Major Crypto Developments for the week:

- Bitcoin realized and implied volatility finally undergoes a large impulse

- Crypto market undergoes large derivatives-led liquidation cascade that wiped out hundreds of millions of dollars in open interest

- Bitcoin ordinals inscriptions cross 25 million, now generating $50 million fees for the Bitcoin network

- Bitcoin hash rate sets new all-time high

- dYdX’s v4’s public testnet 2 has gone live

- Sei Network, an L1 blockchain, has gone live on mainnet

- Social application Friend Tech has exploded, catching interest from mainstream celebrities such as Grayson Allen and FaZe Banks

- Binance Labs has purchased $5 million in CRV tokens to support the DeFi ecosystem, joining Aave and Frax who are set to purchase 5M and 2.5M CRV respectively from Curve co-founder Michael Egorov

Market Structure:

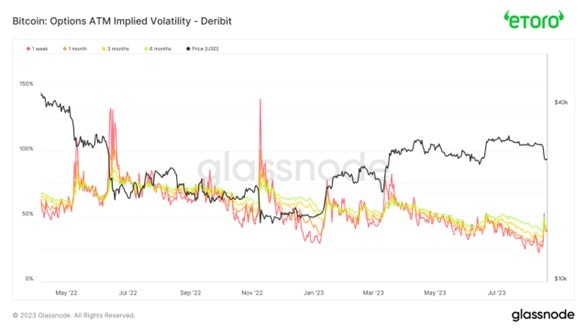

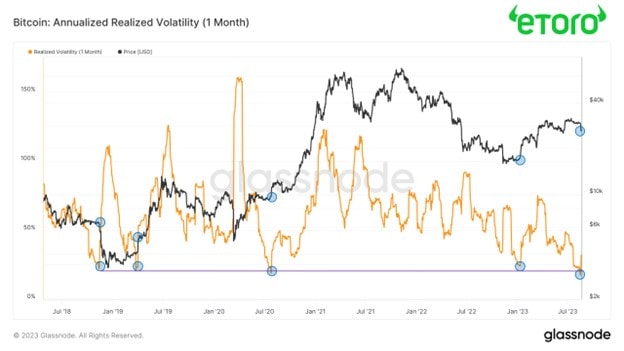

In last week’s update we highlighted that Bitcoin’s 1 month realized volatility was at levels that previously indicated large price impulses were on the horizon. Last Thursday, we finally got the impulse we’ve been waiting for, with Bitcoin implied volatility having its largest one-day increase of the year as Bitcoin dropped below $26,000 in short order. Without any news or catalyst that seems to be tied to the price move, what drove it?

Past performance is not an indication of future results.

Past performance is not an indication of future results.

Futures open interest, which represents the number of contracts outstanding in the futures market, underwent a massive decline during Thursday’s decline. This represents a large unwind of leverage that had built up in the week leading up to the event. Paired with the low liquidity conditions that we’ve highlighted, led the way for the vicious cascade to the downside that took place.

Past performance is not an indication of future results.

To illustrate how extreme of a move this was, we can see that the decline in open interest was the fifth largest on record for Bitcoin ever.

Past performance is not an indication of future results.

On the bright side, this excess leverage in the derivatives market has now been flushed out of the system.

The material in this blog post was created exclusively for eToro by Reflexivity Research.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.