Major developments for the week:

- Spot Ethereum ETFs greenlighted by the SEC

- Hong Kong’s SFC is in talks to allow staking for Ether ETF issuers

- Bitcoin ETF inflows exceed $1 billion

- Uniswap Foundation to vote on protocol fees proposal

- Cosmos introduces Hydro, a bidding and governance platform for efficient liquidity deployment across the interchain

- Optimism will unlock 2.88% ( $80.55 million ) of its supply on May 31st

- Donald Trump enables crypto donations for presidential campaign

- Kabosu, the dog behind the ‘doge’ internet meme, passes away

Ethereum Spot ETFs approved

Last week the U.S. Securities and Exchange Commission approved eight spot Ethereum ETFs, a significant milestone in the cryptocurrency industry following the approval of spot Bitcoin ETFs earlier this year in January.

The approved ETFs come from major financial institutions such as BlackRock, Fidelity, Grayscale, Bitwise, VanEck, ARK 21Shares, Invesco Galaxy and Franklin Templeton. Unlike the spot Bitcoin ETFs, which were approved via a vote by the full SEC commission, these Ethereum ETFs received approval through the SEC’s Trading and Markets Division.

Despite this approval, the ETFs are not yet available for trading. The issuers still need to obtain final approval for their S-1 registration statements from the SEC, which could take additional time and potentially delay the launch by weeks or even months.

The approval of these ETFs is expected to enhance Ethereum’s market liquidity and attract substantial institutional investment. This move signifies increasing regulatory acceptance of digital assets and is anticipated to potentially boost Ethereum’s market position.

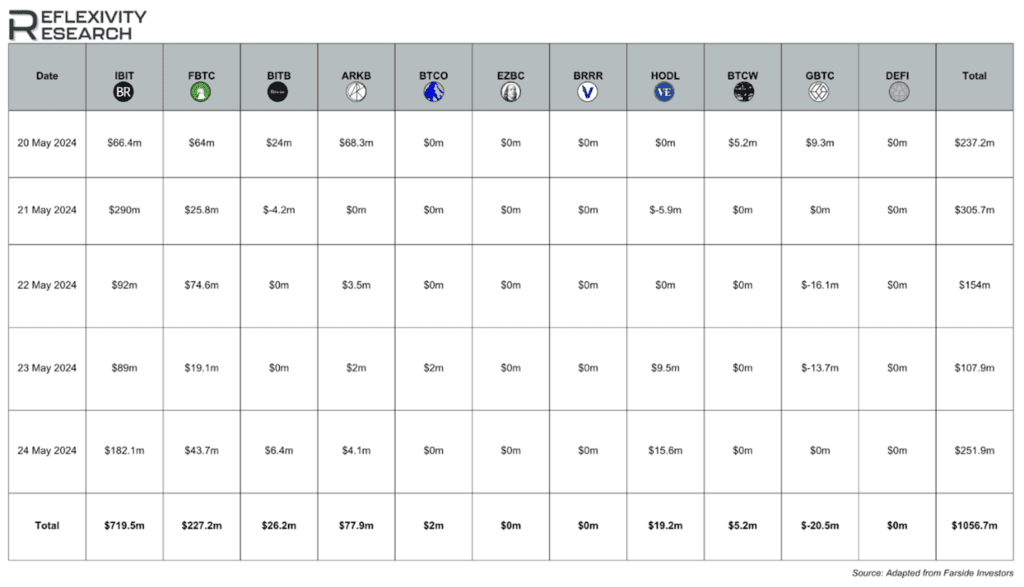

Bitcoin ETF products saw inflows of more than $1.056 billion last week

This week’s performance from May 20th – 24th saw a total value inflow of $1.056 billion. IBIT emerged as the largest contributor with $719.5 million, while GBTC faced outflows amounting to $20.5 million.

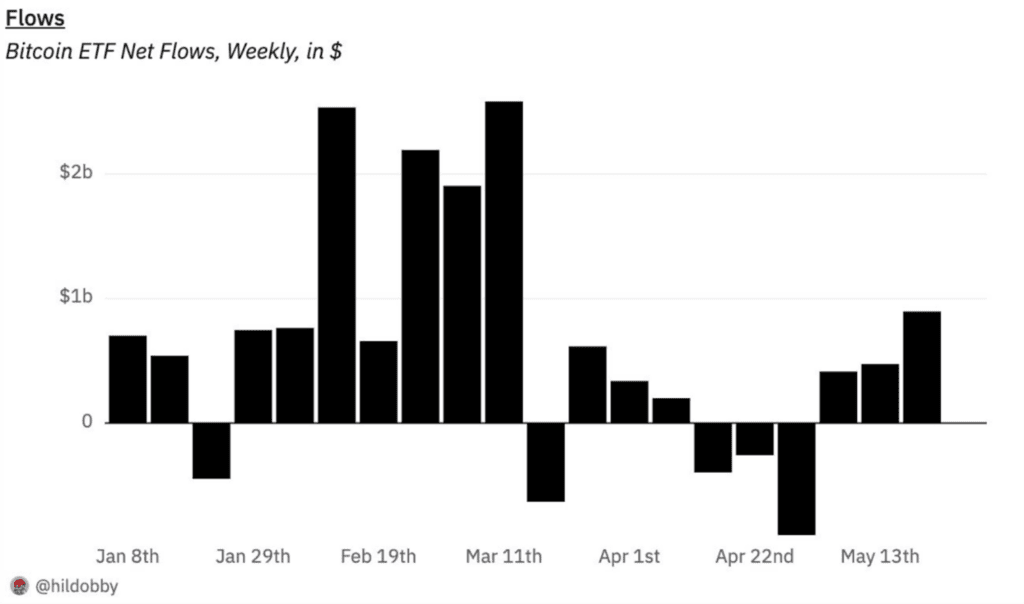

As detailed by the above illustration from Hildobby’s dune dashboard, this was the highest net inflow that the ETF products have experienced in the last 10 weeks.

Uniswap Foundation to vote on protocol fees proposal

The Uniswap community is set to vote on a proposal to activate protocol fees in V3 pools, beginning on Friday, May 31st. This proposal aims to upgrade the protocol, enabling its fee mechanism to reward UNI token holders who have staked and delegated their tokens. Previous attempts to activate this fee switch have failed, including the most recent proposal that did not pass the preliminary voting stage. The new proposal’s authors anticipate that this change will encourage more active delegation and increased engagement in the governance process.

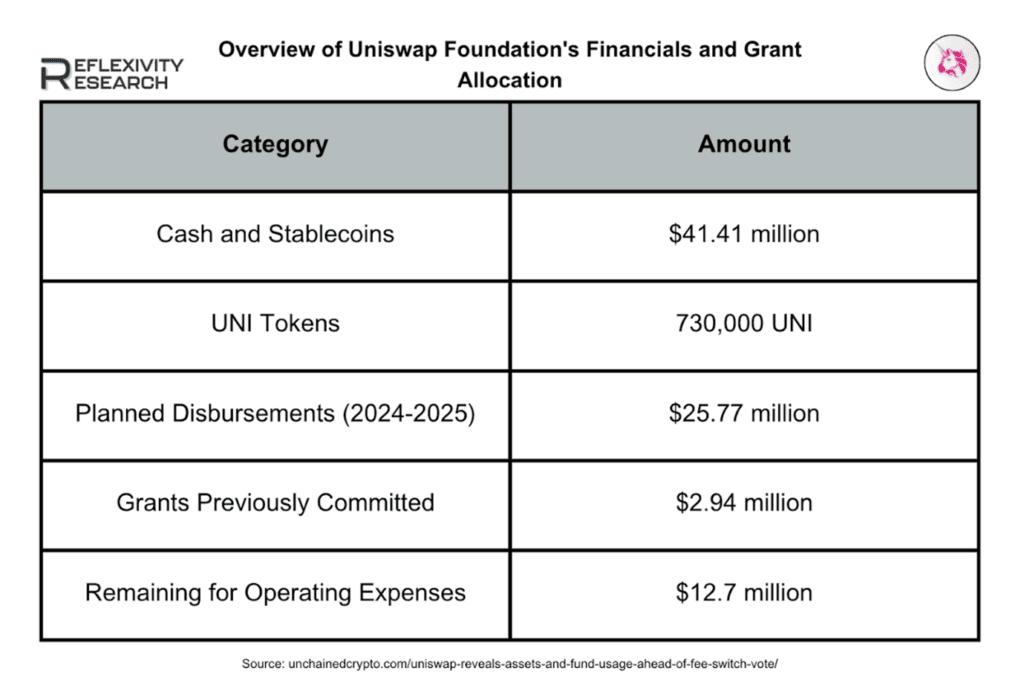

In preparation for the vote, the Uniswap Foundation released its financial summary for the first quarter of 2024 as detailed below:

During the first quarter, most grants were directed toward protocol development and governance, with additional funds allocated to innovation, research, and security. This financial disclosure provides transparency ahead of the significant vote on protocol fees.

Activating the fee switch would benefit UNI holders at the expense of liquidity providers, who have been earning fees from token swaps so far. Since its inception, Uniswap has generated $3.6 billion in fees, according to DeFiLlama. If the vote on May 31st passes, the fees will not be activated immediately. The Uniswap governance team plans to propose another upgrade to streamline the fee-setting process, reflecting their commitment to continuous improvement and adaptation of the protocol.

Cosmos introduces new bidding and governance platform

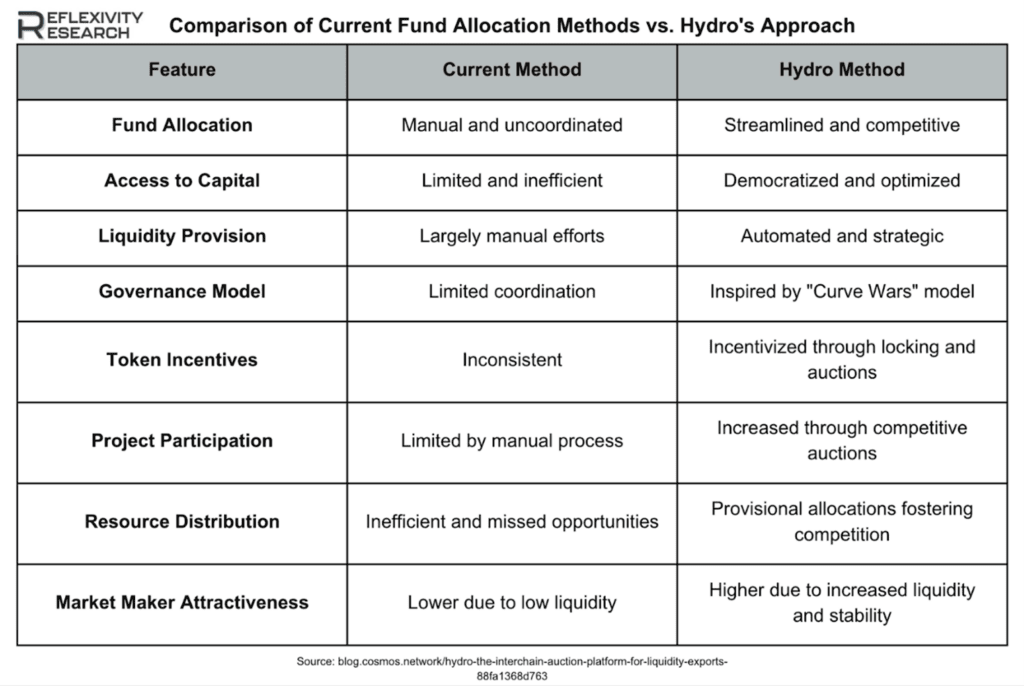

Cosmos has introduced Hydro, a bidding and governance platform designed to optimize liquidity deployment across the interchain ecosystem. This platform plays a crucial role in the ATOM wars, tackling the primary challenge of token liquidity that has plagued the interchain since its inception.

The table below highlights the core differences between current fund allocation methods versus what hydro proposes to introduce:

Optimism will unlock 2.88% ( $80.55 million ) of its supply on May 31st

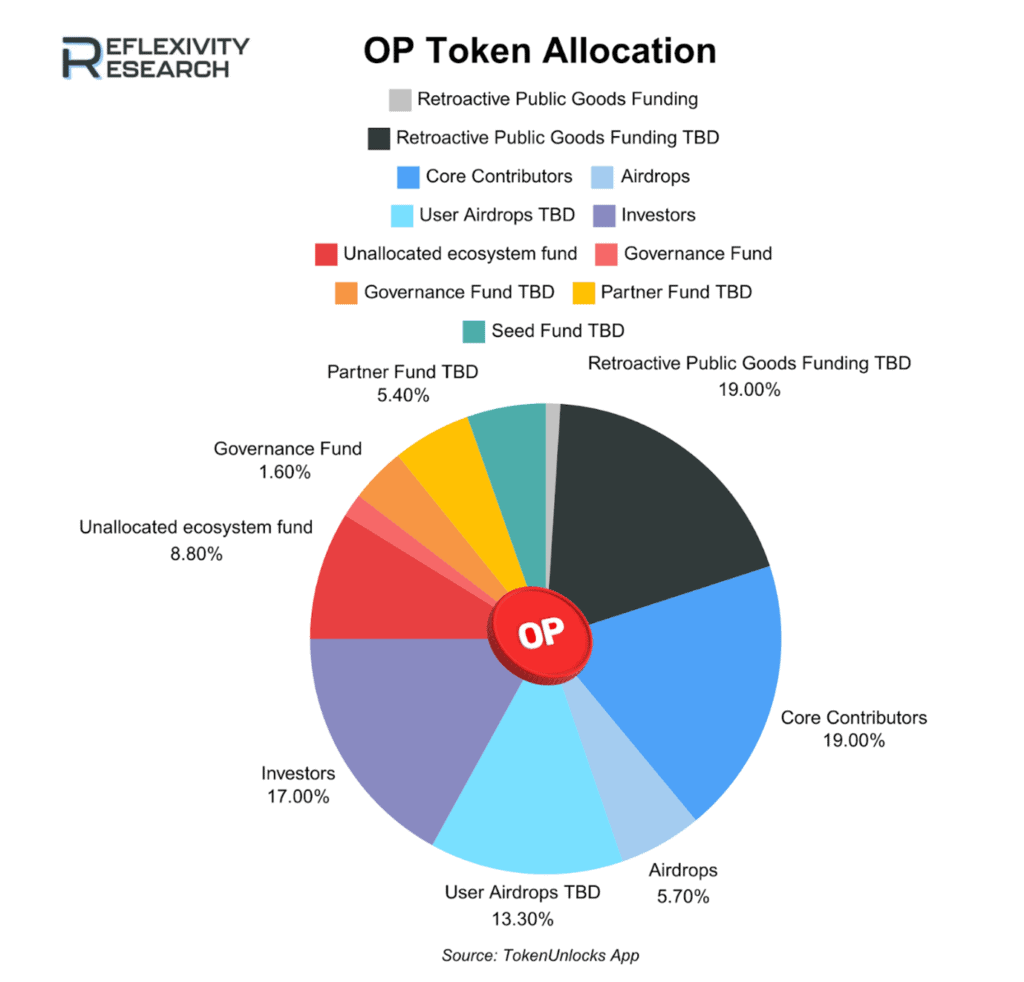

Optimism will unlock 2.88% of its circulating supply on May 31st. This consists of $42.18 million for core contributors and $37.74 million for investors. Optimism’s token allocation breakdown can be seen as illustrated below:

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.