Major crypto developments for the week:

- JPMorgan’s Onyx is testing a portfolio management program on Avalanche connected by LayerZero’s cross chain technology

- Bitcoin ordinals inscriptions see major resurgence

- Blackrock officially files for Ethereum ETF

- HODLers trend continues: Bitcoin that hasn’t moved in at least a year sets record high of 70%

- “Pro-Bitcoin” president elected in Argentina

- Synapse, Phantom Wallet launch bridging solutions to Solana

- dYdX undergoes potential insurance fund exploit

- Tether freezes $225 million worth of stolen USDT after DOJ investigation

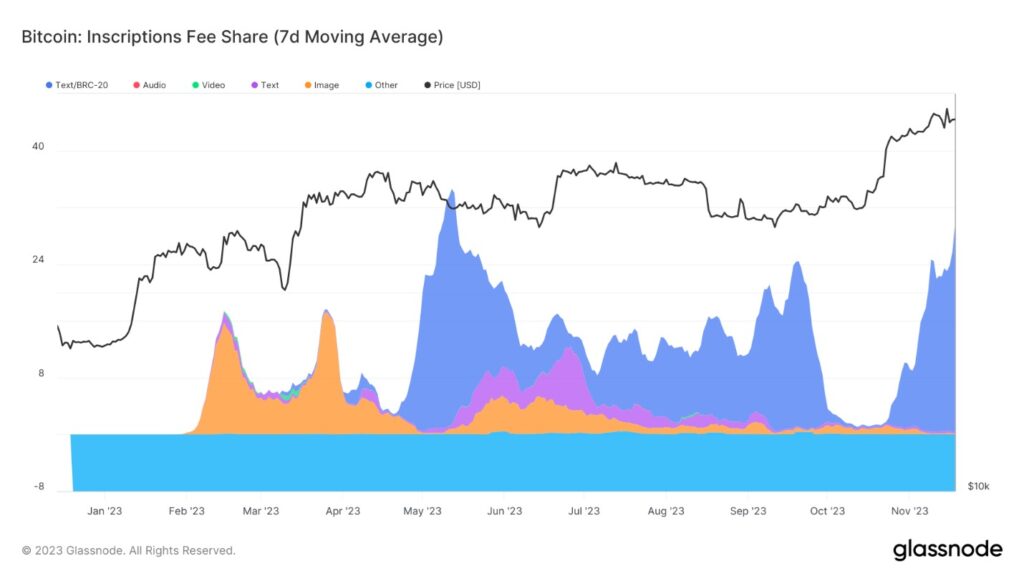

Bitcoin ordinals see resurgence

Over the last two weeks we’ve seen a major resurgence in activity around Bitcoin ordinals inscriptions, which are on-chain inscriptions of text, images, audio, and video natively on the Bitcoin blockchain. The chart below shows the percentage of Bitcoin’s overall fees that are made up by inscriptions, which is now at the highest level since the initial ordinals frenzy earlier this year. What are the implications of this for the Bitcoin network and market? Higher demand to utilize Bitcoin blockspace means higher transaction fees that must be provided to incentive miners to include transactions in a block. While this may not be ideal for a network user looking to conduct small transactions, this is good for miner revenues and increased mining activity, which ultimately translates to more security for the Bitcoin network and its holder base. It will be interesting to see if ordinals can continue their growth and how they will hold up relative to NFTs on Ethereum, Solana, and other smart contract platforms.

Past performance is not an indication of future results

JPMorgan utilizes Avalanche blockchain

One major development that came out this week was the collaboration between JPMorgan’s Onyx and Apollo Global, to test a portfolio management program on Avalanche, connected by LayerZero’s cross chain technology. This proof-of-concept will showcase bringing the wealth management industry on-chain. The collaboration, under the Monetary Authority of Singapore will be entitled Project Guardian and according to the project’s website, aims to “test the feasibility of applications in asset tokenization and DeFi while managing risks to financial stability and integrity”.

Blackrock officially files ETH ETF

One big piece of news came as Blackrock, the largest digital asset manager officially filed for an Ethereum ETF (exchange traded fund) in partnership with iShares. This should come as no surprise, as last week we highlighted that Blackrock had filed for a trust entity in Delaware for this official filling. If approved, the ETF will be listed on the Nasdaq and utilize Coinbase as the designated custodian. This marks a continued push into the digital asset space from the financial giant.

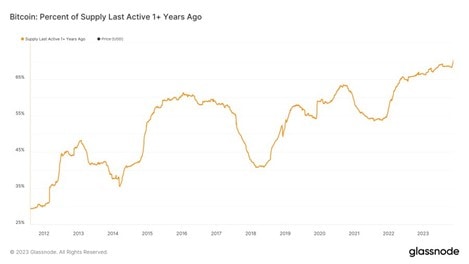

HODLers trend continues: Bitcoin that hasn’t moved in at least a year sets record high of 70%

This week marked a fairly significant milestone for Bitcoin as over 70% of Bitcoin supply has now not been moved in at least a year for the first time in its history. This supports previous data points that we’ve highlighted to reflect the strong belief from Bitcoin’s holder base in the wake of crypto wide contagion and macro headwinds after its all-time highs in 2021. While higher prices will ultimately incentivize new sellers, with Bitcoin up over 100% in the same time period, it appears Bitcoin holders are not planning on offloading inventory at these price levels or any time soon.

Past performance is not an indication of future results

“Pro-Bitcoin” president elected in Argentina

One of the biggest global headlines this week came as Javier Milei was elected as president of Argentina. Outspoken as a liberation that strongly opposes central banks, Milei plans to dollarize Argentina, but has spoken very positively Bitcoin. While there is reason to believe he may implement positive Bitcoin policies, time will tell, and given how vocal he has been about plans to dollarize the country, may not be quite as strong of a force for Bitcoin as some Bitcoin commentators have suggested.

dYdX undergoes potential insurance fund exploit

Overshadowing the announcement that all fees from dydX v4 would go to stakers, an attack on the protocol’s insurance fund took place this week. The attacker did this by taking massive leveraged long positions on YFI, driving up open interest from $0.8 million to $67 million in just a few days, thereby making FYI open interest higher than any other perpetual venue in crypto.

Meanwhile a large amount of YFI spot selling triggered a liquidation cascade on dYdX, which dYdX was unable to liquidate efficiently and was ultimately forced to cover the losses of up to $9 million of the dYdX v3 insurance fund. It is unclear exactly if the same actor was on both the dYdX perpetual and spot side of the events, but there is reason to believe this may have been a targeted attack on dYdX’s insurance fund. According to dYdX founder Antonio Juliano, the organization has contacted the FBI to look into these events to determine whether there was criminal market manipulation intent.

The content in this post was created exclusively for eToro by Reflexivity Research.