Major crypto developments for the week

- Final Bitcoin Spot ETF deadline imminent

- JPMorgan, Jane Street Capital, Cantor Fitzgerald named as authorized participants in updated ETF filings

- Hong Kong regulators set to approve Bitcoin Spot ETF applications

- Bitcoin ends 2023 up 155%, fifth best year of all time

- Bitcoin’s 3-month futures basis breaches 20% annualized as perpetual funding rates breach 80% annualized

- Microstrategy purchases additional $615M Bitcoin

- Bitcoin inscriptions have now generated over $225 million of fees for the network

- Ethereum restaking protocol Eigenlayer surpasses $1 billion of total value locked within 48 hours

Less than a week to go until the BTC Spot ETF deadline…

Multiple Issuers re-file with additional authorized participants

With less than ten days until the final deadline for the SEC to make a decision regarding numerous Bitcoin spot ETF filings, this week we saw further developments with re-filings from multiple issuers. BlackRock’s latest filing includes traditional finance behemoths JPMorgan and Jane Street Capital as authorized participants, which will enable the firms to create and redeem shares of their ETF, if approved.

Senior Bloomberg ETF Analyst Balchunas commented on the move: “Just to be clear: the AP names weren’t due in S-1s, so BlackRock adding them in there is a bit of a flex in that regard. So if we see other S-1s not naming AP doesn’t mean they don’t have one lined up. But this does make BlackRock the first horse officially ready in my opinion.”

Meanwhile, WisdomTree also cited Jane Street Capital as an authorized participant, as did Valkyrie – together with Cantor Fitzgerald – and Invesco cited JPMorgan and Virtu as its respective initial authorized participants. These developments show a continued increasing probability of approval, although all there is to do now is wait until the deadline in seven days.

Hong Kong regulators set to approve spot Bitcoin ETF applications

According to Forbes, Hong Kong financial regulators have laid the groundwork for embracing Bitcoin spot ETFs with both in-kind and cash create models. Following on from developments in the US, this represents a potential global race to embrace Bitcoin and capital flows that may be generated around a Bitcoin spot ETF.

Bitcoin ends 2023 up 155%

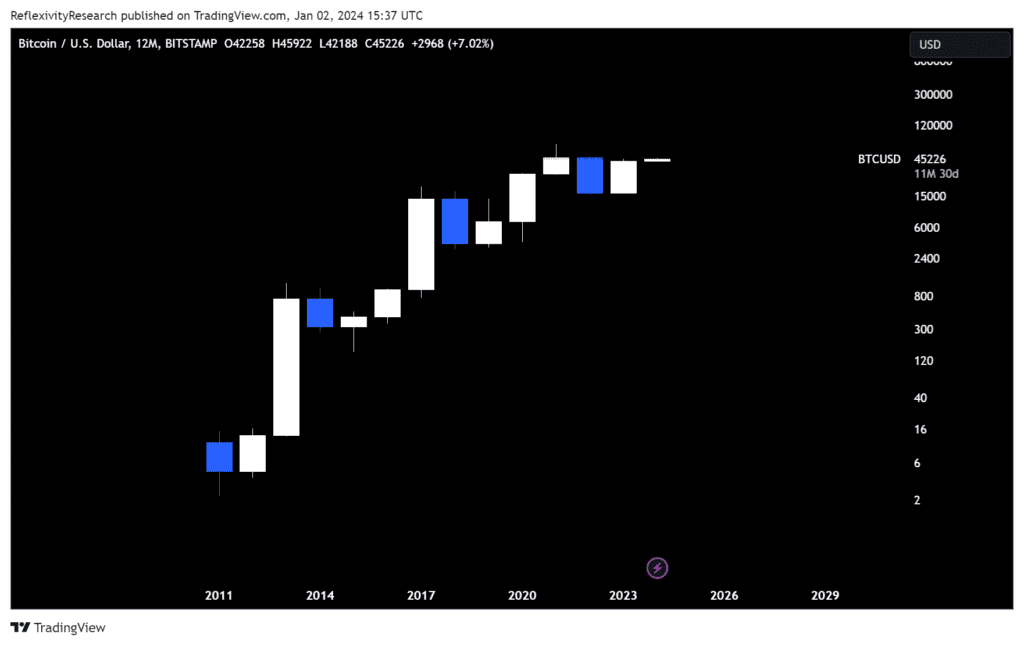

The end of 2023 saw Bitcoin posting its fifth best yearly price performance of all time. The chart below shows yearly candles for the leading digital asset.

Past performance is not an indication of future results.

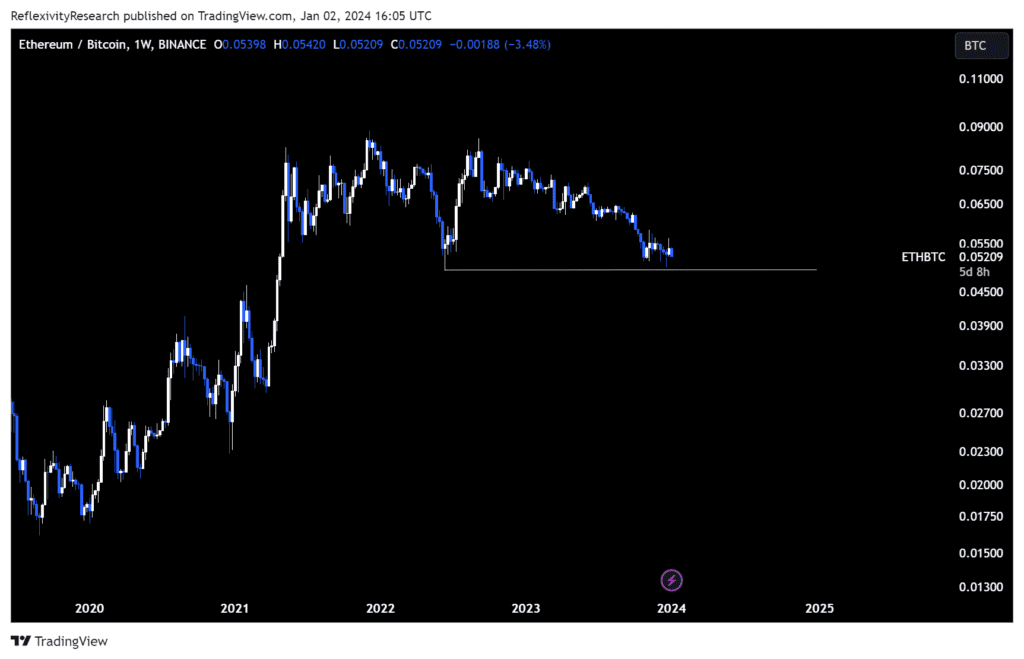

ETH/BTC Ratio approaches May 2022 lows

One must consider the effects that the BTC Spot ETF approval could have on the ETH/BTC ratio, specifically in relation to the possible rotation that traders and funds may make into ETH.

The ETH/BTC ratio has been on a downward trend for approximately 16 months. However, the anticipated approval of the BTC ETF in the near future could offer a turning point for this trend. Traders may shift their attention towards reevaluating ETH, in expectation of the upcoming ETH ETF. This scenario is reminiscent of the recent developments with BTC, where its value experienced a similar repositioning in the months leading up to its potential ETF approval.

Past performance is not an indication of future results.

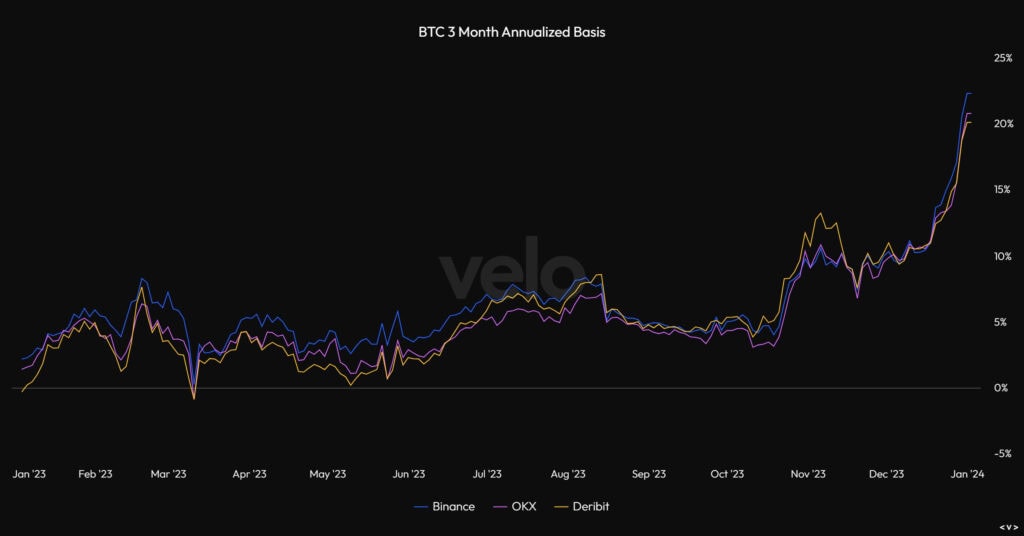

3-month futures basis for Bitcoin breaches 20% annualized

Meanwhile, looking at the futures market we can see strong bullish sentiment from traders, reflected by the difference between Bitcoin’s spot price and the price of its 3-month futures contract. Also referred to as the annualized basis, this is now trading at over 20%, the highest reading of the last 52 weeks by far. This warrants caution around market sentiment, especially when considering that this is the longest Bitcoin has gone without a 25% correction since 2011.

Past performance is not an indication of future results.

Ethereum restaking protocol Eigenlayer surpasses $1 billion of total value locked within 48 hours

This week highly anticipated ETH restaking protocol Eigenlayer raised its caps to 500k ETH, drawing in more than $1 billion of total value locked in the protocol within 48 hours. As a re-staking protocol, the protocol enables users to repurpose their staked ETH to extend security of other applications built on the Ethereum network.

The content in this post was created exclusively for eToro by Reflexivity Research.