Major Crypto Developments for the week:

- Bitcoin held by long term holders approaches all-time highs

- Citigroup expands crypto efforts by launching native token service

- Social platform Friend Tech sees resurgence in activity

- FTX receives court approval to sell its $3.3 billion in cryptoassets

- NFT project “Stoner Cats” sued by the SEC

- Cross-chain protocol Synapse has announced Synapse chain and the Synapse Interchain Network after liquidity provider Nima Capital liquidates DAO grant

Bitcoin Long Term Holders Approach All Time Highs

The percentage of Bitcoin’s supply held by long term holders is getting ready to breach its all time high of 76%. Defined by Glassnode as on-chain entities that have held their Bitcoin for at least 155 days, long term holders continue to add to their Bitcoin stacks despite the broader market conditions. Currently 75.8% of Bitcoin supply is held by long term holders, showing strong conviction in the asset class from experienced market participants.

Past performance is not an indication of future results.

Citigroup expands crypto efforts by launching native token service

On Monday morning (EST), Citigroup announced that they’d be expanding their crypto efforts by launching a pilot program titled Citi Token Services for cash management and trade finance. The permissioned blockchain technology created by Citi will offer 24/7 cross-border payments and liquidity to their client base by integrating tokenized deposits and smart contracts; which will serve as an upgrade to the firm’s cash management and trade finance capabilities. According to Shahmir Khaliq, Global Head of Services, “Digital asset technologies have the potential to upgrade the regulated financial system by applying new technologies to existing legal instruments and well-established regulatory frameworks. The development of Citi Token Services is part of our journey to deliver real-time, always-on, next generation transaction banking services to our institutional clients. This development goes hand-in-hand with our industry leading work on the Regulated Liability Network to create interoperable digital asset solutions on a multi-bank basis.” With Citigroup being one of the largest financial players on the planet, this move adds to the numerous developments we’ve seen from traditional financial players looking to experiment with digital assets despite the market-wide decline since 2021.

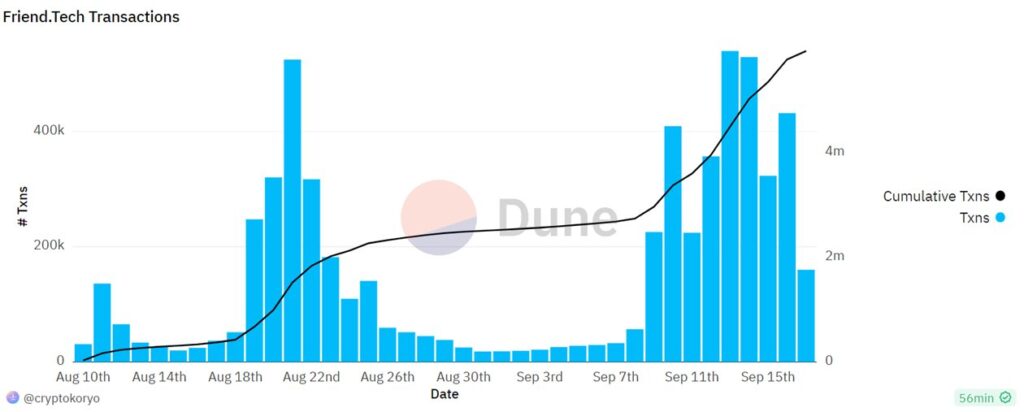

Social platform Friend Tech sees resurgence in activity, surpasses $11 million in fees

Popular crypto application Friend Tech has seen a resurgence in activity over the last week, after many market commentators declared the platform dead following its initial wave of excitement. Friend tech allows traders/investors to speculate on individuals/influencers by purchasing tokenized assets tied to said individuals called “keys”. With several well-known celebrities such as basketball player Grayson Allen and musician Steve Aoki joining, the platform appears to be catching some steam outside of the crypto native crowd. In the chart below from Dune Analytics, we can see that the number of transactions conducted on the platform have seen a major second wind, breaching 400,000 per day. In total the platform has now generated over $11 million in transaction fees from trading activity. With several similar iterations of social trading platforms having been attempted before such as Bitclout, it will be interesting to see if Friend Tech can continue garnering traction and draw in names from outside of the crypto native community.

Past performance is not an indication of future results.

FTX receives court approval to sell its $3.3 billion in crypto assets

Arguably the biggest piece of crypto news this week came as US courts approved the selling of FTX’s crypto assets. While the headline itself seems intimidating upon first glance, there is some nuance to consider around how the process will work. Galaxy Asset Management has been approved to handle the liquidation of FTX’s $3.3 billion of crypto assets, who have years of experience in navigating digital asset markets and are well aware of how to minimize price impact over time throughout the liquidation process. The majority of these sales will likely take place over the counter, meaning that they will not be directly sold at market. With that being said, on one hand one may perceive a rapid offloading of these assets as relatively positive, given that although there may be a larger impact on price, this must mean there was a large appetite from buyers on the other side of these OTC transactions that Galaxy is to facilitate. On the other hand, if these assets take a long time to be liquidated, while this may indicate that there was a smaller appetite to purchase the estate’s assets, there is likely going to be lessened price impact.

Out of the $3.3 billion of crypto assets, the break down by token is the following: $1.1 billion of SOL, $560 million of BTC, $192 million of ETH, $137 million of APT, $120 million of USDT, $119 million of XRP, $49 million of BIT, $46 million of STG, $41 million of WBTC, and $37 million of WETH.

The biggest standout is obviously Solana, who FTX/Alameda had previously been large proponents of. However, again there is nuance worth considering beyond this large headline number. Of FTX’s SOL tokens, roughly $300 million have been vested, which could be seen as short to medium term sell pressure. However, the remaining unvested $700 million SOL tokens do not fully vest until 2028, and again are likely to be sold off through over the counter transactions.

NFT project “Stoner Cats” sued by the SEC

Another development on the legal front this week came with the SEC charging Stoner Cats 2 LLC (SC2) with conducting what the SEC called “an unregistered offering of crypto asset securities in the form of purported non-fungible tokens (NFTs)” The sale of Stoner Cats NFTs raised approximately $8 million from investors to finance an animated web series called Stoner Cats that would be created by SC2. According to the SEC order, before and after Stoner Cats NFTs were sold to the public, SC2’s marketing campaign highlighted specific benefits of owning them, including the option for owners to resell their NFTs on the secondary market. In addition, according to the SEC’s website, “the order finds that, as part of the marketing campaign, the SC2 team emphasized its expertise as Hollywood producers, its knowledge of crypto projects, and the well-known actors involved in the web series, leading investors to expect profits because a successful web series could cause the resale value of the Stoner Cats NFTs in the secondary market to rise. Further, the order finds that SC2 configured the Stoner Cats NFTs to provide SC2 a 2.5 percent royalty for each secondary market transaction in the NFTs and it encouraged individuals to buy and sell the NFTs, leading purchasers to spend more than $20 million in at least 10,000 transactions. According to the SEC’s order, SC2 violated the Securities Act of 1933 by offering and selling these crypto asset securities to the public in an unregistered offering that was not exempt from registration.”

It is unclear exactly why the SEC chose Stoner Cats out of all NFT collections to pursue legal action against, but it will be interesting to see how the case evolves as a potential precedent for other NFT offerings that they may pursue in the future.

The material in this blog post was created exclusively for eToro by Reflexivity Research.