Major developments for the week

- Lido releases a proposal for Lido Alliance; an Ethereum-aligned ecosystem built around stETH

- Bitcoin ETF products sees net inflows of $116.8 million

- Major financial firms collaborate on tokenized asset settlements

- Arbitrum to unlock 3.49% of its circulating supply on the May 16

- ARK 21SHARES to remove staking from their Spot Ethereum ETF application

- 1inch introduces fusion 2.0, which makes order settlements up to 35% cheaper and execution speeds 75% faster

- MakerDAO updates SubDAO details

Lido releases a proposal for ETH-aligned ecosystem

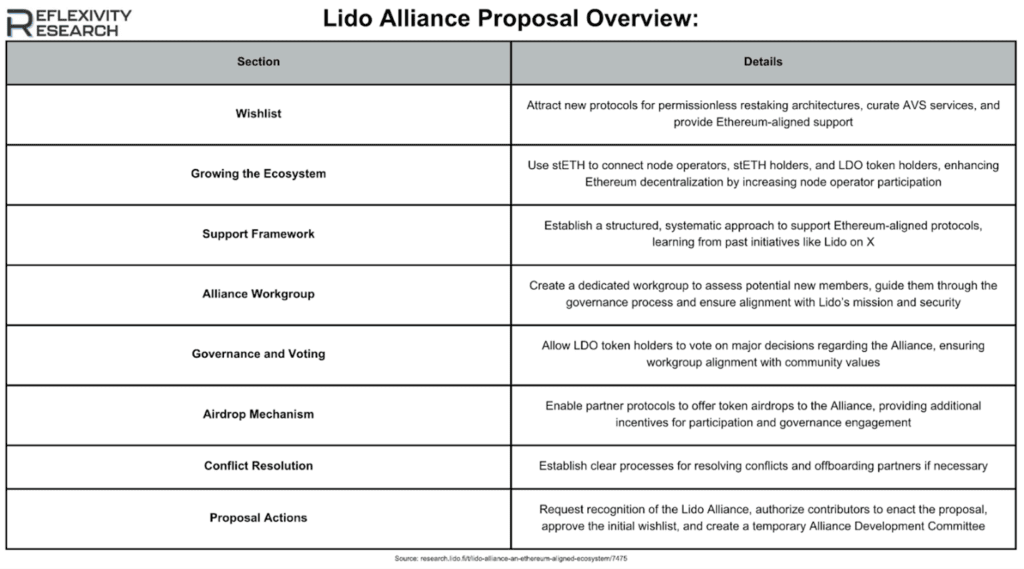

Another interesting development occurred yesterday in which Steakhouse released a significant government proposal on the Lido DAO forums. This proposal was titled Lido Alliance: An Ethereum-Aligned Ecosystem. Below is an overview of some of the core topics touched upon within the proposal:

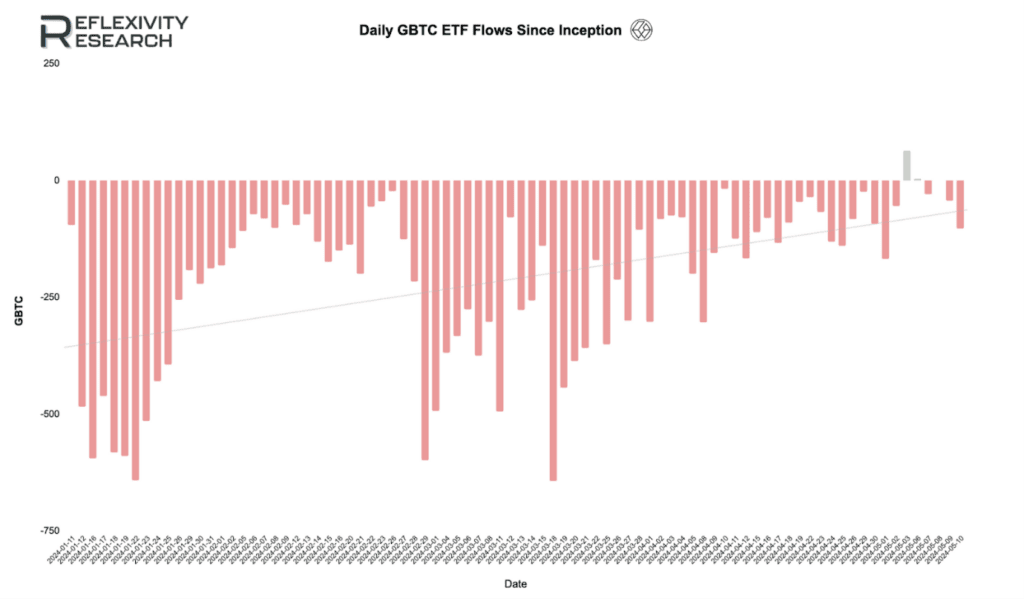

Bitcoin ETF products saw net inflows of $116.8 million last week

From May 6th to May 10th the Bitcoin ETFs experienced improved net inflows when compared to last week’s $400 million in outflows. FBTC reported the highest total inflows, totaling to $111.3 million, with a peak of $99.2 million on May 6th. IBIT also saw notable inflows, amounting to $48.1 million throughout the week. ARKB experienced a cumulative inflow of $82.8 million during the same period.

On the other hand, Greyscale’s GBTC faced outflows totaling $171.1 million, with the largest withdrawal of $103 million occurring on May 10th. Across all Bitcoin ETFs, the total net inflow for the week was $116.8 million. Despite GBTC’s outflows, we are perhaps beginning to see a change in trend of GBTC flows as indicated by the graph below:

Past performance is not an indication of future results

In other recent ETF news, Hong Kong’s new ETH and BTC ETFs have shown significant activity. The BTC ETF saw its highest inflow on May 2nd, adding 174.73 BTC with a trading value of $9.76 million, peaking at $270.77 million in net assets on May 8th. However, notable outflows occurred on May 13th, with 519.5 BTC withdrawn, reducing net assets to $219.70 million.

The ETH ETF also experienced fluctuating flows, with major inflows on May 2nd and May 6th, boosting net assets to $54.87 million. Subsequent outflows on May 8th and May 9th reduced net assets to $48.35 million and $51.51 million, respectively, with a final significant outflow on May 13th bringing net assets down to $39.12 million.

Major Financial Firms Collaborate on Tokenized Asset Settlements

Mastercard, Visa, JPMorgan, and several other leading banks are teaming up to explore the benefits of shared-ledger technology for settling tokenized assets, such as commercial bank money and securities. The initiative, called the Regulated Settlement Network, aims to streamline and secure cross-border transactions using a unified system for these digital assets.

This new phase builds on a successful 12-week trial conducted in late 2022, focusing on domestic and cross-border dollar transactions. The project includes participation from Citigroup, US Bancorp, Wells Fargo, Swift, TD Bank, and Zions Bancorp, among others. Overseen by the New York Innovation Center at the Federal Reserve Bank of New York, this effort ensures a thorough evaluation of the technology’s potential in modernizing financial settlements.

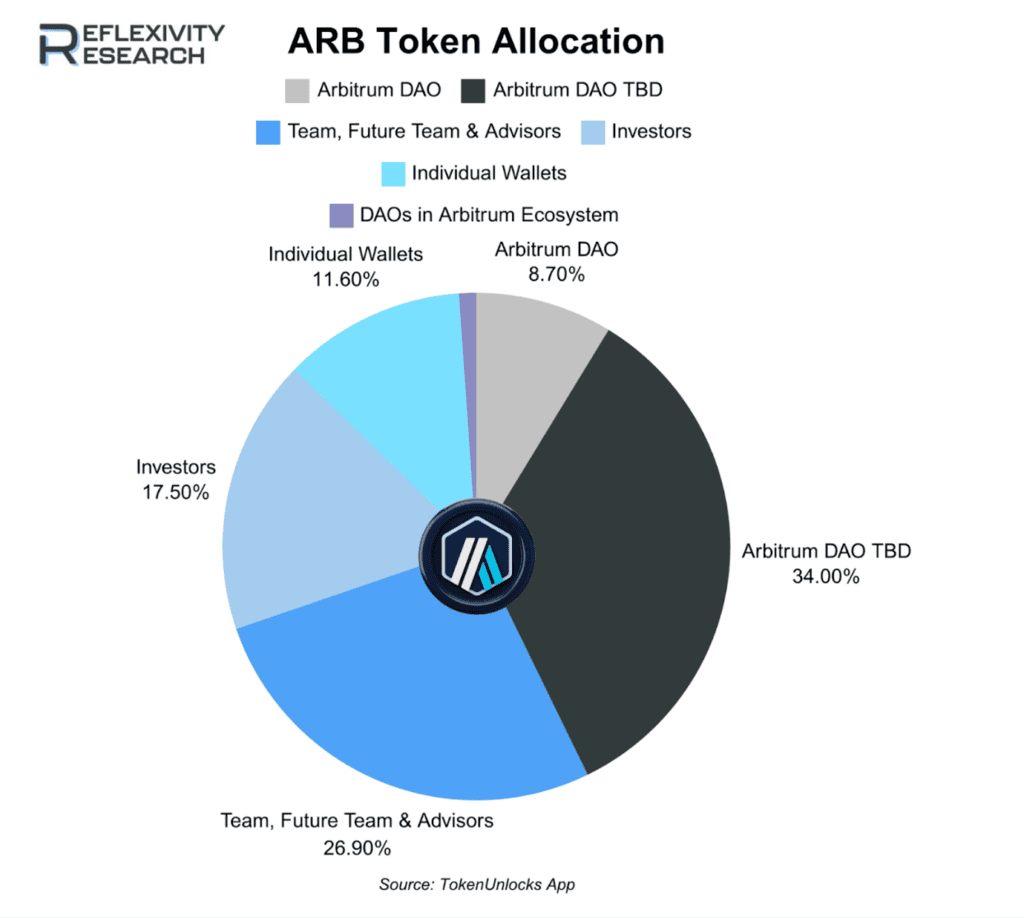

ARB is set to unlock 3.49% of its circulating supply on the 16th of May

Lastly, the primary unlock event of this week comes from ARB. This unlock accounts for 3.49% of its circulating supply or a $92.42 million equivalent. The composition of this unlock is $55.99 million for Team, Future Team + Advisors and $36.43 million for Investors.