Major developments for the week:

- Lido announces that its simple Distributed Validator Technology module is ready for mainnet

- Bitcoin ETF product’s saw net outflows of $204.3 million last week

- EY introduces OpsChain Contract Manager solution on Ethereum Network

- TON Foundation introduces Memelandia

- Optimism to unlock 2.31% of its circulating supply on April 29

- Uniswap Labs increases interface fee by 0.1%

- Tether reveals company restructure plans

- Jupiter exchange announces JupSOL, the highest yield LST on Solana

Lido announces simple DVT module ready for mainnet

Lido DAO‘s Simple Distributed Validator Technology (DVT) module, which was approved by vote six months ago, is live on mainnet as of April 17.

This module makes Lido’s tech more accessible. The DAO aims to diversify its node operators by involving users who stake assets with Lido, and plans to extend Simple DVT to stakers to achieve this goal.

Ready for mainnet deployment, Lido DAO’s Simple DVT module, part of the Obol Cohort 1 clusters, accepts Ethereum deposits. The aim is to diversify node operators by involving community and solo stakers. Deposits will flow into the Simple DVT Module until it reaches capacity, then transfer to the Curated Module. The third Obol testnet run exceeded performance benchmarks, paving the way for Simple DVT’s mainnet launch.

Bitcoin ETF products see net outflows of $204.3 million

Since their inception in January, Bitcoin ETFs have seen a net flow of $12.3 billion. Despite this, the past week has witnessed a slight setback, with a net outflow of $204.3 million. IBIT saw the largest total inflow at $165.40 million, while GBTC faced the largest outflow, summing to $458.40 million over the same period. FBTC saw a significant increase on April 19, with a single-day inflow of $54.8 million. ARKB’s flows varied notably, with a peak outflow of $42.7 million on April 17.

As of April 22, total on-chain holdings for ETF products stand at 835,000 BTC which equates to 4.24% of the available BTC supply. However, a more granular look at recent trends reveals that the total on-chain holdings over the last 14 days, if annualised, project a decrease of 0.46% in Bitcoin supply absorption.

When analysing Bitcoin holdings per respective entity, Grayscale leads the group with a portfolio of 304,961 BTC valued at $20.2 billion, capturing 36.5% of the market share. BlackRock follows closely, managing 273,142 BTC with a total value of $18.1 billion, representing 32.7% of the market. Fidelity holds a significant position as well amounting to $9.9 billion, which equates to 18% of the market share amongst ETFs. On the smaller end of the spectrum, 21Shares and Bitwise have also made substantial inroads with $2.8 billion and $2.2 billion in assets respectively.

EY introduces OpsChain Contract Manager solution on Ethereum network

EY recently introduced OpsChain Contract Manager (OCM), a solution based on Ethereum technology, aimed at streamlining business agreements for private companies.

EY opted for Ethereum’s public blockchain to maintain fairness and confidentiality. By using zero-knowledge proofs, OCM ensures confidentiality and efficiency while cutting costs. The platform can boost contract accuracy and slash administrative expenses by up to 90% and 40%, respectively.

Paul Brody, EY’s Global Blockchain Leader, mentioned that the technology behind OCM, Nightfall, originally emerged on Ethereum’s test network and will soon transition to its mainnet. This launch aligns with the growing trend of major financial players embracing blockchain technology, such as BlackRock‘s recent introduction of a tokenized fund on Ethereum.

TON Foundation introduces “Memelandia”

TON, the decentralised blockchain network developed by the creators of the messaging app Telegram, has launched a new initiative named Memelandia, following in the footsteps of protocols like Fantom and Avax in the memecoin sphere. This platform is dedicated to supporting and showcasing community tokens and memecoins, demonstrating their role in fostering community engagement, loyalty and creativity.

Memelandia features “The Open League,” where selected communities can compete and showcase their tokens, aiming for rewards and recognition.

Moreover, TON facilitates the launching of memecoins with no-code solutions, allowing creators with limited technical skills to design, mint and manage their tokens. This setup promotes community engagement through tools like TON Raffles or TonUP.

Overall, the TON Foundation’s Memelandia and The Open League represent strategic efforts to improve the fair launch and support of memecoins, fostering a more inclusive and safe environment.

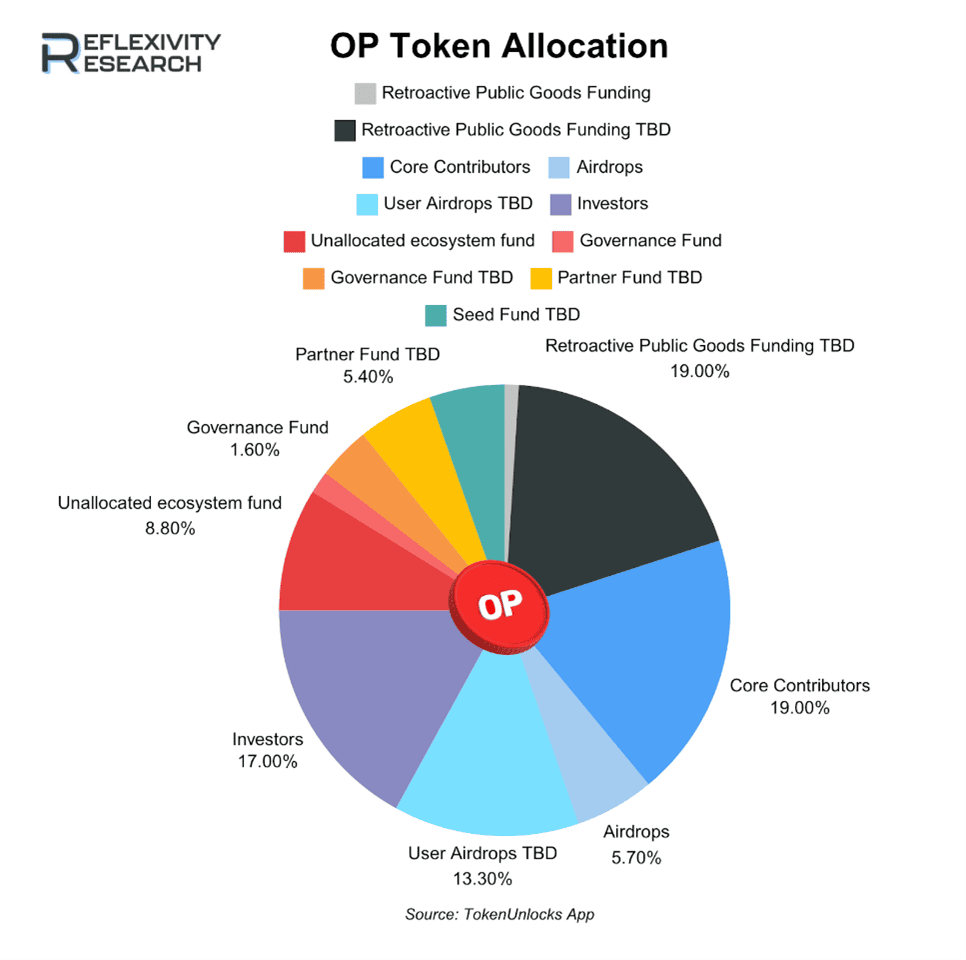

OP to undergo $60.4M unlock on April 29, 2024

Scheduled for April 29 2024, OP plans to release 2.31% of its circulating supply. This comprises $31.88 million for Core Contributors and $28.52 million for Investors. $OP’s vesting schedule is estimated to reach completion by August 28, 2027.

Tether announces re-org plan into four new divisions

Last week saw an intriguing development from Tether, as it expanded beyond its well-known USDT stablecoin to develop a comprehensive range of infrastructure solutions aimed at enhancing inclusivity and building resilient financial systems. This strategic shift includes the introduction of four new business divisions as shown below:

- Tether data – Focuses on the development and investment in emerging technologies, including artificial intelligence and peer-to-peer platforms. It supports ventures such as Holepunch and investments in such AI companies as Northern Data Group.

- Tether Finance – Acts as the core for Tether’s stablecoin products and financial services, aiming to use blockchain technology to democratise the financial system and develop platforms for digital asset tokenization.

- Tether Power – Dedicated to sustainable Bitcoin mining operations, this division aligns with responsible environmental practices and aims to maintain the integrity of Bitcoins monetary network.

- Tether Edu – Committed to expanding global access to digital education, this division supports the proliferation of blockchain and peer-to-peer technology through various educational initiatives and partnerships.

The restructuring demonstrates Tether’s move towards a broader and more varied approach, focusing on sustainable solutions and conscientious investments across different technological and financial sectors.