Could Cosmos or Polkadot be next?

As we move into March, the crypto recovery has been hit by two headwinds: a financial crisis at one of the biggest crypto-friendly banks, and comments from SEC Chair Gary Gensler that everything except Bitcoin is likely a security.

Altcoins have taken the biggest hit from the bad news, with many tokens flashing double-digit losses.

Yet even as the market turns red, several established DeFi projects are staying green: Maker has risen around 20%, followed by Synthetix which has added 15%, while Ethereum stays relatively still as it clears the penultimate hurdle before the Shanghai upgrade.

Read more after the jump.

This week’s focus

– Maker moves towards $1K on controversial proposal

– Synthetix surges 15% on DeFi revival — which protocol will be next?

– Ethereum lingers at $1.6K as Shanghai draws closer — the calm before the storm?

Maker moves towards $1K on controversial proposal

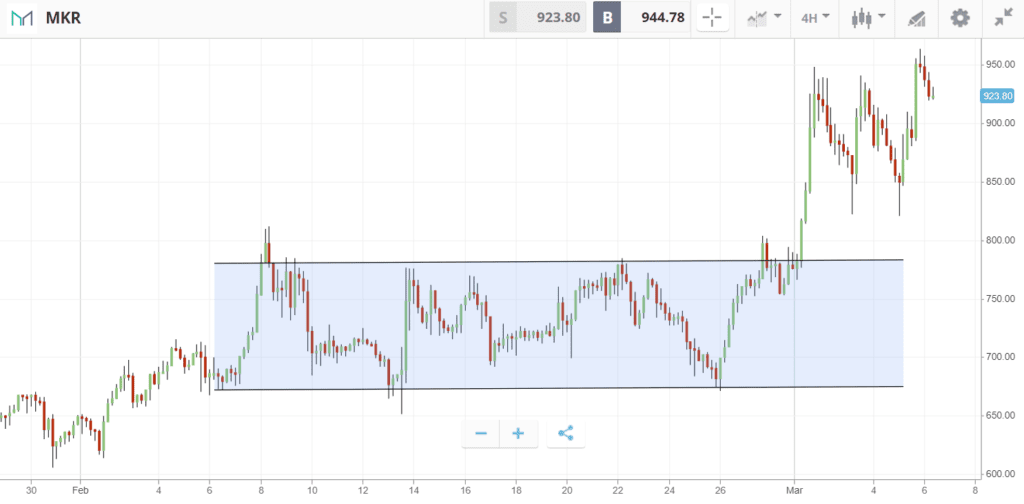

MKR has broken out of a trading channel to push towards $1,000

Pioneering DeFi protocol Maker is weighing a proposal that would allow users to borrow its DAI stablecoin against its MKR governance token.

If that sounds familiar, it’s because the ill-fated stablecoin project Terra Luna used a similar mechanism to stabilize the value of UST using governance token LUNC (the token formerly known as LUNA). Although there are a few key differences, including that the proposal does not call for DAI to be solely backed by MKR.

Despite the controversy caused by the proposal, the resulting publicity appears to be benefiting the price of Maker, which is up 20% over the last week.

This rally could also be supported by other big headlines, including the news that a lawsuit filed against MakerDAO in 2020 has finally been dismissed, and the rejection of a $100M Loan proposal to Cogent Bank that was deemed too risky.

Synthetix surges 15% on DeFi revival— which protocol will be next?

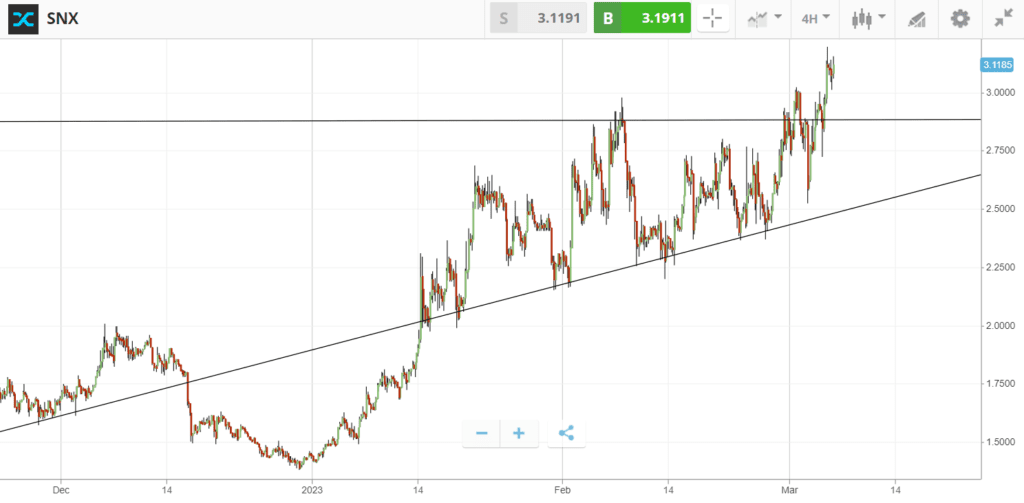

After inching higher in an ascending triangle pattern, SNX has broken through resistance at $3

A new wave of innovation is sweeping over the DeFi market as well-established projects launch new products and upgraded protocols.

Synthetix, which pioneered the first onchain derivatives protocol, is the latest to upgrade. Its token popped 15% last week on excitement about Synthetix V3, which boosts capital efficiency by allowing users to deposit other assets such as Ethereum as collateral. In addition, the upgrade also enables the development of separate DeFi applications on top of Synthetix — such as exchanges or no-loss lotteries.

Other blue-chip DeFi protocols with big plans for this spring include Aave and Curve, which are both racing to release new stablecoins.

Ethereum stable as Shanghai approaches — is this the calm before the storm?

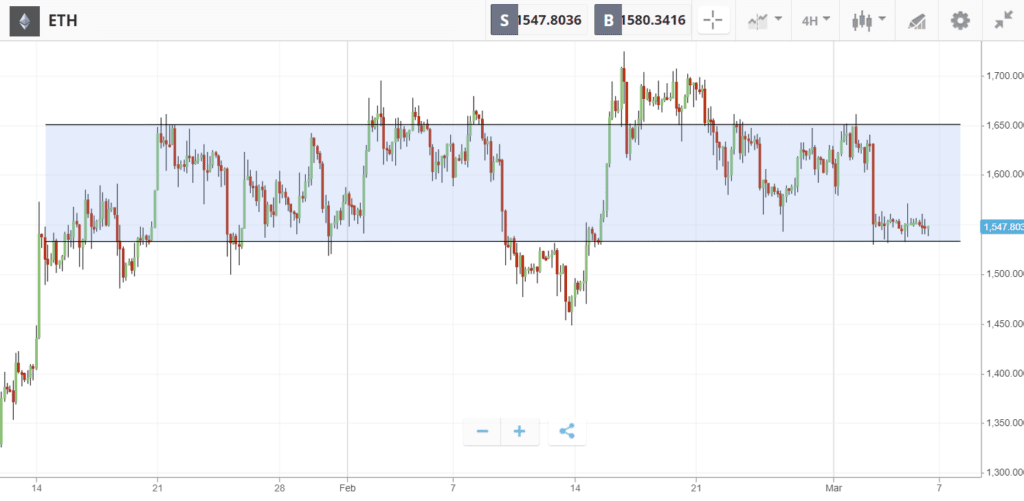

ETH is demonstrating relative stability as it trades sideways in a channel around $1,600

As the Shanghai upgrade draws near, the price of Ethereum is lingering around the $1.6K level.

Last week, the penultimate hurdle before the upgrade was cleared as the ‘Shapella’ upgrade was deployed on Ethereum testnet Sepolia. This leaves only the final testnet deployment, Goerli, before the Shanghai upgrade finally hits the mainnet later this month.

Although some expect this to be bearish, as it will mark the moment when previously locked Ethereum begins to hit the market, it could have a bullish impact on price. This is because the upgrade not only represents a monumental milestone for Ethereum’s transition to proof-of-stake, but could also encourage the uptake of staking and catalyze innovation by reducing risk.