Major developments for the week

- Hong Kong plans to permit in-kind contributions for spot Bitcoin ETFs

- Optimism allocates $3 billion for grants to its blockchain developers

- Ondo Finance to transfer $95 million to BlackRock‘s tokenized fund for immediate settlements of its T-Bill token

- Synthetix will be coming to Arbitrum, Solana and Sui

- 1inch launched phase two of its community builder program

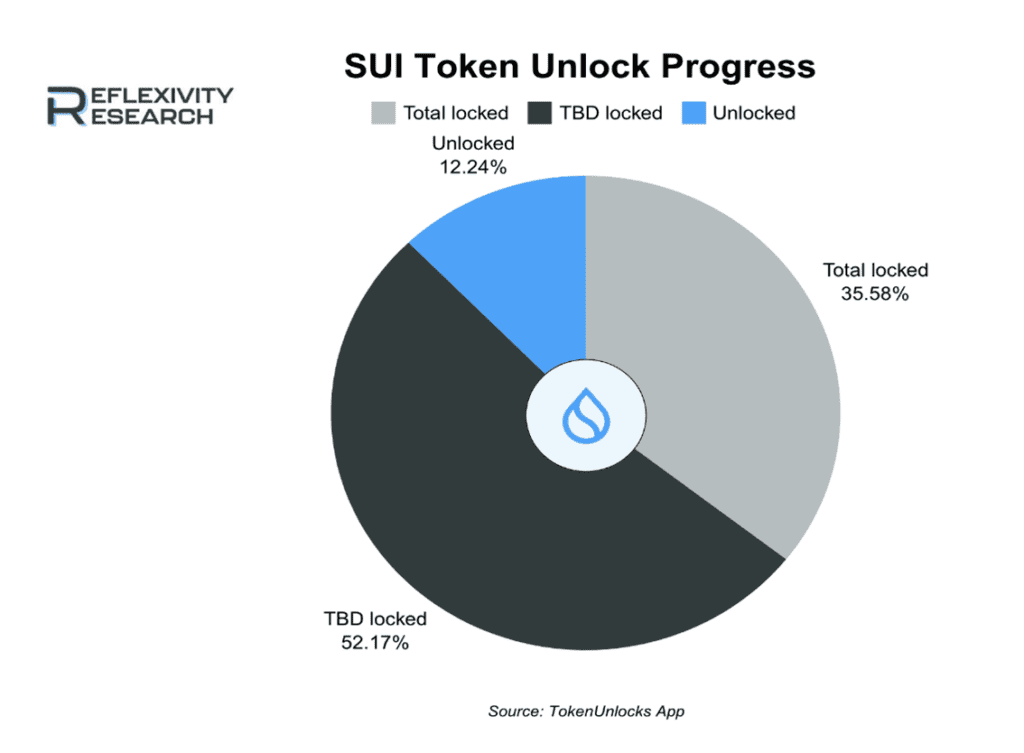

- Sui is set to unlock 2.67% of its supply on April 3, equivalent to $65.08M

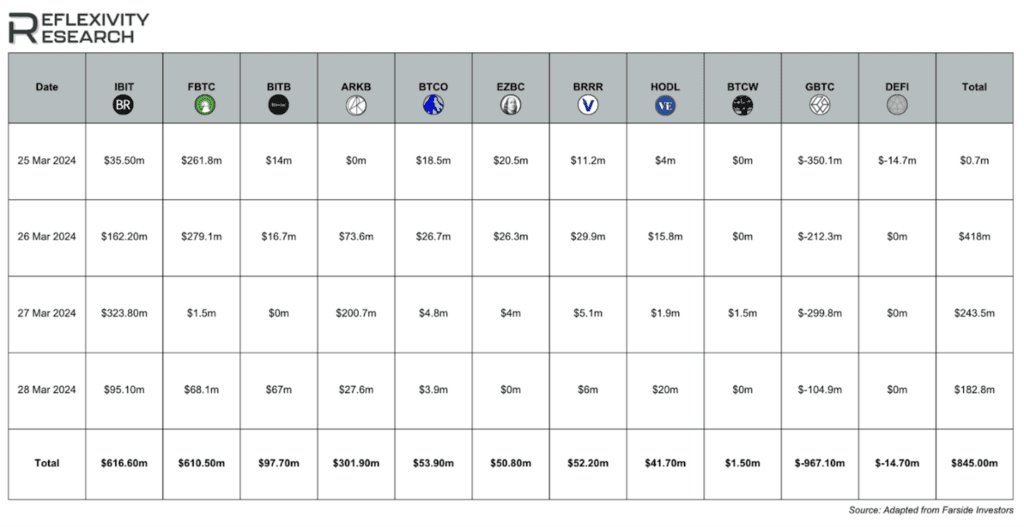

- Bitcoin ETF products saw net inflows of $845 million last week

Insights into Bitcoin’s Market Cycle

With the much-anticipated Bitcoin halving coming up in just two weeks, many Bitcoin and other crypto investors may be asking themselves where do we currently stand in Bitcoin’s broader market cycle?

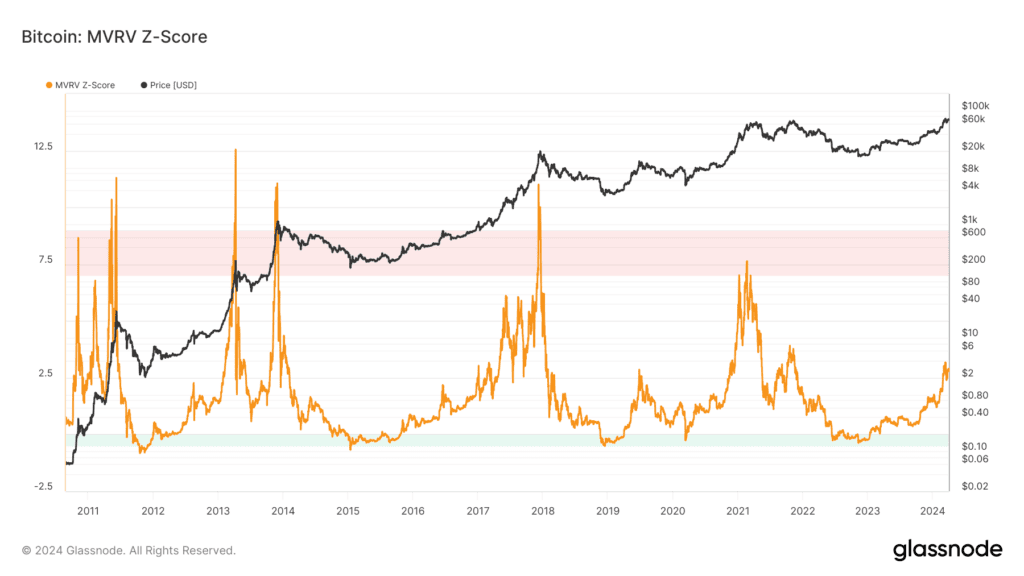

One of the best ways to figure out how Bitcoin is valued is by looking at something called the MVRV z-score. This compares the actual price of Bitcoin, which is how much the whole Bitcoin network is worth, to how much Bitcoin is being traded for right now. It helps us see if people are making profits or losses without actually selling their Bitcoin yet.

When the market isn’t doing well (bear markets), buying Bitcoin when the MVRV score is below one has usually been a good idea. That’s because, overall, people are losing money in the market. On the other hand, when the market is doing great (bull markets), it’s smart to sell some Bitcoin when the MVRV score is high. This means people are making a lot of money in the market, so there’s a good chance they’ll start selling soon.

Past performance is not an indication of future results

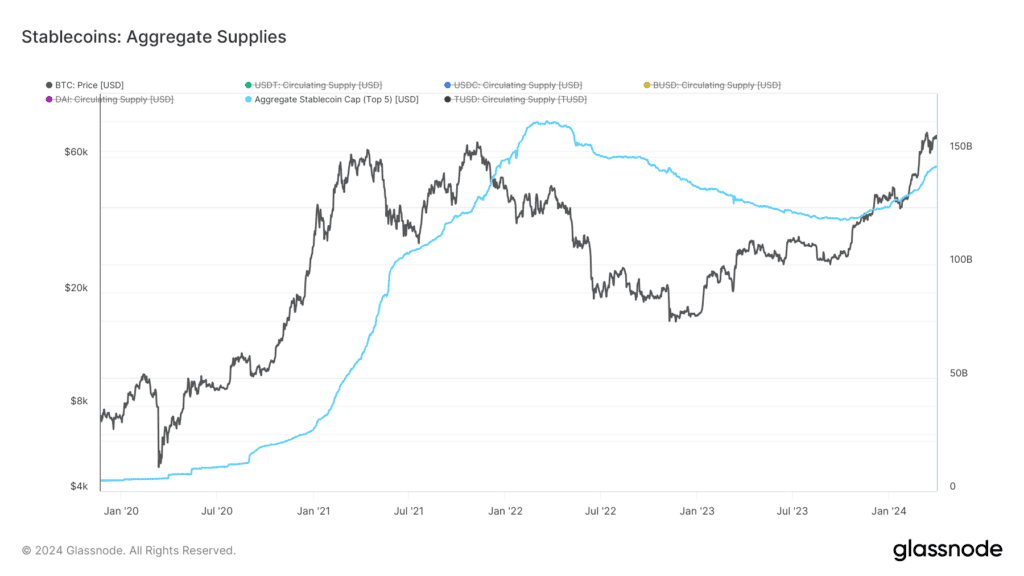

Another thing to look at is how much stablecoins are being used. These are cryptos that are supposed to stay stable in value, like the US dollar. When more stablecoins are being used, it shows that more money is coming into the cryptocurrency market and that people want to be part of it. Right now, stablecoins are being used a lot, with over $20B more in circulation compared to before, reaching over $140B in total.

Past performance is not an indication of future results

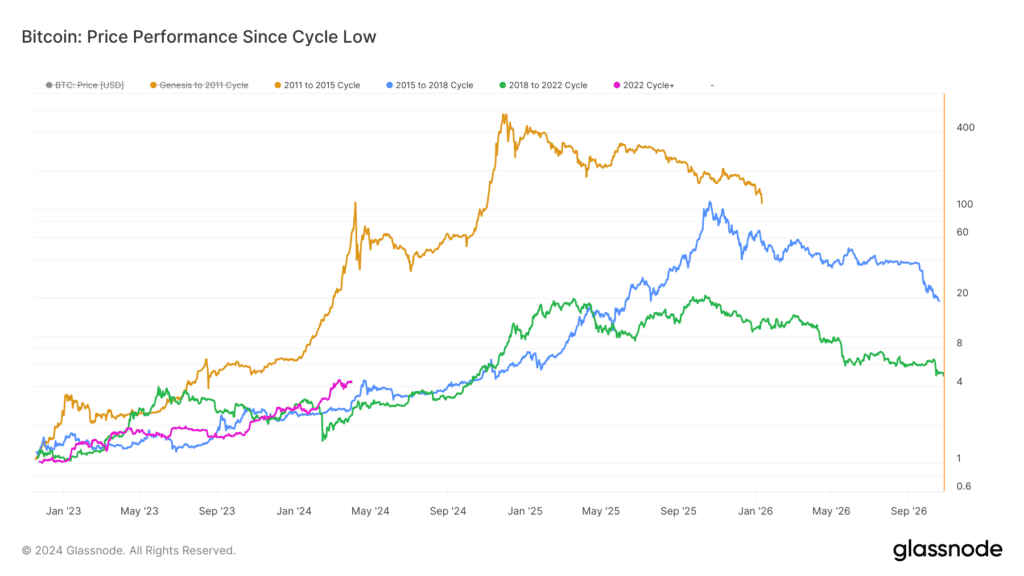

If we look at how Bitcoin’s price has changed compared to its past performance after reaching all-time highs, we see a similar pattern. It seems like we’re somewhere in the middle of the cycle.

Past performance is not an indication of future results

As Bitcoin continues to gain traction, eToro’s @BitcoinWorldWide Smart Portfolio presents an optimal investment avenue. It encompasses a broad spectrum of assets tied to the Bitcoin value chain, from miners to custodians.

Optimism allocates $3 billion for grants to its blockchain developers

Another interesting development last week came from Optimism, which has allocated $3.3 billion in OP tokens to support its community and fund projects or individuals contributing significantly to its ecosystem. A total of 850 million OP tokens have been earmarked for this purpose, as announced by the Optimism Collective, the network’s governance and community branch, on March 26th. These tokens, representing 20% of the initial OP token supply, will be distributed over four categorised funding rounds starting in May and extending into 2024. According to the COO of the Optimism Foundation, 40 million OP have already been distributed in three previous rounds.

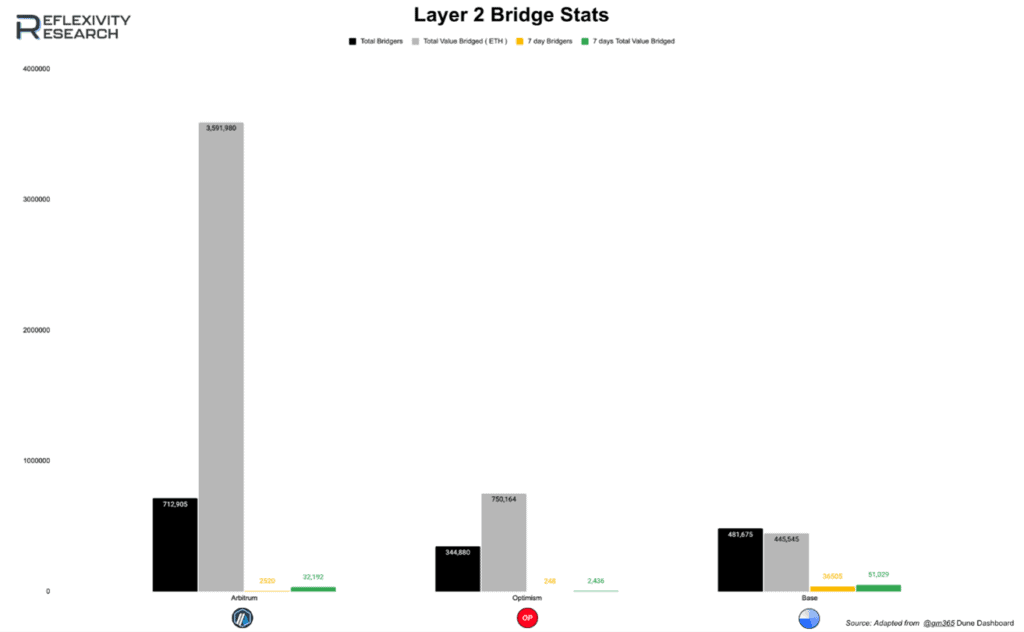

The upcoming fourth round will focus on retroactive public goods funding, encouraging community votes on projects that have demonstrated value to receive token grants. Subsequent rounds, five through seven, aim to reward contributions to infrastructure, governance and development tools, with eligibility extended to anyone working to improve Optimism. The final round is scheduled to conclude in mid-November. This initiative underlines Optimism’s commitment to supporting public goods and services that contribute freely to the blockchain or crypto community, rewarding them for their demonstrated contributions. Below is an overview of current bridge activity amongst each respective Layer 2 solution:

Past performance is not an indication of future results

It will be intriguing to observe the developments in the coming weeks and months to determine the concrete impact of the grant program on the network activity of Optimism.

Bitcoin ETF products see net inflows of $845M in the past week

Last week, Bitcoin ETF products experienced a net inflow of $845 million, marking a substantial rise from the previous week’s net outflow of $887.6 million.

Past performance is not an indication of future results

Sui is set to unlock 2.67% of its supply on April 3rd, the equivalent of $65.08M

The primary unlock event this week features SUI. Scheduled for April 3, 2024, SUI plans to release 2.67% of its circulating supply. This comprises $65.08 million for the community access programme. SUI’s vesting schedule is estimated to reach completion by August 31, 2030.