Major Crypto Developments for the week:

- Chart reveals Bitcoin is the best performing asset class of 2023

- Judge blocks SEC’s request to appeal in Ripple case

- Developer activity in crypto drops to lowest level since end of 2020

- 50M $ARB to be distributed as part of an incentive program to drive capital and activity to the Arbitrum ecosystem. Numerous projects have applied so far, with the governance snapshot ending on October 13th

- Money market protocol Radiant Capital has pushed back its Ethereum mainnet launch to October 15th

- Frax Finance to launch Frax v3, enabling users to access US t-bills on-chain

Bitcoin remains the best performing asset class of 2023

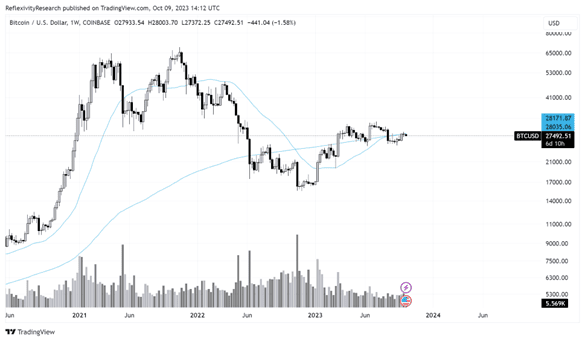

Bitcoin has once again struggled to reclaim both its 200-week and 200-day moving averages, amidst headwinds from rising US treasury yields and dollar, as well as recent geopolitical uncertainty.

Source: TradingView. Past performance is not an indication of future results.

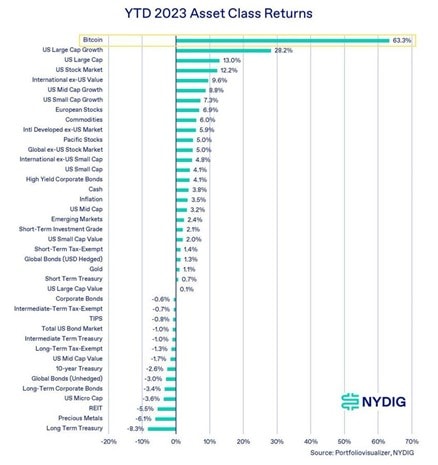

However, despite this, the chart below from New York based Bitcoin investment firm NYDIG highlights that Bitcoin is the best performing asset class of 2023, returning 63.3% year to date. This performance has outpaced US large cap growth stocks at 28% on the year, US large cap stocks at 13%, bonds, commodities broadly, and REITs.

Source: NYDIG. Past performance is not an indication of future results.

Developer activity in crypto drops to lowest level since end of 2020

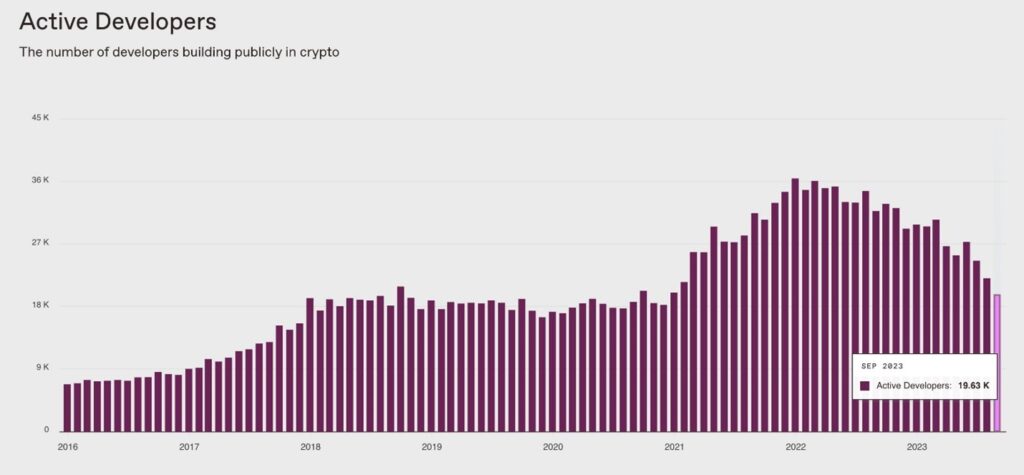

Another interesting chart that was released from Electric Capital and A16Z is shown below, displaying the number of active developers in crypto. According to their data sets, the number of active developers building publicly in crypto has dropped to 19,630, its lowest level since late 2020. This reflects trends we’ve highlighted in weekly updates for the last few months of “tourists” exiting the ecosystem throughout the bear market and only hard-core believers, builders and investors remaining in the industry.

Source: Electric Capital, A16Z. Past performance is not an indication of future results.

Judge blocks SEC appeal request in Ripple case, SEC Grayscale appeal deadline Oct 13

One major development on the legal/regulatory front came the U.S. District Court for the Southern District of New York as Judge Torres denied the SEC’s motion for an interlocutory appeal to the ruling in the Ripple versus SEC case. This comes after the court’s ruling that Ripple’s sales of XRP did not violate securities laws, while sales of XRP to institutional investors were securities. Judge Torres also stated that the trial in the XRP lawsuit is now set to begin on April 23, 2024, marking continued developments of the 3+ year long litigation process. Meanwhile, another important date for the SEC comes this Friday, as the 45 day window for the SEC to appeal the decision of their loss against Grayscale in the firm’s lawsuit regarding the SEC’s denial of their ability to convert their Bitcoin closed trust ($GBTC) into a spot ETF. There is an array of potential outcomes by Friday as the SEC has the ability to decide to accept the decision and approve the conversion of GBTC into an ETF, deny under different reasoning, or provide next steps. The bottom line is that the market will have more clarity on how the resolution of the case will progress forward by that date.

Bitcoin Relative Performance

One important metric to continue to monitor is Bitcoin’s market cap dominance. This metric looks at Bitcoin’s market capitalization as a percentage of the total crypto market capitalization. Oftentimes market participants view Bitcoin’s dominance as a risk gauge for the crypto market. As with other traditional markets such as stocks, early stages of market cycles begin with capital concentrated into a small set of high quality assets, that as the cycle goes on, disperses into longer tail risker assets. This dispersion continues until there are no longer sufficient inflows to hold up the market across the board and the market implodes in on itself, causing a flood back to value/safety assets. The crypto market is no different, with major trends beginning with capital concentrated in Bitcoin, followed by dispersion into Ethereum, and then eventually other altcoins. The cycle ends with capital flooding into high risk assets such as memecoins in 2021. Highlighted by Bitcoin dominance rising in the chart below, currently it appears that the crypto market is in a healthy concentration of capital into the core leading asset, which is of course Bitcoin.

Source: TradingView. Past performance is not an indication of future results.

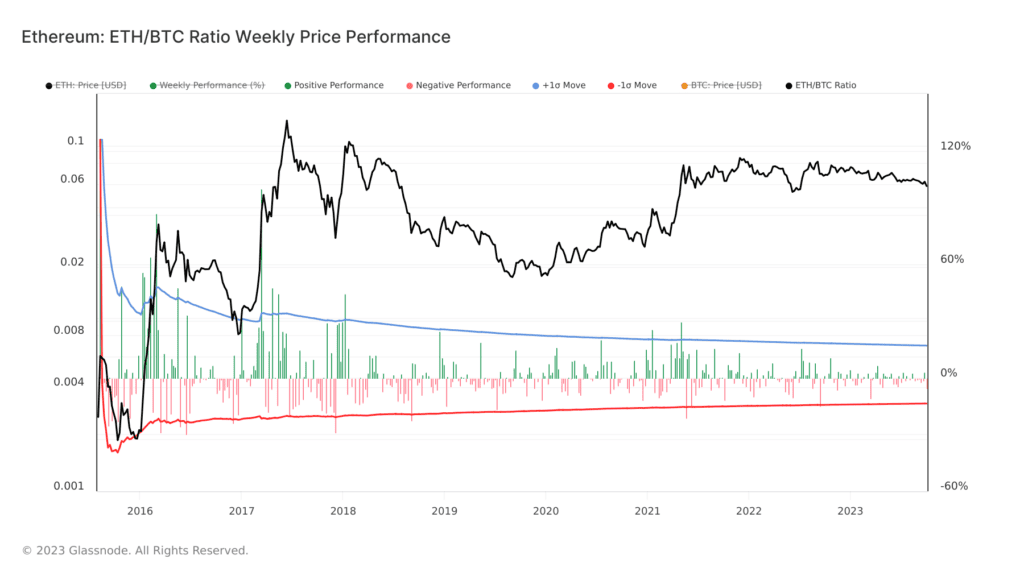

In addition to watching Bitcoin dominance, another gauge for risk taking behavior in the crypto markets is by looking at the ETH/BTC ratio, which compares Bitcoin’s performance relative to Ethereum as the #2 cryptoasset by market capitalization. As shown in the chart below, ETH/BTC has been trending downward since the merge in September of 2022. Both of these metrics will be important to watch for a shift from a Bitcoin dominated market regime into higher risk taking. For now, with the exception of a select pocket of idiosyncratic outperformers, the altcoin market looks questionable.

Source: Glassnode Past performance is not an indication of future results.

The material in this blog post was created exclusively for eToro by Reflexivity Research.