Can the ‘Dencun’ upgrade help the blockchain level up?

Crypto has been largely directionless over the last week, with most cryptoassets showing slight losses.

This lackluster performance was driven by mixed sentiment. The worsening banking crisis has dominated headlines and helped support the case for Bitcoin, while high transaction fees have overshadowed news about the next phase in Ethereum‘s evolution. Elsewhere, Solana and Avalanche have both dipped 3% despite positive ecosystem developments.

Read more after the jump.

This week’s focus

– Bitcoin up and then drifts sideways as banking crisis intensifies

– Ethereum lingers under $2K ahead of big upgrade — Can Dencun help the blockchain level up?

– Solana dips 3% despite booming blockchain activity

– Avalanche falls 3% despite Ali Baba deal

Bitcoin up and then drifts sideways as banking crisis intensifies

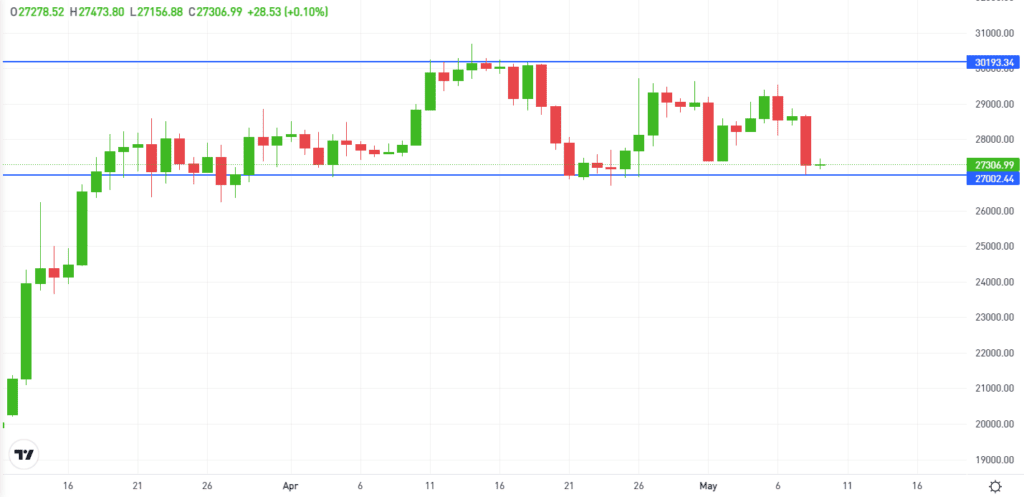

BTC remains range bound above support at $27K

Forged in the fiery aftermath of the 2008 financial crisis, Bitcoin has since become seen as a hedge against banking sector turmoil.

In the last few days, this has played out again, with Bitcoin holding strong and later drifting sideways as the US banking sector was rocked by the most serious string of failures since 2008.

Another US bank, First Republic, was sold to JP Morgan last week, after depositors pulled out $100bn over concerns that their money was no longer safe. This was followed by fears around two more banks, Los Angeles-based PacWest and Arizona’s Western Alliance, which both saw regulators step in to halt trading after a sudden drop in their share prices.

According to eToro’s Global Markets Strategist Ben Laidler, Bitcoin’s resilience amidst this turmoil is due to the “return of fear to the fiat US banking system” which “highlights the benefits of decentralized crypto”.

Ethereum lingers under $2K ahead of big upgrade — Can the Dencun upgrade help the blockchain level up?

ETH has fallen away from the next key hurdle at $2K

Drifting sideways below the key $2K milestone, Ethereum has shown little momentum over the last week.

Yet technically, the blockchain could be set to take a leap forward as the Ethereum Foundation plans the network’s next upgrade, known as Dencun.

According to a May 3rd blog post from Ethereum Foundation community manager Tim Beiko, Ethereum’s core developers are already in “the final stages of planning” for Dencun, and have currently included a “tentative set of [Ethereum Improvement Proposals]”.

These proposals include the highly-anticipated “Proto-Danksharding”, which is expected to significantly reduce the costs associated with transacting on Ethereum Layer 2 networks such as Polygon.

Such a development could help Ethereum overcome its current problem with transaction fees, which are currently sitting at a one-year high.

Solana dips 3% despite booming blockchain activity

Despite bullish blockchain data, SOL continues to drift sideways below $25

After activity on the blockchain plummeted in 2022, Solana appears to be bouncing back.

The token price has fallen 3% this week, despite data from analytics firm Nansen, which revealed that wallet activity on Solana was the second-highest among all blockchains in April, second only to BNB Chain.

At the same time, staking on the network has also surged. Data provided by Staking Rewards shows that more stakers are locking up their assets to support the network, with the number of addresses staking Solana increasing by around 3% over the last week.

This promising activity follows a series of big developments; from new NFT collections on the blockchain such as Madlads, to the launch of a new hardware phone: the Solana Saga.

Looking ahead, the resurgence could be set to continue following the launch of the Solana Foundation’s ‘NFT Showdown’, which aims to encourage more quality NFT projects to take root on the blockchain.

Avalanche falls 3% despite Ali Baba deal

AVAX fell 3% last week, but is now bouncing back from support at $15

Despite being at the center of one of crypto’s biggest recent partnerships, Avalanche has fallen 2.5% over the last week.

Chinese tech behemoth Alibaba recently revealed that it has built a launchpad for businesses to deploy metaverses on the Avalanche blockchain. The platform, named Cloudverse, offers companies a way to create metaverse spaces for engaging with their customers.

Yet despite hitting headlines for all the right reasons, the price of Avalanche could be weighed down by concerns about the supply schedule of the token.

In a recent tweet, K33 Research (formerly known as Arcane Research) highlighted that a substantial amount of AVAX is set to be unlocked in the coming month, which could have a negative impact on prices.