Major crypto developments for the week:

- Check out the latest BTC etc podcast! “Exploring causes behind Bitcoin’s soaring value”

- Solana Total Value Locked (TVL) continues to rise, closing in on $600 million

- ETH L2 scaling solution Blast goes live, attracting $400M+ in TVL within 4 days

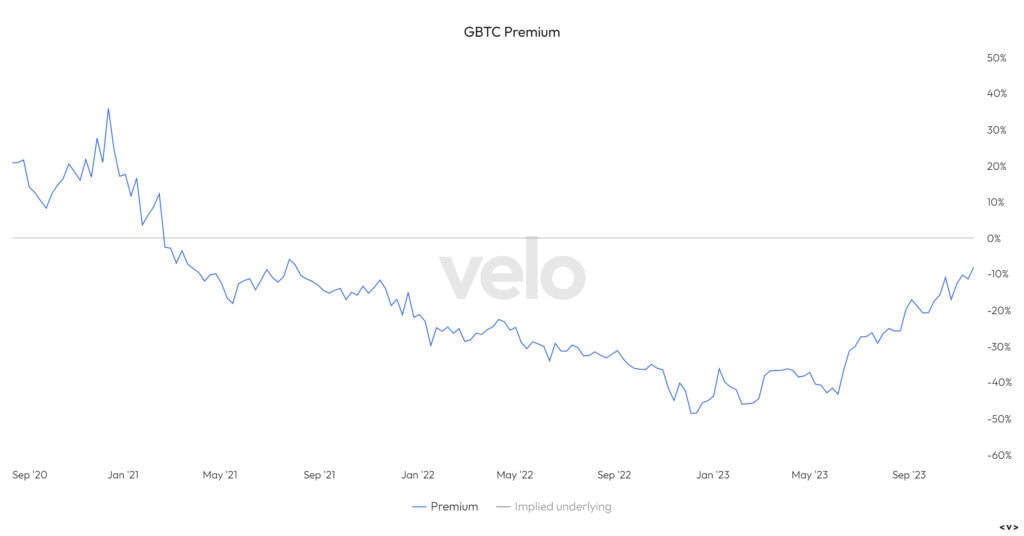

- GBTC discount to net asset value dips below 10% for the first time since mid-2021

- Crypto structured products see yearly record weekly inflows of roughly $350 million, highest since 2021

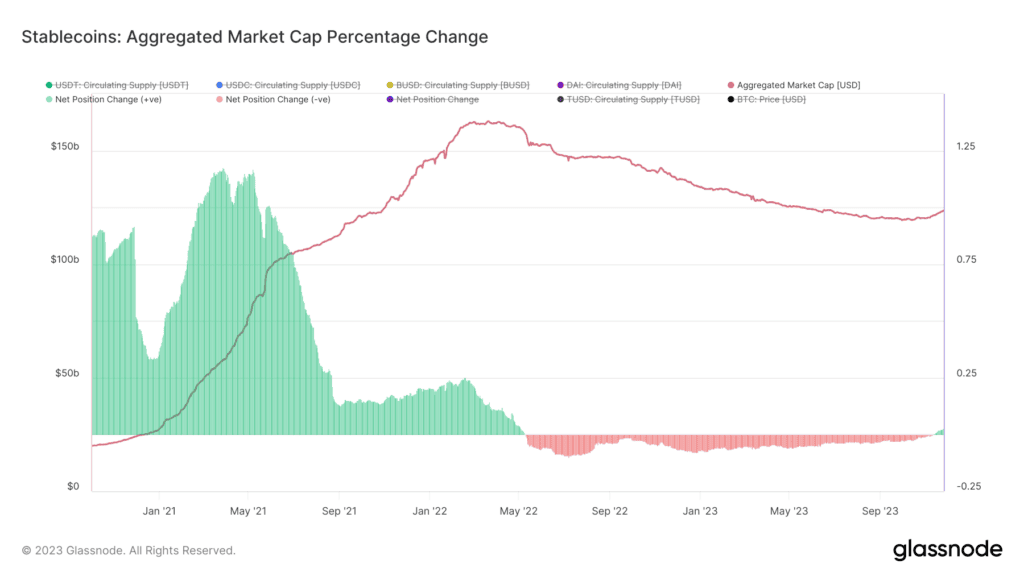

- Stablecoin supply growth continues, now up $2.2 billion (2.8%) over the last two weeks

Solana TVL Continues to Grow

It is no secret that Solana has been the best performing large cap cryptoasset of the year, up nearly 6x from its lows reached during the end of 2022 after the collapse of FTX. Throughout its price recovery, one trend we’ve seen is the recovery of the amount of total value locked on the Solana network. Partially a bi-product of price action, the USD denominated total value locked on SOL is nearing $600 million; a benefit to DeFi protocols within its ecosystem.

Past performance is not an indication of future results

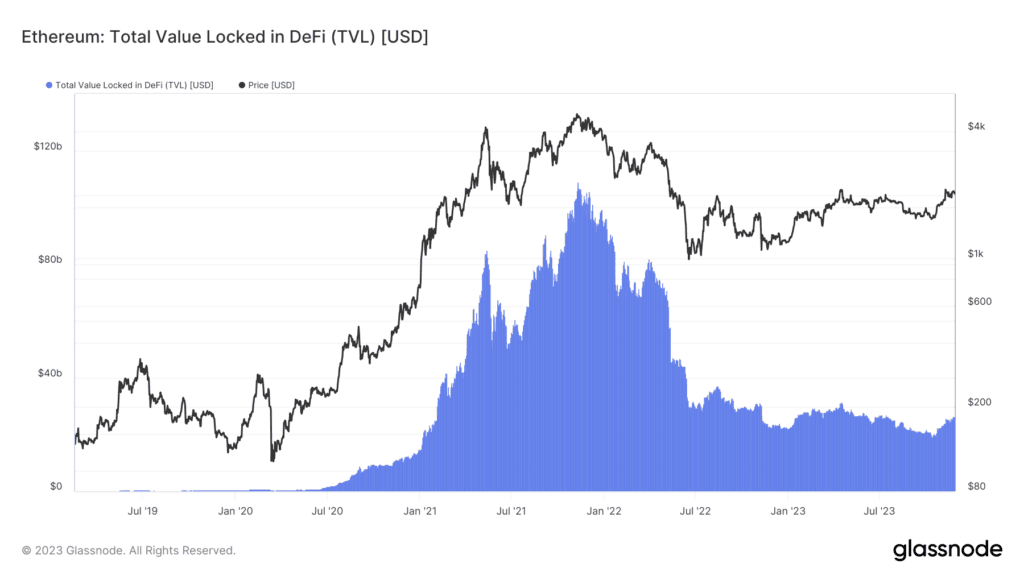

To put this into perspective, total value locked on Ethereum sits at just shy of $26 billion across its entire ecosystem, as shown in the chart below.

Past performance is not an indication of future results

ETH L2 scaling solution Blast goes live, attracting $400M+ in TVL within 4 days

One of the most controversial developments of the week was the launch of Blast, an Ethereum L2 scaling solution launched by NFT marketplace Blur’s founder “Pacman”. Blast claims to be the first ETH L2 with native yield, allowing individuals to put their ETH and stablecoin assets on Blast to work through protocols such as Lido and MakerDAO through its “auto-rebasing” stablecoin, USDB. There are some that have expressed security concerns around Blast’s multi-signature setup, with all of the wallets associated with the multi-set being relatively new and unknown; potentially signaling centralizing risk. Nonetheless, seeing the L2 garner $400 million of TVL in just four days speaks to the current state of the crypto market, with many market participants eager to pile capital into newly launched protocols.

GBTC discount to NAV dip could indicate pro-ETF approval sentiment

We’re seeing the Grayscale Bitcoin Trust’s discount to net asset value (NAV) continue to close in. GBTC’s discount to NAV is now less than 10%. While this may partially represent demand to get Bitcoin exposure, this largely reflects sentiment towards the likelihood of a Bitcoin ETF getting approved, and GBTC’s conversion into an exchange traded fund that would trade at par with the underlying Bitcoin that it offers exposure to. Combined with the inflows shown in the previous chart and price action from crypto proxies, it is clear that traditional financial firms have the ETF trade put on and are placing a high likelihood of approval by the January 10th deadline.

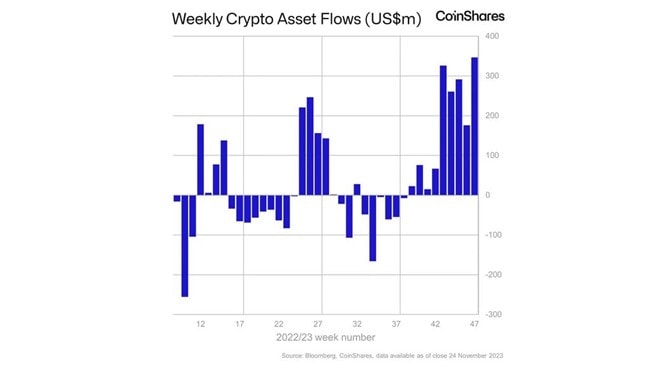

Crypto Structured Products See Yearly Record Weekly Inflows

This week structured digital asset funds saw the highest week of inflows of the entirety of 2023 at $343 million, according to CoinShares. There are two ways to interpret this; on one hand this may signal euphoria around ETF-front running, on the other, a potential prelude of continued institutional demand for digital assets to come.

Source: CoinShares

Past performance is not an indication of future results

Past performance is not an indication of future results

Stablecoin supply growth continues, now up $2.2 billion over the last two weeks

In prior weekly updates one metric that we placed a great deal of importance on was the 90 day change in aggregated stablecoin supplies. This looks at the percentage change in the total number of stablecoins in circulation. Due to the minting of USDT, after flipping positive two weeks ago, we’ve seen continued growth in stablecoin supplies. Over the last two weeks aggregated stablecoin supplies are now up $2.2 billion, a 2.8% increase over the last 90 days. Increasing stablecoin supplies means that on-chain liquidity is improving and there is more capital in the crypto economy to be deployed into directional bets on crypto tokens as well as in yield strategies within DeFi.

Past performance is not an indication of future results

Exploring causes behind Bitcoin’s soaring value – the latest BTC etc podcast is live!

Listen to Pomp and Will discussing how Bitcoin is more scarce than gold and how “more suits than hoodies” now best describes Bitcoin investors. 🎧 Listen now

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.