Major crypto developments for the week:

- Bitcoin transaction fees reach highest level on record due to inscriptions

- “Fish” accumulation is nearly offsetting Bitcoin’s entire block issuance

- Bitcoin addresses with non-zero balances have breached 50 million

- Ark, WisdomTree, Blackrock re-file ETF filings with cash versus in kind settlement after Fidelity

- Blackrock meet with the SEC to discuss their ETF applications

- Friend Tech announces v2 launch in Spring of 2024

- Synthetix turns off $SNX inflation and will use fees to buy back $SNX

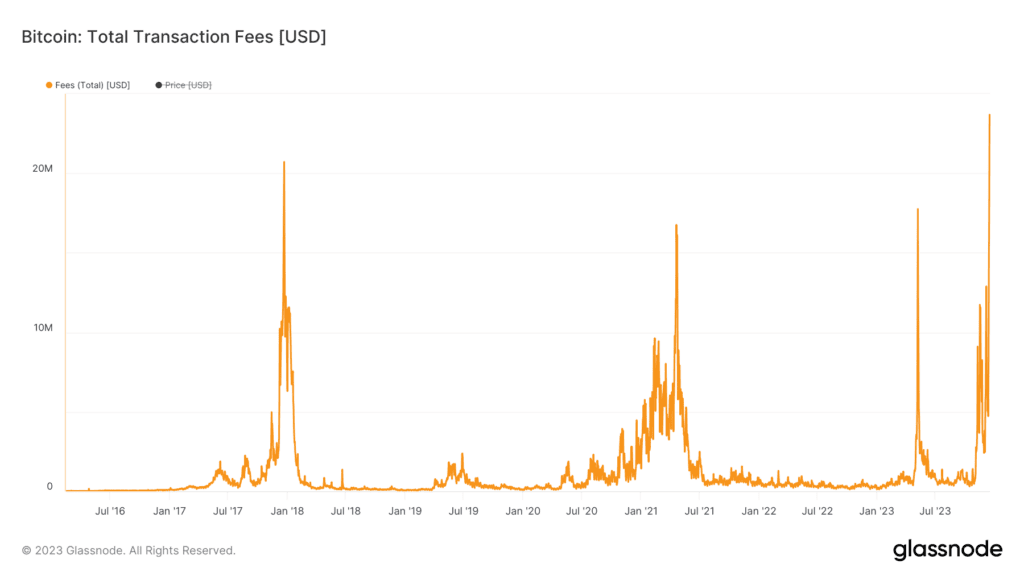

Bitcoin transaction fees reach highest level on record

This week Bitcoin transaction fees surged to their highest single day reading of all time at $23.6 million.

Past performance is not an indication of future results.

Did you know that certain publicly traded companies specialize in Bitcoin mining, with their revenue directly influenced by transaction fees? If you’re interested in gaining diversified exposure to these companies, check out our @bitcoinworldwide portfolio.

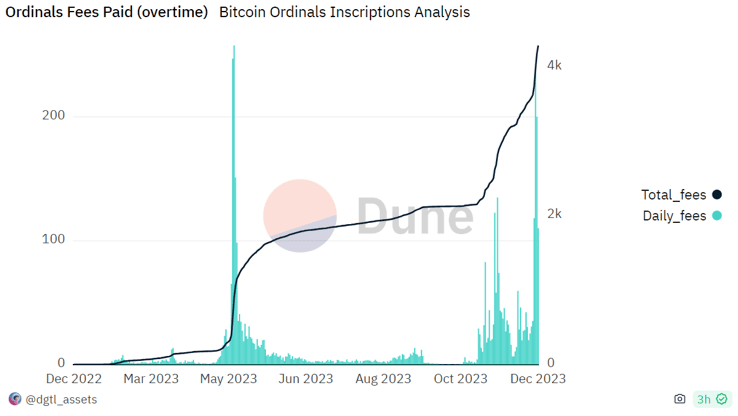

What’s behind the spike?

Ordinals inscriptions have caught a second wind, as shown in both the daily and cumulative values of transaction fees derived from ordinals inscriptions. Inscriptions have now generated over $175 million in transaction fees for the Bitcoin network.

Past performance is not an indication of future results.

What are the implications going forward?

Bitcoin miner revenues are made up by the block subsidy paid out from the protocol as well as transaction fees paid by users to get their transactions included in the next block on the blockchain. While higher transaction fees on Bitcoin’s base chain may price out small purchases, more miner revenue up for grabs means that more miners will plug in machines to capture the surge in fees; ultimately making the network more secure.

Does this solve Bitcoin’s “security budget” issue?

This also brings into question the concerns some pundits have expressed around Bitcoin’s security budget issue; the theory that Bitcoin will run into a security issue once Bitcoin rewards are longer being issued after the 21 millionth coin has been mined. The idea of sustained transaction fees from inscriptions combats this theory. It is also worth noting that should there ever be a substantial drop in miner revenues and hash rate comes offline, the difficulty adjustment that takes place every two weeks would bring block times back in line with the amount of hash rate; the China mining ban of summer 2021 is a great example of this. The theoretical debate lies on whether there is a quantifiable threshold of “sufficient security”.

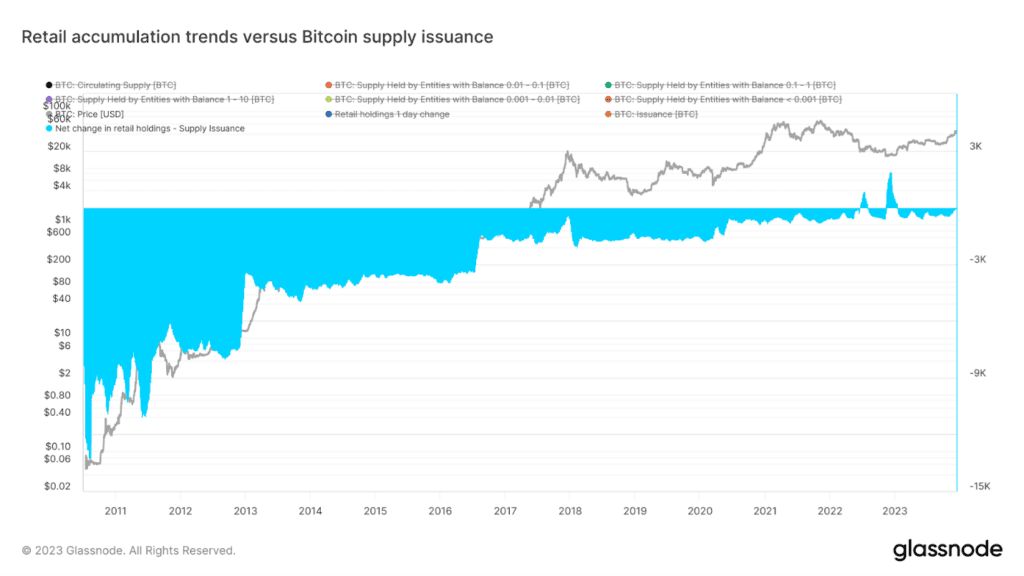

“Fish” continue to relentlessly accumulate Bitcoin

One interesting development to continue to keep an eye on is trends within on-chain wallet cohorts by size. The chart below compares the daily net change in on-chain wallet clusters with 1 Bitcoin or less to the daily issuance of Bitcoin that is rewarded to miners. As shown in the graph below, this spread has continued to push towards positive territory. With the upcoming halving set to cut issuance in half, should accumulation from “fish” (investors who own a small quantity of crypto) persist at current rates, this would offset the entirety of Bitcoin’s block issuance for the first sustained period of time ever.

Past performance is not an indication of future results.

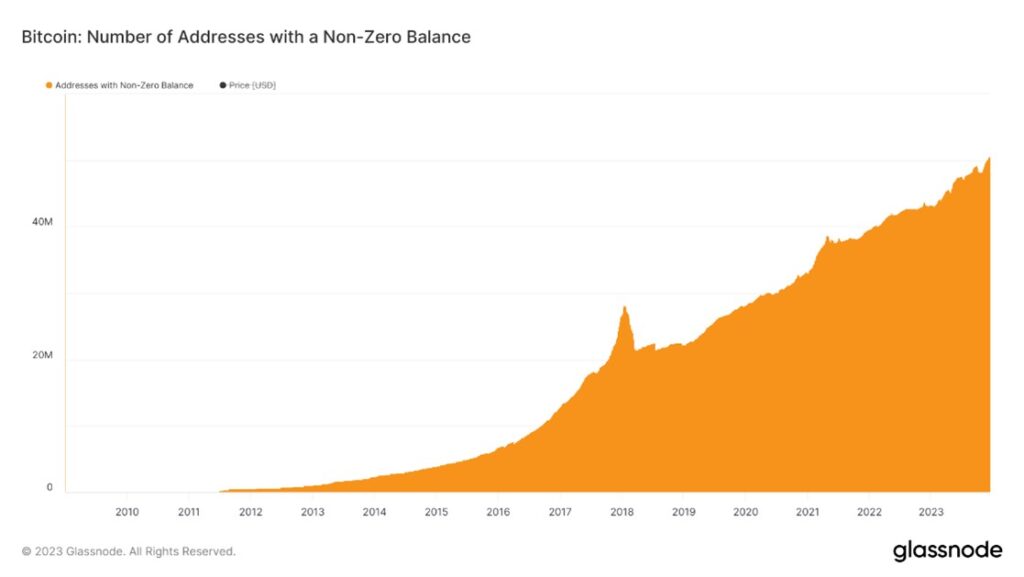

Bitcoin addresses with non-zero balances have breached 50 million for the first time

Over the last few weeks, the Bitcoin network crossed a major milestone with 50 million addresses with a balance of greater than 0 BTC. This perpetual rise is one way to measure Bitcoin’s accelerative growth as an emerging digital monetary network.

Past performance is not an indication of future results.

Learn more about the Halving.

The content in this post was created exclusively for eToro by Reflexivity Research.