Major crypto developments for the week

- Fidelity releases Bitcoin report, making the case for Bitcoin as an investment

- River releases Bitcoin lightning network report, showing substantial growth from 2021

- Arbitrum incentive program closes, worth roughly $40 million for recipients

- Ethereum-based SocialFi application, Friendtech, adds 2FA to bolster security

- Reports of Blackrock ETF approval confirmed false

- SEC chooses to not appeal court’s decision in Grayscale case

Bitcoin lightning report published by River

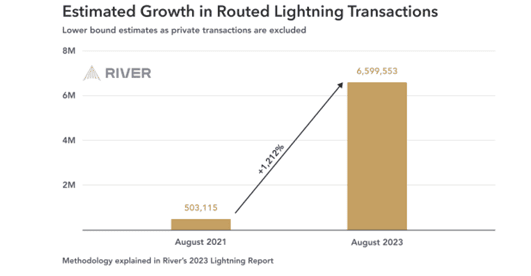

An interesting report published this week by River, entitled “The lightning network 1,212% in 2 years. Why it’s time to pay attention” highlights some interesting developments on Bitcoin’s layer two scaling solution “the lightning network.” One of the most interesting takeaways from the report was that based on River’s findings, they estimate a lower bound of 6.6 million lightning transactions in August of 2021, which only reflects public lightning network capacity; the true number is likely much higher but private capacity is difficult to track. This is a 1,212% increase from August of 2021 based on previous findings from K33 (previously Arcane) Research, see the chart below.

Past performance is not an indication of future results.

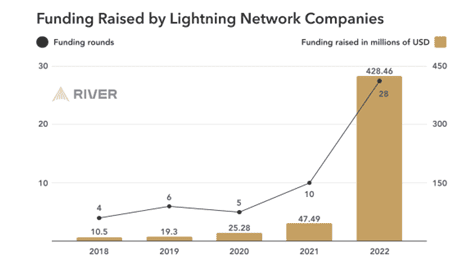

Another interesting chart from the report was published around the amount of investment that has been poured into lightning network companies, which reached $428 million in 2022, up nearly 10x from the year prior.

Past performance is not an indication of future results.

The report also includes several other measures of the lightning network’s growth, as well as a full map of the lightning network’s ecosystem.

Fidelity releases Bitcoin report

While the crypto market was relatively slow on the news/market structure front this week, $4.5 trillion asset manager Fidelity released a report titled “Bitcoin First Revisited,” walking through their investment case for Bitcoin, particularly in relation to other cryptoassets. Fidelity is no novice when it comes to digital assets and Bitcoin, with their investment team having highlighted the bullish case for Bitcoin as early as 2013. The main points made throughout their recent report included Bitcoin’s superior monetary properties, Bitcoin’s role as an initial entry point for investors to get involved with investing in crypto, and the case for Bitcoin fundamentally solving different issues than other crypto protocols/assets.

SEC chooses not to appeal Grayscale case

In last week’s crypto market update we mentioned that an important deadline to keep an eye on was October 13, which marked the end of the 45-day window for the SEC to appeal the court’s ruling in favor of Grayscale in their case disputing the SEC’s denial of Grayscale to convert their GBTC closed end trust into a spot Bitcoin ETF. On Friday it was revealed to Reuters that the SEC would not be appealing the court’s decision. The court is now expected to issue an order detailing how the process will move forward from here, which likely entails instruction to the SEC to revisit Grayscale’s ETF conversion application.

Arbitrum short-term incentive program (STIP) ends: recipients to get approx. $40M in ARB tokens

Over the last week numerous 29 crypto protocols in the Arbitrum ecosystem, which is an Ethereum layer two, have applied for the short-term incentive program (STIP); which plans to distribute 50 million ARB tokens worth roughly $40 million to encourage ecosystem development. The voting ended on Thursday, with on-chain derivatives exchange GMX gaining the largest batch of rewards at 12 million ARB, followed by another on-chain exchange, Gains Network, being awarded 7 million ARB.

Claims around Bitcoin spot ETF approval confirmed as false

On the morning of Monday 10/16 the market rallied up over 7% within minutes after a false headline was published in a crypto news outlet. Shortly after, the headline was disputed by Fox Business journalist Eleanor Terrett, providing a statement from Blackrock confirming that their Bitcoin ETF application is still under review. Shortly after, the falsity of the headline was confirmed once again by the SEC. This event triggered over $100 million in liquidations of futures positions in the 45 minutes following, meaning traders were forced to close positions on both the long and short side.

The material in this blog post was created exclusively for eToro by Reflexivity Research.