Will it compete with bank payment networks?

The altcoin market is heating up, with Chainlink, Synthetix and Stellar leading the charge on growing adoption and new products.

Meanwhile, Bitcoin and Ethereum are cooling off. Both of the major cryptoassets have drifted sideways over the last few days to show low percentage losses.

Read more after the jump.

This week’s focus

– Payments adoption boosts Stellar 12%

– Synthetix rises 4% on release of new frontend — will it boost revenue?

– Institutions remain bullish as Bitcoin slips below $30K

– Chainlink rallies 22% on release of Cross Chain Interoperability Protocol

Payments adoption boosts Stellar 12%

A sudden vertical jump briefly took XLM to prices not seen since April 2022

The world of traditional finance was shaken up this week as the ‘FedNow’ payment network for banks went live, marking what eToro Global Strategist Ben Laidler called the “biggest upgrade since the 1970s.”

This new network is designed to help make everyday payments faster and more convenient, offering functionality that crypto supporters have long championed.

Some expect, therefore, that the service could increase friction between the conventional financial system and payments-focused cryptoassets. But the recent performance of Stellar suggests the opposite.

Stellar has risen 12% on the week, amidst speculation from Twitter commentators like Altcoin Hero that it could be used to “facilitate the blockchain aspect of the new FedNow Payment System.”

In addition, the cryptoasset could also be benefiting from news of a recent partnership. Last week, Stellar revealed a collaboration with cross-border remittance app HoneyComb, which enables anyone across Kenya, Uganda, Tanzania, Nigeria, Ghana, and the UK to withdraw cash from USDC balances on the blockchain.

Synthetix rises 4% on release of new frontend — will it boost revenue?

SNX is pushing towards the next critical resistance level at $3

DeFi giant Synthetix is setting its sights on new horizons, with the release of a project that aims to compete with large exchanges.

The price is up 4% on the week after founder Kain Warwick published a blog post revealing his intention to introduce a new derivatives front-end called Infinex to Sythnetix’s decentralized trading infrastructure. This will offer features similar to traditional exchanges, but be accessed on-chain as a DeFi protocol.

Some analysts expect the project to contribute significantly to Synthetix’s revenue, which hit headlines last month on reaching over $1.02 million in a single day.

Tweeting on the topic last week, Twitter commentator theeth.merge said: “Synthetix Perps v2 was released at the start of the year. Revenue started really popping in March…think about where we will be in 5 years”.

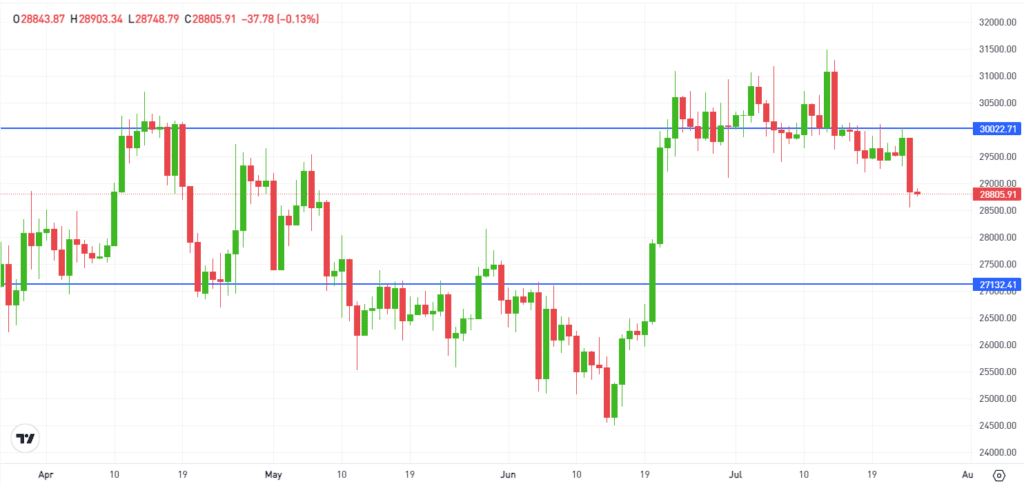

Institutions remain bullish as Bitcoin slips below $30K

BTC has fallen below $30K towards the next support level at $27K

Bitcoin has fallen slightly below $30K as institutions continue to move into the market.

The SEC has now accepted eight spot Bitcoin ETF applications for review, with filings from BlackRock, BitWise, Fidelity, WisdomTree, VanEck, Invesco, Proshares, and Valkyrie all set to be processed.

Meanwhile, other Bitcoin exchange-traded products outside of the US are enjoying newfound popularity. Since BlackRock filed for a spot-based ETF on June 15, the BTC-equivalent exposure of ETPs listed worldwide has increased by 25,202 BTC ($757 million), according to data from K33 Research, marking the second-highest monthly net inflow ever.

This institutional interest has also been noted by analysts at Ark invest, who recently wrote that “increased balances on OTC desks suggest institutions and other large capital allocators are focused increasingly on Bitcoin”.

Chainlink rallies 22% on release of Cross Chain Interoperability Protocol

LINK is quickly climbing towards double digits

Chainlink jumped 22% on Thursday, notching its biggest single-day rally in more than two years on the release of its long-awaited Cross Chain Interoperability Protocol (CCIP).

As a cross chain communication protocol, Chainlink’s CCIP meets the need for growing numbers of different blockchains to communicate with each other. This includes the likes of Ethereum and Avalanche, which are two of the most popular blockchains that it connects.

As users who pay for CCIP transaction charges using Chainlink are offered a reduced rate, analysts expect the popularity of this infrastructure to translate into value for the token. This was highlighted by analysts at Blockworks Research, who recently wrote that “It will be interesting to track Chainlink’s protocol revenue as more projects establish CCIP integrations.”