Major Developments for the Week

- US and German governments sell seized BTC

- BTC trading levels hit an all-time low post-ETF approvals.

- Yei Finance boosts SEI Network‘s TVL to $60 million.

- New Solana ETF filings surface in the U.S.

- Arbitrum DAO invests $35 million in on-chain real-world assets.

- Crypto ATM installations approach record highs.

- Chainlink activates data streams on the Avalanche network.

- Over $3 billion in crypto tokens are set to unlock in July.

- Tezos blockchain developers have unveiled a new roadmap called “Tezos X”

Bitcoin

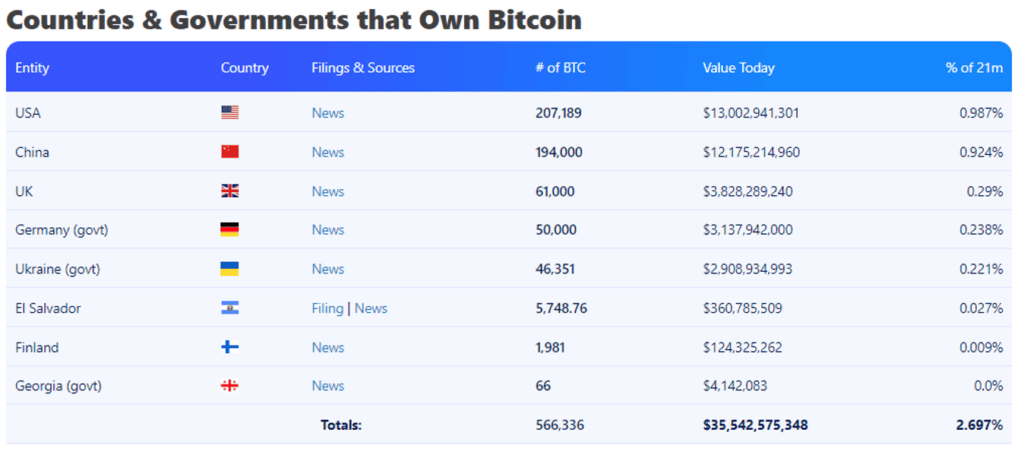

Governmental Liquidation of Seized Bitcoin

Last week, the US government transferred 3,940 BTC (approximately $240 million) to a full-service prime brokerage platform. The Bitcoin had been confiscated from Banmeet Singh, a convicted narcotics trafficker, and forfeited at trial in January 2024. The sale is part of a broader strategy by the US government to liquidate seized cryptocurrencies, following previous large-scale transfers related to Silk Road seizures.

Similarly, the German government is liquidating Bitcoin seized from Movie2k, a defunct streaming site involved in illegal activities. This sale aligns with Germany’s ongoing efforts to convert seized digital assets into fiat currency for public use.

These actions by the US and German governments reflect a growing trend of converting seized digital assets into public funds, impacting the cryptocurrency market’s liquidity and stability.

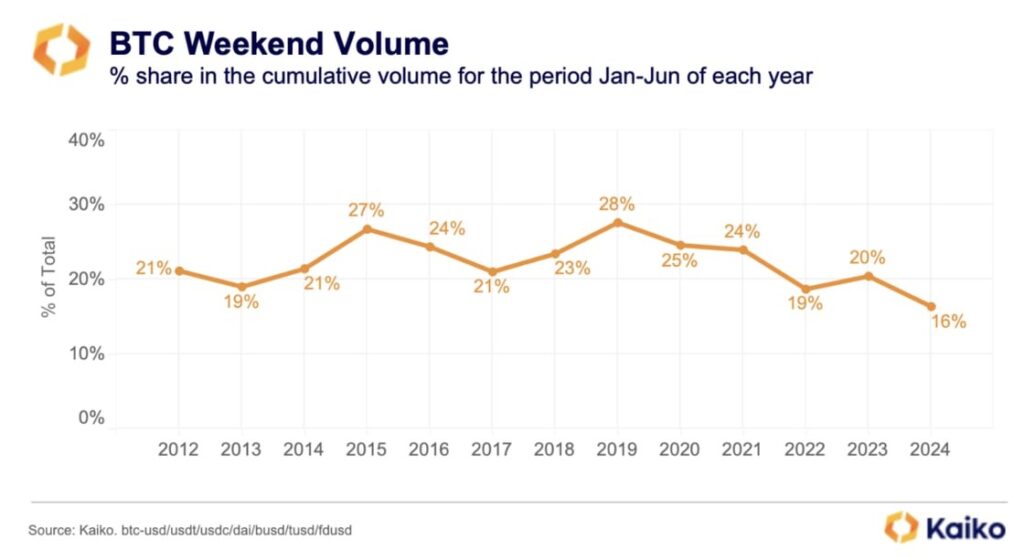

Bitcoin’s weekend trading slumps following ETF approvals

Recent data from Kaiko reveals a significant drop in Bitcoin trading volumes on weekends following the approval of several ETFs, which only trade during stock market hours. This has shifted Bitcoin trading activity to the final hour of market trading, creating a concentration of activity during specific hours.

Despite expectations of a boost from the approval of multiple spot Bitcoin ETFs by major firms like BlackRock and Fidelity, this trend marks a notable downturn in weekend activity.

Past performance is not an indication of future results.

For those interested in diversified exposure to Bitcoin’s financial landscape, eToro’s @BitcoinWorldWide Smart Portfolio offers a strategic option.

Smart Contract Platforms

Yei Finance Elevates Sei Network

Yei Finance’s recent initiatives have propelled the total value locked (TVL) on the SEI Network to over $60 million. This growth reflects strong confidence and increased utility in Sei Network’s offerings, enhancing its position in the competitive DeFi landscape.

Expansion of Solana ETFs

Following VanEck’s lead, 21Shares has filed for a new Solana-based ETF in the U.S. This move marks a significant step toward broader market acceptance and investment in the Solana blockchain, known for its speed and efficiency.

Optimism Announces Superfest

Optimism has announced their Superfest event, highlighting significant progress in Ethereum‘s Layer 2 scaling solutions. Key highlights from the event include:

- OP Stack: An open-source, modular framework that simplifies the creation of Layer 2 chains, enhancing interoperability and ease of upgrades.

- Superchain Vision: A network of interoperable Layer 2 chains designed to improve scalability and reduce transaction costs on Ethereum.

- Funding and Incentives: $3.3 billion in OP tokens are allocated to support public goods and incentivize developers, fostering innovation and decentralization.

Optimism Superfest underscores collective efforts to boost Ethereum’s scalability and usability, promoting a decentralized blockchain ecosystem.

These advancements in smart contract platforms, through ETFs and increased TVL, highlight significant growth potential. Investors can explore these opportunities with eToro’s @Scalable-Crypto Smart Portfolio, designed to leverage the scalability of blockchain technologies like Solana.

DeFi and TradFi

Arbitrum’s On-Chain Investment Move

Arbitrum DAO is planning to inject $35 million into real-world assets (RWAs) on-chain. This sets a precedent for integrating traditional financial assets with DeFi protocols, potentially increasing the security and profitability of blockchain investments.

Surge in Crypto ATM Installations

Crypto ATM installations are nearing an all-time high, reflecting growing global acceptance and accessibility of cryptocurrencies. As of 2024, 2,564 new cryptocurrency ATMs have been installed, indicating a positive trend compared to the net loss of 2,861 machines in 2023, according to Coin ATM Radar.

The blend of DeFi innovations and traditional finance tools, such as increased ATM accessibility, aligns with the strategies employed by eToro’s @DeFiPortfolio Smart Portfolio, designed to optimize returns from these emerging financial technologies.

Web3

Chainlink Integrates with Avalanche

Chainlink has launched its data streaming services on the Avalanche network, enhancing its capabilities for handling complex applications and securing user transactions with reliable data feeds.

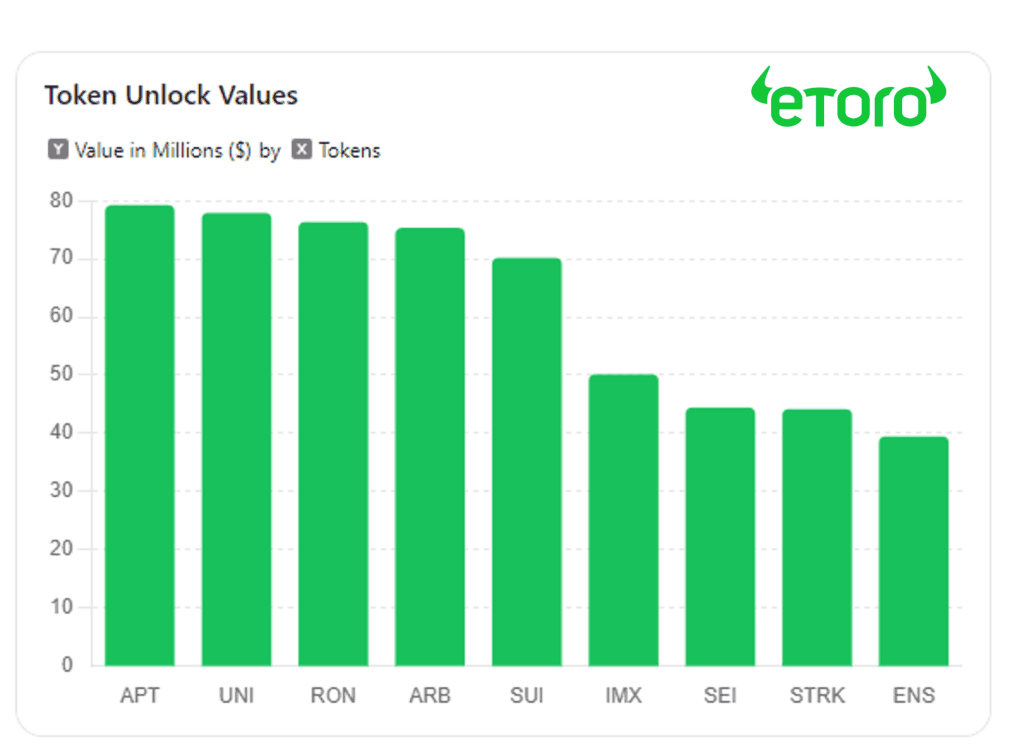

Massive Token Unlock in July

July is set to see the unlocking of over $3 billion in crypto tokens, including $730 million across 40 projects. This could potentially increase market liquidity and volatility as these tokens re-enter circulation.

Past performance is not an indication of future results.

These developments in Web3, from Chainlink’s expansion to token unlockings, showcase the sector’s dynamic nature and growth potential. eToro’s @Web3Applications Smart Portfolio is strategically positioned to benefit from advancements in blockchain applications and integrations.