Major Developments for the Week

June sees a rise in Bitcoin mining profitability post-halving.

- Germany relocates an additional $28M in Bitcoin

- TRON threatens Ethereum’s revenue dominance.

- Flare Network enhances cross-chain connectivity with LayerZero.

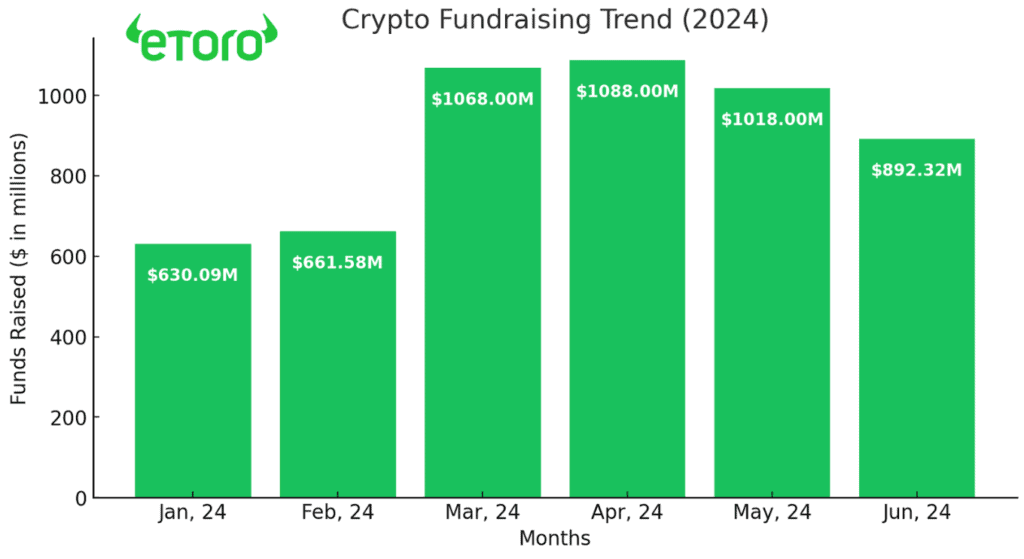

- Crypto venture capital funding hits $3.2 billion in Q2.

- Fidelity and Sygnum bank on Chainlink for digital asset integration.

- Web3 users reach an all-time high of 10 million in Q2.

- Tangem wallet integrates Visa for crypto payments.

- Celo has introduced its Layer-2 Testnet named Dango

Bitcoin

Bitcoin Selling Pressure Continues

The German government recently transferred Bitcoin worth over $28 million to two large crypto exchanges, with a further 500 BTC sent to an unidentified address. This activity involves part of Germany’s Bitcoin holdings totaling 38,826 BTC ($2.2B), primarily seized from criminal cases. The broader market feels pressure from ongoing Bitcoin sell-offs related to the large BTC holders, such as Germany and the US, pushing BTC below $60,000.

Increased Mining Profitability in June

Following the recent Bitcoin halving, mining profitability notably increased in June. This adjustment reflects a positive shift in the economics of mining operations, where reduced block rewards lead miners to optimize operational efficiencies and potentially invest in more sustainable technologies. Hardware efficiency and power cost management have become pivotal in maintaining profitability.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

Smart Contract Platforms

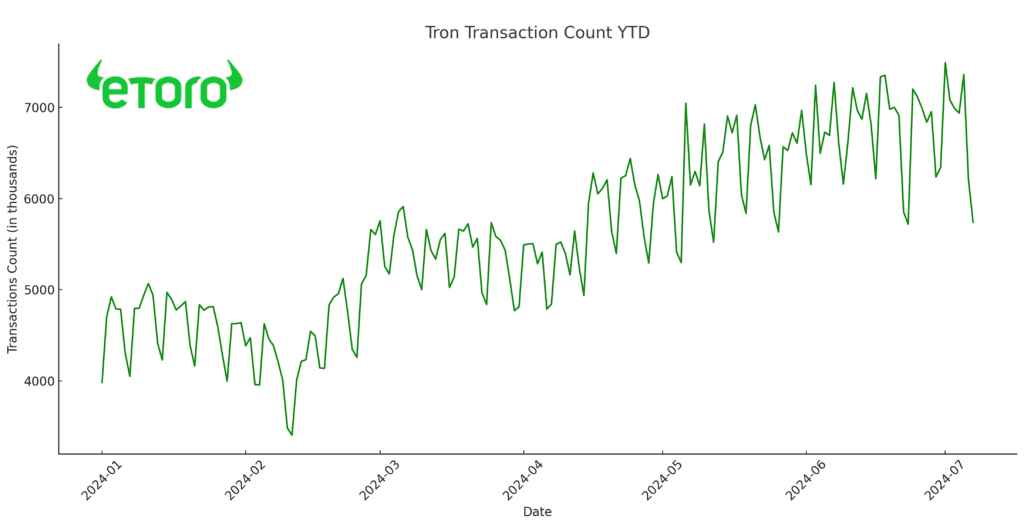

TRON now a serious contender to Ethereum’s smart contract domination

TRON is rapidly emerging as a formidable contender to Ethereum’s dominance in the smart contract platform space after Ethereum’s gas fees recently plummeted to multi-year lows. With innovative revenue models and aggressive market strategies, TRON is attracting new developers and threatening to carve a significant niche in the smart contract market, traditionally dominated by Ethereum. The below graph indicates this, showing Tron’s smart contract transaction count, year to date.

Past performance is not an indication of future results

Flare Network’s Strategic Expansion

Flare Network is making substantial strides in enhancing interoperability among blockchain platforms. By leveraging LayerZero, Flare aims to connect with over 75 different blockchains, facilitating seamless cross-chain communication and transactions, which could revolutionize how decentralized applications operate across diverse networks.

eToro’s @Scalable-Crypto Smart Portfolio provides an opportunity to invest in leading smart contract platforms, including those like Flare Network that are at the forefront of blockchain interoperability and scalability solutions.

DeFi and TradFi

Surge in Crypto Venture Capital Funding

The second quarter of 2024 saw a surge in venture capital funding within the crypto sector, amounting to $3.2 billion. This influx of capital indicates robust confidence among investors regarding the future of cryptocurrencies and blockchain technology despite the volatile market conditions.

Past performance is not an indication of future results.

Source: Messari

Tangem’s Innovative Crypto Payment Integration

Tangem, known for its hardware wallets, has now integrated Visa payments, bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi). This integration allows users to make direct crypto payments using their Tangem wallet, enhancing the practical usability of cryptocurrencies in everyday transactions.

The @DeFiPortfolio Smart Portfolio by eToro capitalizes on these trends, offering investors exposure to a mix of assets in both DeFi and traditional financial sectors, reflecting the convergence of these two worlds and the growing investment in blockchain-based financial solutions.

Web3

Fidelity and Sygnum Utilize Chainlink for Better Integration

In a significant development for Web3, Fidelity Investments, and Sygnum Bank have partnered with Chainlink to enhance their capabilities in digital asset integration. This partnership aims to leverage Chainlink’s decentralized oracle network to create more robust and reliable financial products within the Web3 ecosystem.

Record highs in June for Web3 user engagement

Web3 platforms have experienced unprecedented growth, reaching 10 million users in Q2 of 2024 alone. This milestone underscores the expanding influence and adoption of decentralized applications (DApps), highlighting a significant shift in user engagement and platform development within the Web3 space.

The @Web3Applications Smart Portfolio by eToro is ideally positioned to benefit from this surge in Web3 user engagement. It offers investors a tailored investment strategy that aligns with the burgeoning growth and adoption rates of DApps and related technologies.