcement, David Hirch, has left the agency after nearly a decade of service.

Hirsch played a key role in the SEC’s enforcement actions against many major crypto firms. Under his leadership, the SEC aggressively targeted unregistered securities offerings, fraud, and market manipulation within the crypto sector. Last year, he warned of imminent enforcement actions against improperly registered crypto firms.

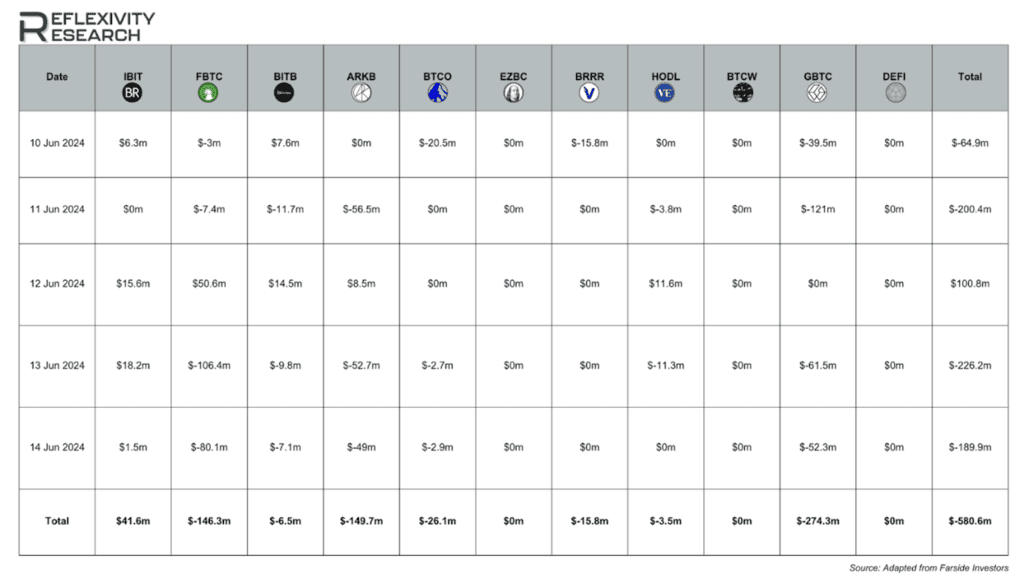

Bitcoin ETF products see net outflows of approximately $600M

Last week the Bitcoin ETF IBIT recorded the highest net inflow of $41.6 million, contrasting sharply with the significant net outflows from ARKB and GBTC, which lost $149.7 million and $274.3 million respectively. The most substantial daily outflows occurred on June 11th and 13th, with net changes of $-200.4 million and $-226.2 million, driven by major outflows in FBTC, GBTC and ARKB. IBIT showed consistent positive inflows on most days, whereas EZBC, BTCW and DEFI showed no net changes, indicating inactivity. This period underscores significant volatility, with major outflows in FBTC and GBTC overshadowing the few positive inflows, particularly impacting the overall balance.

This outflow is the largest since March 22, 2024 and is likely driven by a more hawkish-than-anticipated FOMC meeting, which led investors to reduce their exposure to fixed-supply assets.

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.