Major crypto developments for the week:

- MVRV shows that on a multi-year view, Bitcoin is still far from being overvalued

- Bitcoin enters top 10 largest global assets by market cap

- Blackrock seeds ETF with $100K, confirms high likelihood of ETF approval

- Bitcoin soars to $44K, registers historic positive weekly returns before correcting

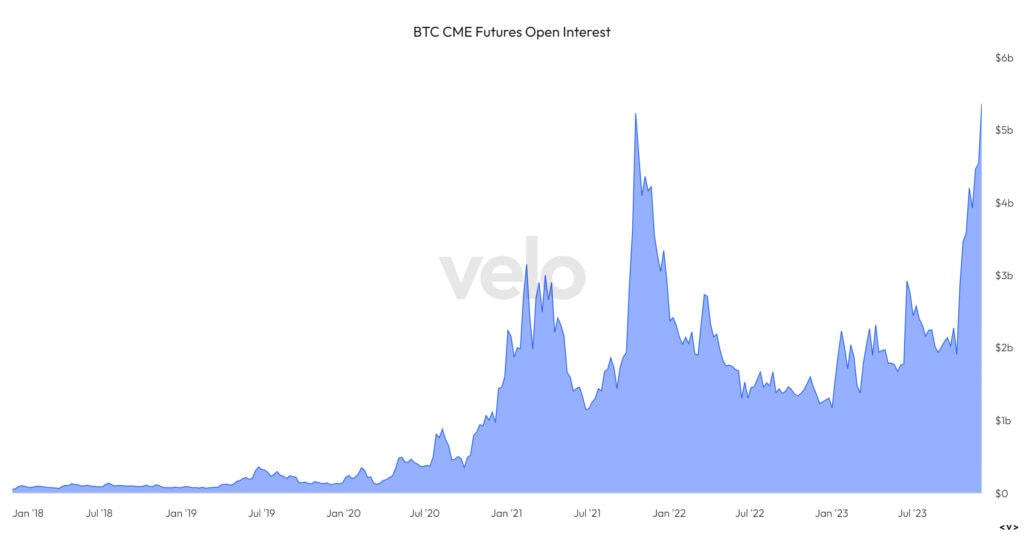

- CME futures open interest for Bitcoin reaching all time highs of over $5 billion

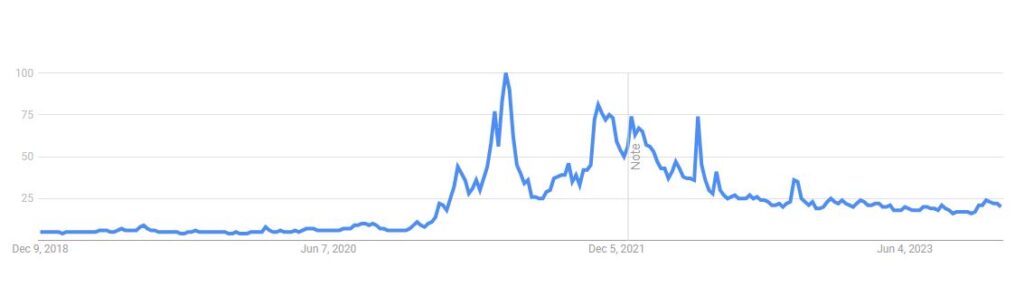

- Google search trends show lackluster retail exuberance in crypto market

MVRV shows that on a multi-year view Bitcoin still far from “overvalued” territory

It is worth keeping in mind that Bitcoin historically has undergone multiple 30%+ corrections throughout multi-year price runs such as 2013, 2017, and 2017. However, with this being said, zooming out we can see that Bitcoin remains far from overheated levels of valuation that marked cyclical peaks in 2013, 2017, and 2021. It’s worth maintaining this perspective while also understanding Bitcoin’s tendency for high volatility which includes aggressive corrections.

Past performance is not an indication of future results.

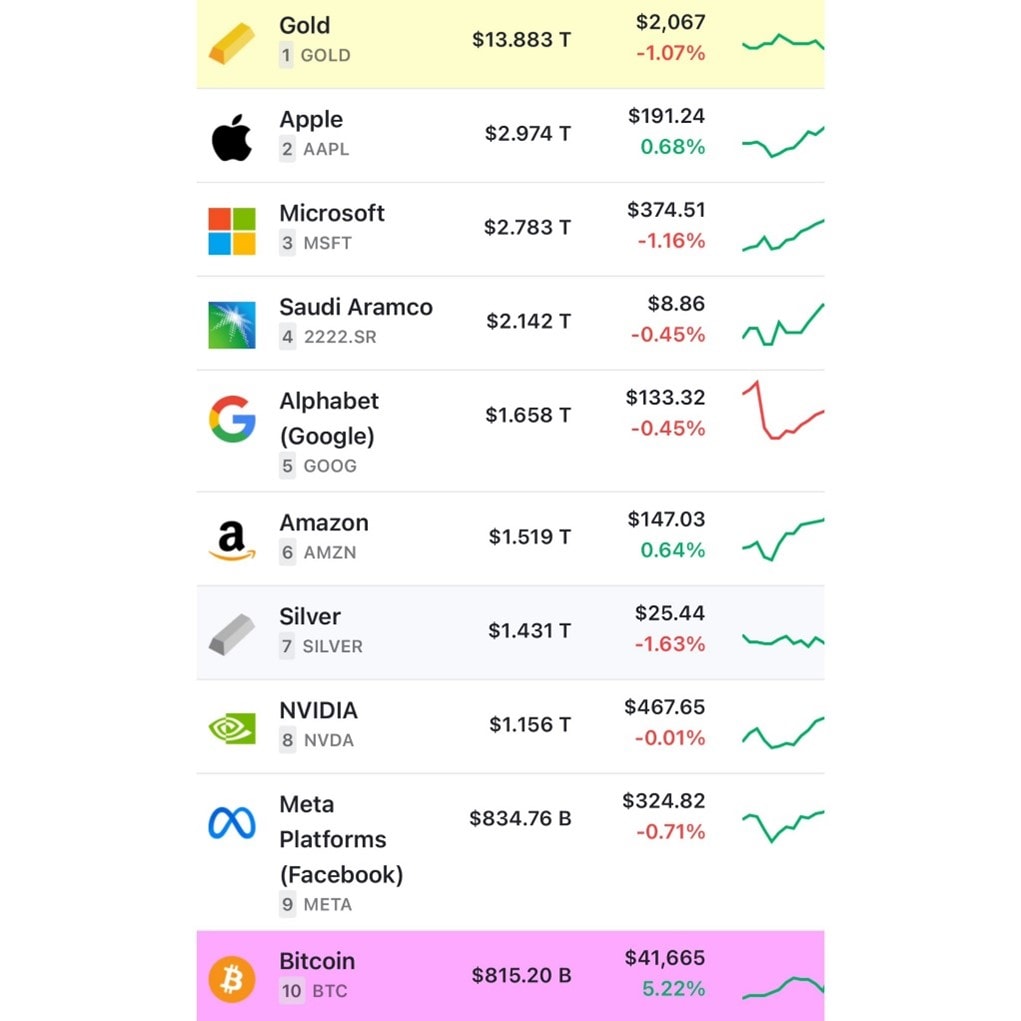

Bitcoin enters top 10 largest global assets by market cap

With Bitcoin’s recent price action to the upside, the leading digital asset crossed back into the top 10 largest assets by market capitalization. Breaching $800 million in market capitalization, Bitcoin surpassed the #10 slot and now sits behind other major assets such Gold at ~$14 trillion, Silver at $1.5 trillion, and Apple at $3 trillion. This reflects Bitcoin’s growing relevancy and legitimacy as a global macro asset.

Past performance is not an indication of future results.

Did you know? Most of the top 10 companies are involved in the Bitcoin ecosystem. eToro @BitcoinWorldWide Smart Portfolio allows investors to capture the entire Bitcoin value chain in a single click and invest in assets such as $BTC and $NVDA.

Blackrock seeds ETF with $100K, more evidence of ETF approval likelihood

This week we got further color on developments around the anticipated Bitcoin ETF. In Blackrock’s most recent updated filing it was revealed that they had received seed funding for their potential ETF. In the context of an ETF, seed funding refers to the initial capital allocated towards the initial creation of shares to be traded once the vehicle goes live in public markets. The filing revealed that the seed investor agreed to purchase $100,000 in shares on October 27, 2023 and took delivery of 4,000 shares at a price of $25 per share. While the outright number of $100,000 in seed capital is not a remotely significant number, this adds further evidence of the expectation for approval by the upcoming January 10th decision deadline.

Bitcoin Soars to $44K, Registers Historic Positive Weekly Returns

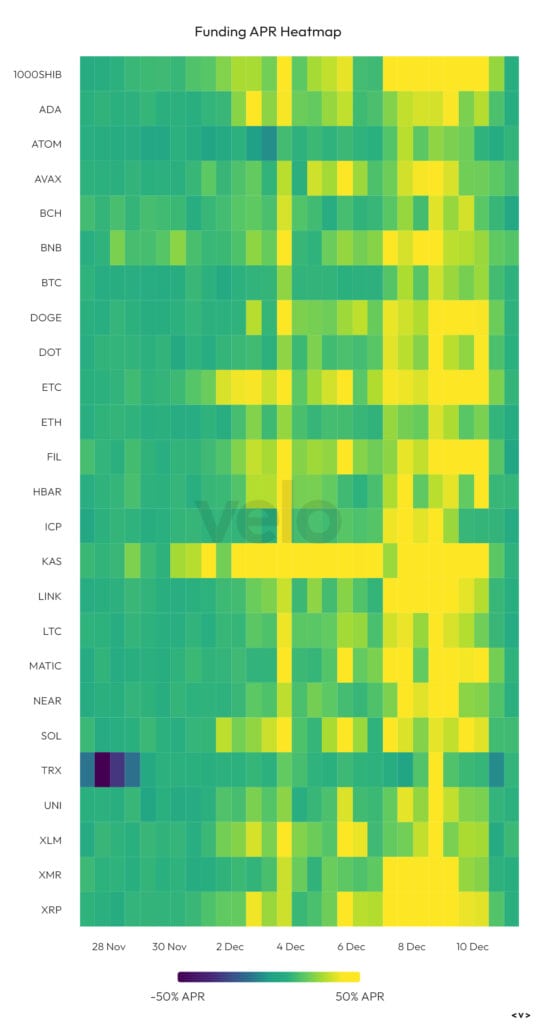

In a remarkable milestone, Bitcoin surged past the $44,000 mark, marking a pivotal moment with eight consecutive positive weekly returns—a feat not seen since mid-2017. Achieving yearly highs at exactly $45,000, the leading digital asset showcased its resilience. Despite subsequently experiencing its most significant correction since early September, dipping from $45,000 to slightly above $40,000, the correction’s impact played second fiddle to Bitcoin’s momentous achievement. This downturn swiftly wiped out hundreds of millions in open interest, reflecting the liquidation of leveraged longs in the futures market.

The below heatmap of funding rates, based on the delta between the spot and futures market, shows the broader context of the market. The shift from bright green (indicative of high funding rates) to darker green signifies a healthy neutralization of funding rates for large-cap crypto assets. In simpler terms, the futures market has cooled off from a state of high exuberance, underscoring the significance of Bitcoin’s surge to $44,000.

Past performance is not an indication of future results.

CME futures open interest for Bitcoin breaches $5 billion for first time since late 2021

Something that we’ve tracked closely for throughout the last few months, Bitcoin futures open interest on the CME just breached all time highs, above $5 billion for the first time since late 2021. While a large amount of this likely reflects traditional finance putting on the ETF trade, this also reflects that this cohort of market participants is back in a big way for the first time since late 2021.

Past performance is not an indication of future results.

Google search trends show lack of retail exuberance in the crypto market

On a similar note, looking at google search trends for “Bitcoin” we can see that the market is still far from levels of euphoria and retail speculative activity that was previously reached during cyclical Bitcoin peaks.

The content in this post was created exclusively for eToro by Reflexivity Research.