Major developments for the week:

- Hong Kong BTC & ETH spot ETFs to begin trading today

- Brazilian Nubank app now allows Bitcoin transactions for customers

- BTC ETF products saw net outflows of $328 million last week

- Global asset mgmt leader Franklin Templeton activates peer-to-peer transfers for on-chain US GMF

- Metis announces Phase 2 of its Decentralized Sequencer

- Consensys served Wells Notice, files lawsuit against SEC

- Morgan Stanley may allow brokers to suggest Bitcoin ETFs

- Payment giant Stripe reopens crypto payments

- Paraguay Deputy proposes BTC legalization and legal tender status

- Grayscale filed for S-3 for spot Ether ETF and mini spot Ether ETF

- FTX to auction locked Solana collection due to high demand

- Shiba Inu raises $12M to develop new privacy-focused Layer 3 blockchain

Hong Kong BTC & ETH spot ETFs to begin trading today

We’re seeing multiple news stories regarding institutional adoption of crypto. News about the launch of BTC and ETH ETFs today in Hong Kong, plus follow-up news about the progress of the BTC ETFs in the US indicate that institutional investment in crypto is steadily increasing.

The Hong Kong’s spot BTC and ETH ETFs have been approved by Hong Kong’s Securities and Futures Commission and include products managed by prominent asset managers like China Asset Management, Harvest Fund Management and Bosera Asset Management in partnership with HashKey. This marks a significant development in Hong Kong’s digital assets space, aiming to provide investors with a regulated, efficient and safe means to invest in Bitcoin and Ethereum.

The spot Bitcoin and Ether ETFs in Hong Kong will employ an “in-kind” creation model. This differs from the cash-creation model used in the United States, as it allows the direct exchange of cryptocurrencies for ETF shares, which could lower costs and enhance liquidity.

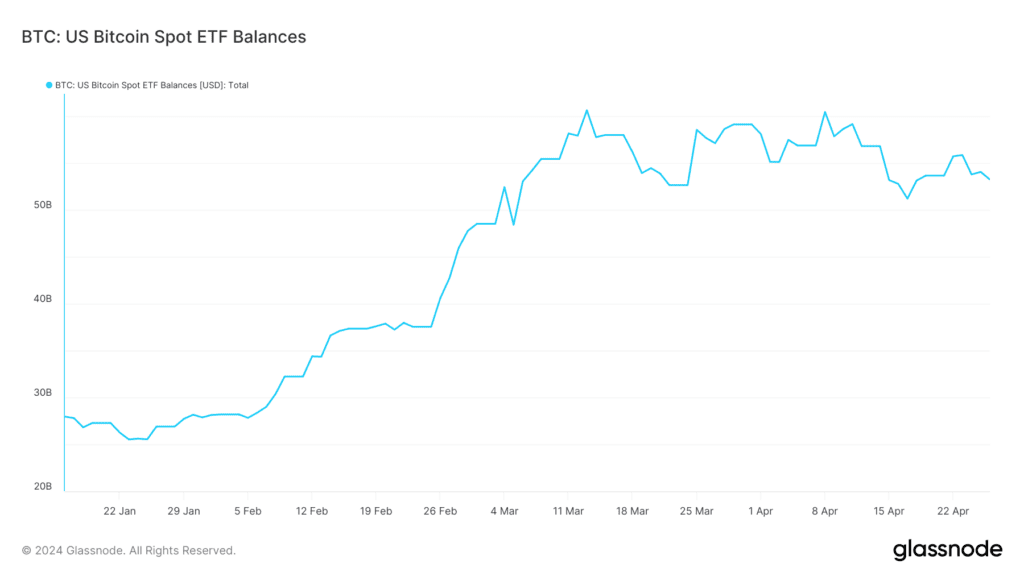

With US Bitcoin spot ETF balances having slowed, could Hong Kong pick up the slack?

Past performance is not an indication of future results

Brazilian Nubank app now allowing Bitcoin transactions for customers

Brazilian fintech leader Nubank has now introduced to its app the option to execute deposits and withdrawals for Bitcoin, Ethereum, and Solana. Announced on April 22, Nubank’s move aims to enhance user experience in the crypto sphere. These functionalities are being gradually rolled out to ensure seamless integration and customer satisfaction.

Metis Announces Phase 2 of its Decentralized Sequencer

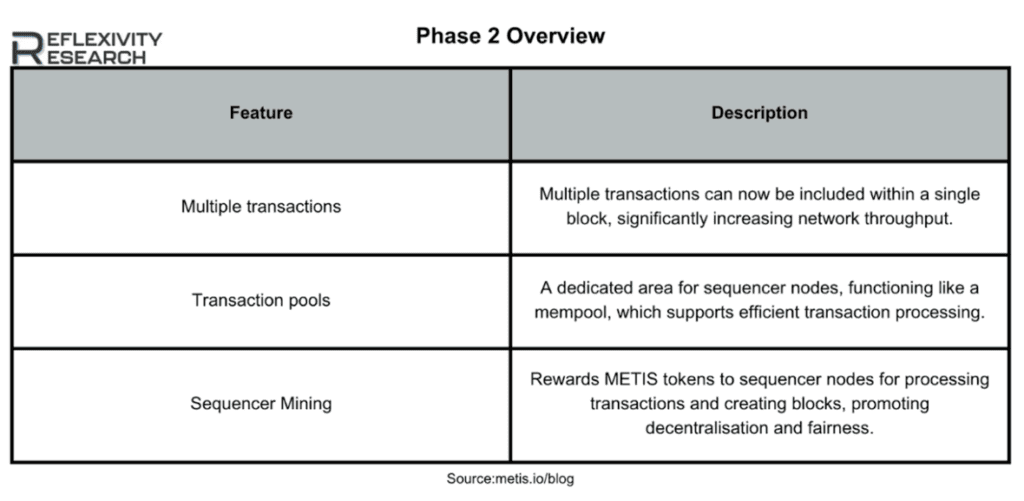

Another interesting development last week came from Metis in which it announced Phase 2 of its Decentralized Sequencer. The completion of Phase 1 of the Metis Decentralized Sequencer upgrade occurred on March 14th 2024. This advancement positioned Metis as the pioneer rollup platform featuring a decentralized sequencer. Phase 2 is currently underway, aiming to improve incentive alignment among all network participants. Below is a summary of the main aspects of Phase 2 and how they will impact the community:

Franklin Templeton has activated peer-to-peer transfers for its on-chain US Government Money Fund

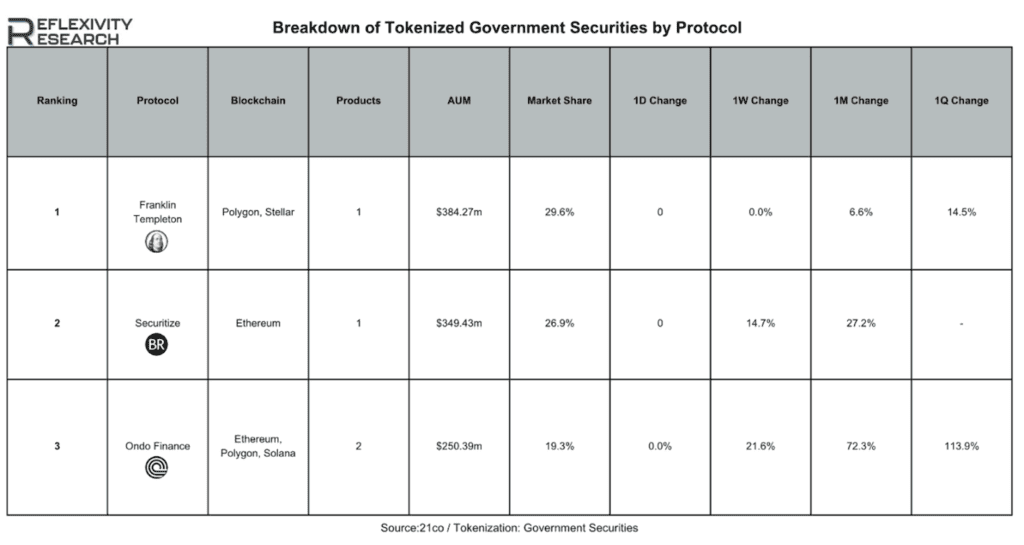

Franklin Templeton made history in 2021 as the first U.S-registered fund to utilise a public blockchain for processing transactions and recording share ownership. Last week they announced that they have facilitated peer-to-peer transfers of tokenized shares within its on-chain U.S. Government Money Fund.

Each share is represented by the BENJI token, which operates on the Polygon and Stellar blockchains. At present, Franklin Templeton strands as the leader in the tokenized U.S. Treasuries sector as detailed by the below table:

The firm currently boasts $384.27m in AUM and 29.6% market share. It is noteworthy, however, that Blackrock has achieved rapid growth since its launch in late March of this year.

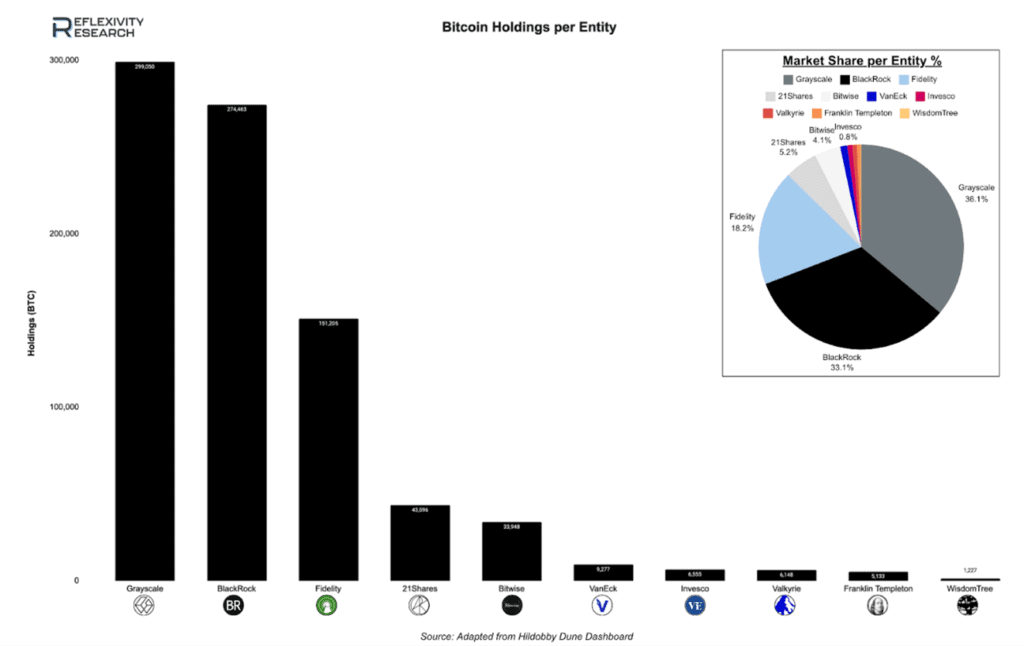

Bitcoin ETF products saw net outflows of $328 million last week

During the period of April 22nd to April 26th, the aggregate data shows that IBIT received a total of $57.6 million, while FBTC experienced inflows of $19.4 million. BITB and ARKB saw inflows of $15.6 million and $34.2 million, respectively. Conversely, GBTC witnessed significant outflows, totaling $454.1 million for the period. Other funds, such as ARKB, faced a notable single-day outflow of $31.3 million on April 25th. The total movement across all Bitcoin ETFs for this five-day period was an outflow of $328 million. A more granular look at recent trends reveals that the total on-chain holdings over the last 14 days, if annualized, project a decrease in Bitcoin supply absorption by 1.37%.

Past performance is not an indication of future results

Last week GBTC announced its intention to convert 20% of its holdings into a new Bitcoin ETF, featuring the lowest fee among all existing spot ETFs. The significance of this move is highlighted by an SEC filing, which indicates that GBTC plans to shift 63,000 BTC into this ETF. This transfer represents 20% of their total assets under management, elevating the Bitcoin ETF to become the fourth largest, with an AUM of $4 billion. Additionally, the new ETF will have a management fee of only 0.15%, the most competitive rate across all Bitcoin ETFs.

Consensys files lawsuit against the SEC

In other news, last week saw major developments on the litigation front between SEC and Consensys.

The recent lawsuit filed by Consensys against the SEC challenges the agency’s attempt to classify Ethereum’s native token $ETH as a security. This legal dispute underscores broader issues concerning regulatory jurisdiction and the potential impact on the Ethereum blockchain and the wider cryptocurrency sector.

Consensys argues that the SEC’s actions are inconsistent with previous regulatory guidance and contradict the Commodity Futures Trading Commission’s classification of Ether as a commodity. The company is contesting the SEC’s issuance of a Wells notice and potential enforcement actions related to their MetaMask wallet product, asserting that such actions represent a misapplication of securities law to a technology that functions primarily as a commodity.

The lawsuit seeks a judicial declaration that Ether is not a security and that MetaMask does not operate as an unlicensed broker-dealer.