The amount of Bitcoin held by long term holders reached an all-time high this week, breaching 75% of total circulating supply. This represents resilience among Bitcoin’s holder base and deep belief in the asset as a store of value despite the headwinds faced from both crypto contagion and monetary tightening throughout the last two years.

Past performance is not an indication of future results.

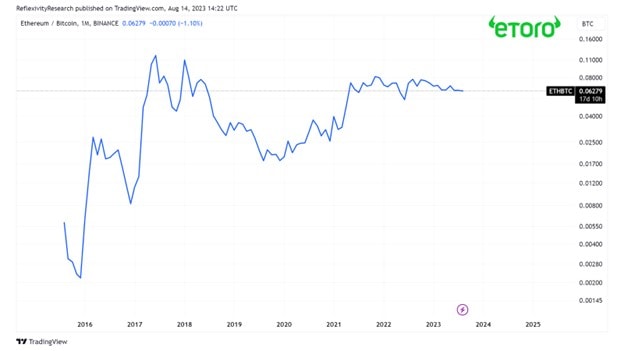

One key difference between the prior 2018 bear market for crypto and this current one has been the performance of the ETH/BTC ratio which compares Ethereum’s performance relative to Bitcoin’s. As we can see in the chart below, Ethereum has held up much better on a relative basis compared to 2018. The notion of Ethereum serving as higher “beta” to Bitcoin (meaning it will outperform on the way up and underperform on the way down) appears to be in question due to this relative strength. This perhaps suggests that Ethereum has matured into a solidified “blue chip” asset in the eyes of crypto investors.

Past performance is not an indication of future results.

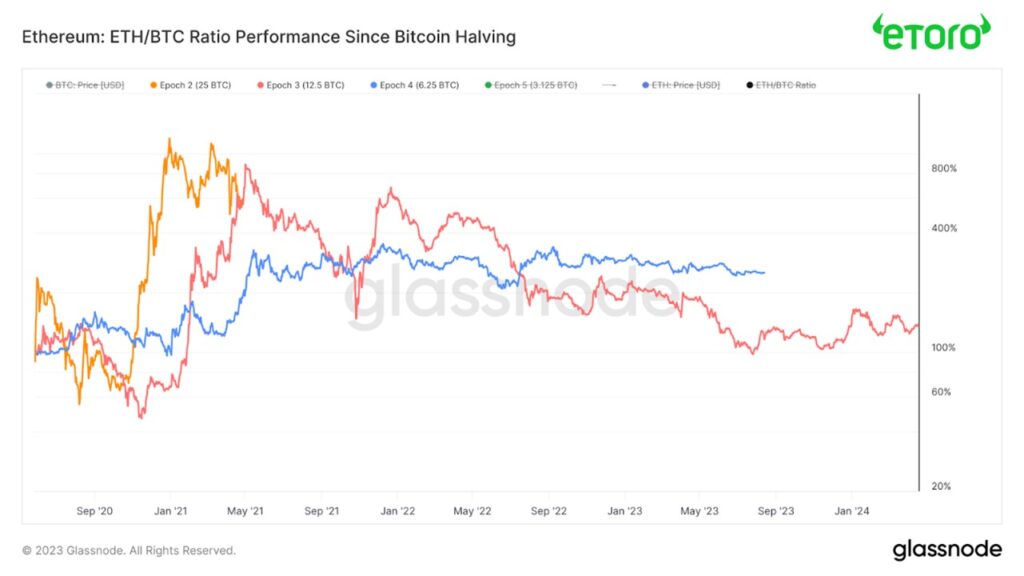

In a previous report we included a chart showing Bitcoin’s performance during each halving epoch starting from its prior all time high. The chart below takes a similar concept but instead looks at the ETH/BTC ratio’s performance since the last Bitcoin halving. We can clearly see that the drawdown from its prior peak has not been as severe as previous impulses and as we near the halving, can have reason to believe we may see an ETH/BTC run in 6-8 months following this upcoming halving. This also aligns with the way capital flows have traditionally played out during prior market cycles for crypto: Bitcoin -> ETH -> Higher risk assets.

Past performance is not an indication of future results.

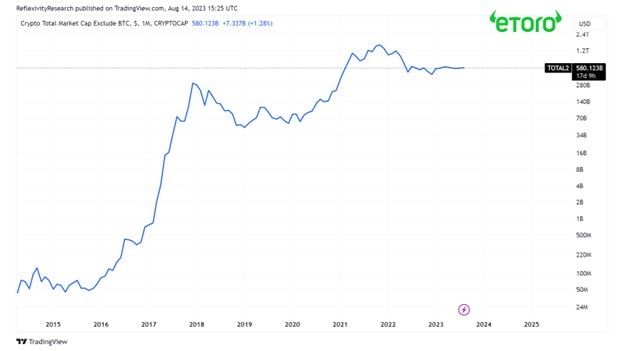

For now, the total crypto market capitalization excluding Bitcoin and Ethereum is currently consolidating around $580 billion.

Past performance is not an indication of future results.

One of the most common terms a newcomer into crypto markets may hear is references to the “four-year cycle”. This term refers to the Bitcoin/crypto market’s cyclicality that to date has moved in 4-year patterns around macroeconomic factors and Bitcoin’s supply halving, which is an event in which Bitcoin’s supply issuance is cut in half. Taking the number of blocks until the next halving multiplied by the estimated block time of 10 minutes for Bitcoin, we can estimate that the halving is set to take place sometime in mid-April of next year; now just under 250 days away.

The material in this blog post was created exclusively for eToro by Reflexivity Research.