Major Crypto Developments for the week

- VISA announces integration of Solana for stablecoin payment pilot program

- SEC delays multiple Bitcoin spot ETFs

- Ark Invest files for an ETH spot ETF

- Ripple acquires custodian Fortress

- FASB approves marked to marked accounting rule for companies holding Bitcoin/crypto on their balance sheet

Upcoming Catalysts

- dYdX is rumored to be launching their v4 by the end of September, which will migrate the DYDX to their native blockchain and include value accrual from trading activity to the token

- Polygon zkEVM mainnet beta will undergo an upgrade called Dragon Fruit that will enable to network to operate with EVM equivalence

- Aptos ($APT) set to unlock 2% of circulating supply worth roughly $25 million on September 12th

VISA announces integration of Solana for stablecoin payment pilot program

One of the most exciting developments of this week was from VISA, announcing that they are going to be utilizing the Solana blockchain’s high transaction throughput for USDC-based cross-border stablecoin transactions.

In the announcement, VISA stated that they are one of the first financial/payment institutions to integrate the Solana blockchain at scale. This is not VISA’s first time dabbling in crypto, as the payment giant previously ran a pilot program with crypto.com in 2021, utilizing Ethereum blockchain to enable stablecoin-tied payments made with crypto.com VISA cards. According to the head of crypto at VISA, “By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we’re helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury”.

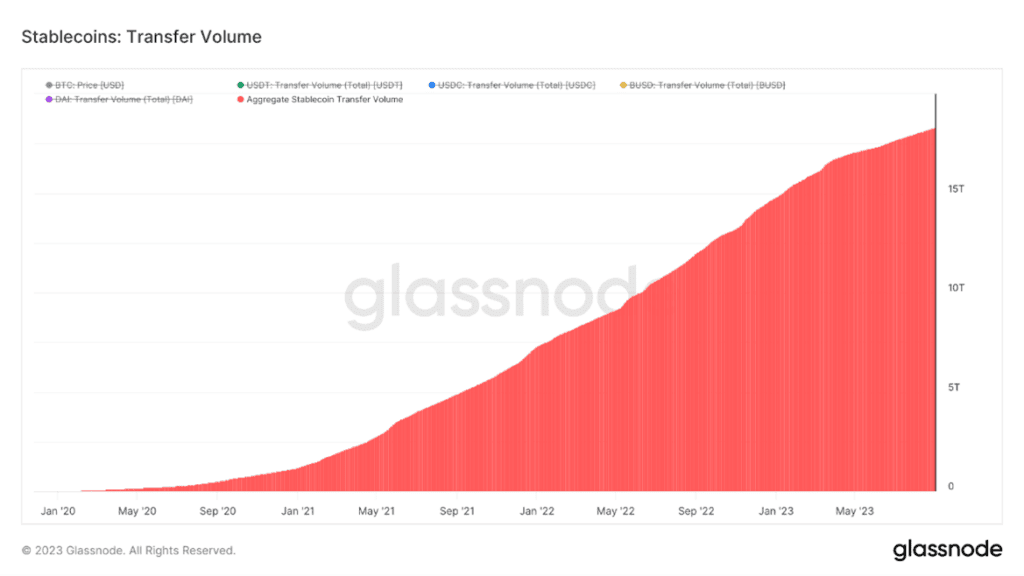

This move continues to solidify stablecoins as one of the clearest findings of product market fit for crypto, which have now crossed over $18 trillion in cumulative settlement.

Past performance is not an indication of future results.

SEC delays multiple Bitcoin spot ETFs, Ark Invest files for an ETH spot ETF

Last week, to the surprise of few, the SEC’s decisions on several Bitcoin spot ETF applications were delayed once again. The table below, from head ETF analyst at Bloomberg Eric Balchunas, shows important dates to watch out for regarding major Bitcoin ETF applications.

The next batch of deadlines comes in mid-October. Ultimately, the most important dates, which are the final deadlines, all come in Q1 of 2024; with the earliest (Ark Invest/21Shares) coming on January 10th. In addition, another big development in the ETF world was Ark Invest filing for an Ethereum spot ETF in partnership with 21Shares.

Source: Eric Balchunas, Bloomberg

Past performance is not an indication of future results.

FASB Approves Favorable Crypto Account Rule

Another major development for the crypto industry that went under the radar this week was the Financial Accounting Standards Board (FASB) approving a favorable crypto accounting law that allows firms to mark their holdings to current fair market value on their balance sheet. In a meeting last week, the FASB gave staff permission to draft up a final copy for the new standard, which is expected to be officially voted on and approved by the end of this year and would go into effect after December 15, 2024. This move is one step closer to enabling broad adoption of Bitcoin and digital assets for corporations.

We hope you enjoyed this week’s crypto market update and look forward to touching base again next week! Thanks for reading.