Major Crypto Developments for the week:

- Bitcoin posts first positive-returning September in 6 years

- VanEck launches Ethereum futures ETF

- Percentage of Bitcoin supply held by long term holder officially reaches all time highs

- Hong Kong to tokenize stocks

- NFT project Pudgy Penguins launches retail collection in Walmart

- DeFi TVL on Ethereum reaches lowest level since January 2021

Bitcoin posts first positive-returning September in 6 years

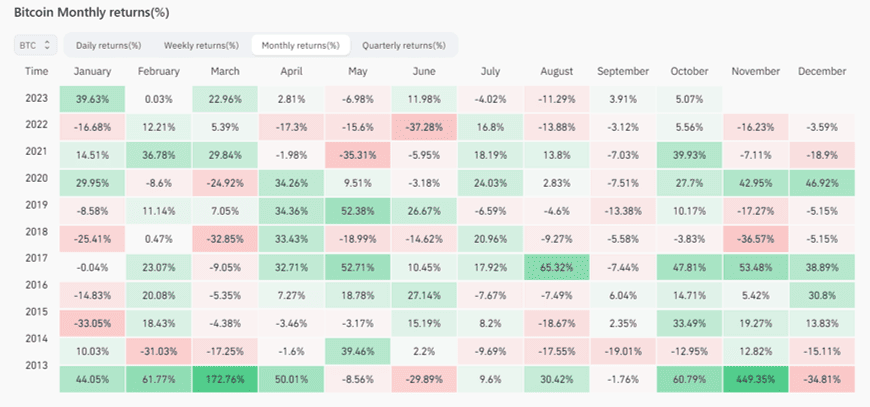

With October now underway, Bitcoin has posted its first positively returning September in 6 years at 3.91% month over month. The table below from Coinglass shows Bitcoin’s returns by month. With the worst month on average now behind us, looking ahead to the final 3 months of the year, seasonality is clearly on the side of bulls.

Past performance is not an indication of future results.

Did you know? $BTC is part of eToro’s @CryptoCurrency portfolio, one of eToro’s Smart Portfolios series, covering innovative themes.

Your capital is at risk. Past performance is not an indication of future results.

VanEck preparing to launch Ethereum futures ETF

As of the US stock market open at 9:30AM ET on Monday 10/2, Vaneck’s Ethereum futures ETF has officially gone live for trading. The vehicle is available for investors to trade on the CBOE under ticker $EFUT (Ethereum-Futures). While this will offer exposure to Ethereum through the futures market, there is still a gaping hole in the marketplace for both Bitcoin and Ethereum spot ETFs. At time of writing both ETH and ETH/BTC are down on the day. In addition, while everyone has primarily focused on developments around Bitcoin spot ETFs, on Monday 10/2 Grayscale filed a 19b-4 to convert their $5 billion Ethereum trust ($ETHE) into an Ethereum spot ETF.

Did you know? $ETH is also part of eToro’s @CryptoCurrency portfolio, designed to provide investors with exposure to the world’s two largest cryptoassets, and part of eToro’s Smart Portfolios series.

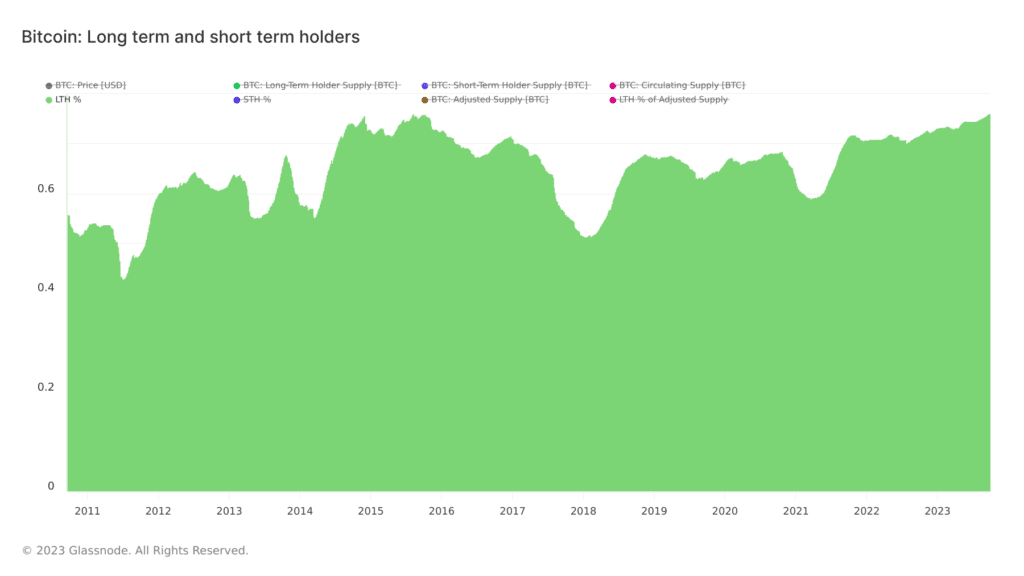

Percentage of Bitcoin Supply Held By Long Term Holders Officially Reaches All Time Highs

After months of waiting, the percentage of Bitcoin’s supply held by long term holders officially reached new all time highs over the last week at 76.09%. Defined based on the statistical likelihood of coins being spent, this means that over 3 out of every 4 Bitcoin in circulation is currently held by on-chain entities that have a low likelihood to sell any time soon. This reflects a strong belief from Bitcoin’s core holder base despite the industry-wide blowup in 2022 and macro headwinds. With this being said, it is also worth noting that less Bitcoin trading on exchanges means that price movements can be exacerbated in both directions.

Past performance is not an indication of future results.

Hong Kong to tokenize stocks on-chain

Another headline that largely went under-reported from the past week came out of Hong Kong, stating that the region is actively seeking to provide guidance for the tokenization of stocks. According to a speech given by Christina Choi, executive director of investment products of Hong Kong’s Securities and Futures Commission: “Our current thinking is that in principle, primary dealing of tokenized SFC-authorized products would be more appropriate to be allowed first at this stage in view of the nascent state of development of the [virtual asset services platforms] regime in Hong Kong”. This is a development worth continuing to watch, as paired with the rise in popularity of RWAs (real world assets on-chain) paints a picture of a potentially increasingly tokenized financial world.

NFT project Pudgy Penguins launch retail collection in Walmart

This week also presented a pretty big development in the world of non-fungible tokens. While NFTs have widely been declared “dead” by mainstream media with floor prices for numerous collections down 80-90% from their 2021 highs, Luca Netz and the Pudgy Penguins team have continued to build out the IP of the collection. On September 26th it was revealed that Pudgy Penguins would be launching a toy collection in 2,000 Walmart stores, which is the world’s largest retailer. The toys have launched with 16 different variations, ranging between $2.99-$11.97. According to Brittany Smith, vice president of merchandising/toys at Walmart U.S., “Pudgy Penguins is bridging the gap between our physical and digital worlds of play for kids in a really engaging way”. This is an exciting step forward for the NFT industry, which has been struggling with the traditional royalty model throughout the bear market.

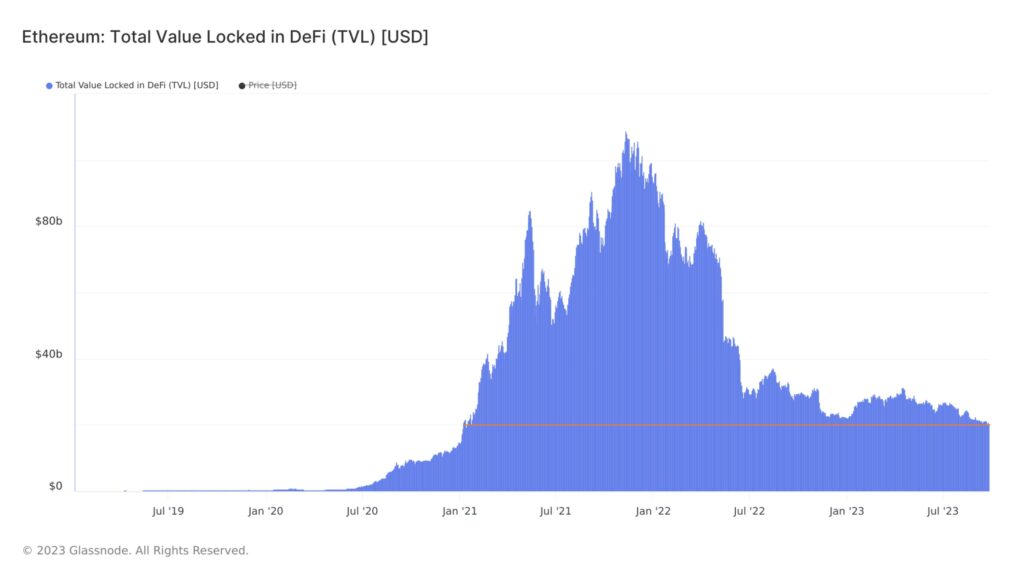

DeFi TVL Reaches its lowest level since January 2021

Total Value Locked in DeFi, which measures the total amount of assets locked up or staked in DeFi protocols on Ethereum, has reached its lowest level in USD terms since January 2021. Down 80% from $109 billion to $21 billion, this marks a continued decline in activity in DeFi and liquidity on-chain. It’s worth noting that some prefer to look at crypto denominated TVL as opposed to USD (which largely reflects the prices of cryptoassets), howeverbut regardless this still reflects the broader market wide decline for DeFi and crypto broadly.

Past performance is not an indication of future results.

The material in this blog post was created exclusively for eToro by Reflexivity Research.