Trading volume hits record high of $7 billion

As the traditional financial world is rocked by turbulence in the banking sector, the crypto market is showing resilience.

Last week saw one of the largest stablecoins lose its peg on the sudden collapse of two American banks, following a warning from Jerome Powell that the Federal Reserve is still prepared to fight inflation with bigger interest rate hikes .

Yet despite briefly falling below $20K on the bad news, Bitcoin made a strong recovery. Ethereum is in a similar position with 2% weekly gains, while Curve climbed 4% to lead the altcoin market higher.

Read more after the jump.

This week’s focus

– Bitcoin bounces strongly to $24K on banking crisis

– Curve climbs 4% as trading volume hits record-high at $7 billion

– Ethereum whipsaws 10% on regulatory uncertainty — but is there light at the end of the tunnel?

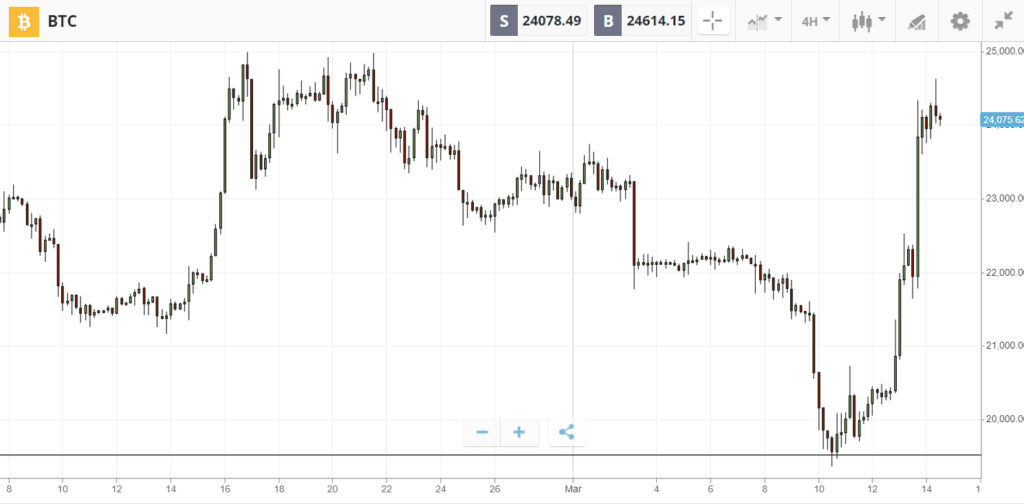

Bitcoin surges to $24K on banking crisis

BTC has made a strong recovery after testing lows under $20K

Bitcoin fell briefly below $20K at the weekend, as the collapse of two major American banks sparked fears of mass layoffs and paycheck delays.

Yet as another major bank was shut down on Tuesday morning, the leading crypto was already sitting back above $24K.

This recovery appeared to be driven by the Federal Reserve, which announced $25 billion worth of “additional funding” to backstop the banking sector and prevent problems from spreading to other institutions.

Many in the crypto community are now speculating that this intervention marks a shift towards the looser monetary policy that has historically supported higher Bitcoin prices. That includes Bitcoin maximalist Max Keiser, who tweeted on Monday that “we’re about to see “the biggest flood of money printing in history. Easily more than $50 trillion.”

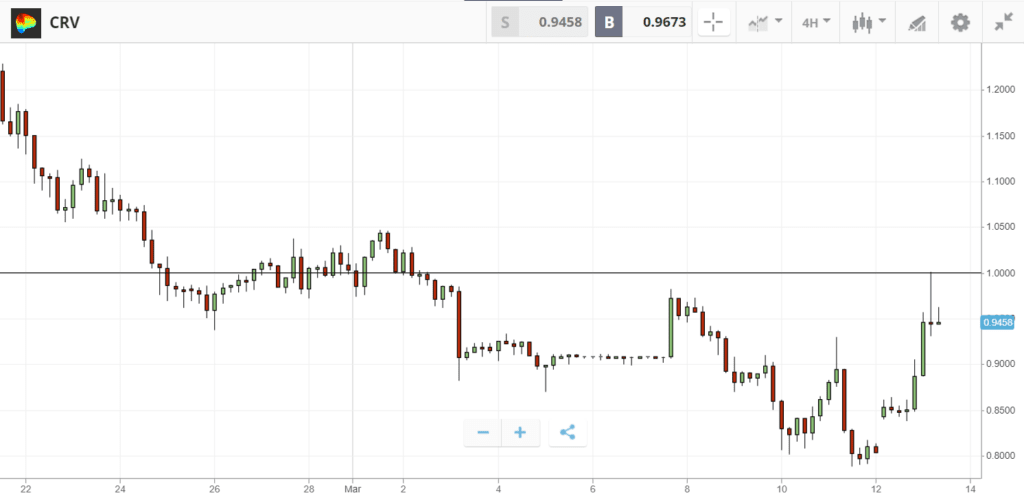

Curve climbs 4% as trading volume hits record-high at $7 billion

CRV taps $1 after quickly recovering from the weekend volatility

Stablecoin exchange Curve was among the first to recover from the weekend volatility, emerging from the carnage with 4% weekly gains.

The decentralized exchange is one of the most popular places to trade stablecoin USDC, which lost its peg early on Saturday after the company behind it disclosed that $3.3 billion of its $40 billion reserves are stuck in the collapsed Silicon Valley Bank.

As traders rushed to sell the ailing stablecoin, daily trading volume on Curve hit a record-breaking high of $7 billion. This surge in activity not only benefits investors, who can receive trading fees by locking up their tokens, but also reinforces the significance of Curve as critical stablecoin infrastructure.

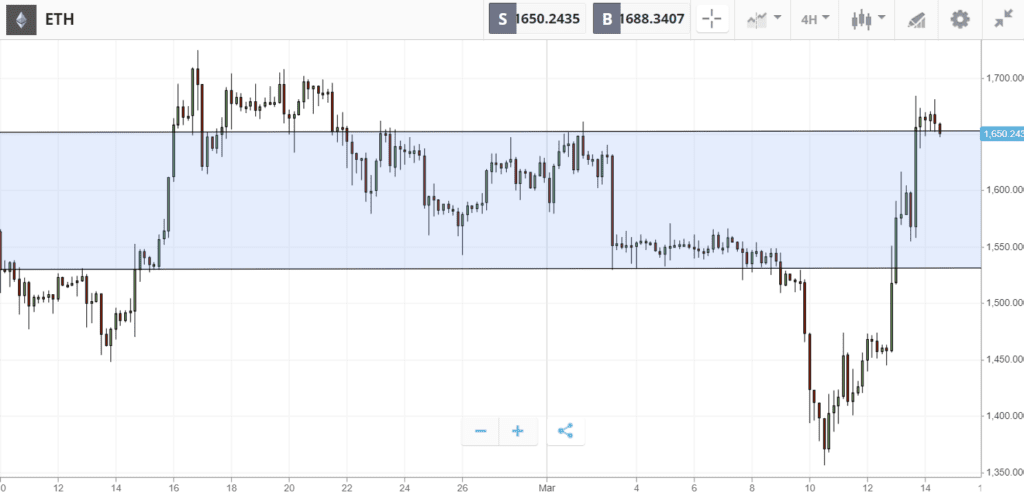

Ethereum whipsaws 10% on regulatory uncertainty — but is there light at the end of the tunnel?

Despite a sudden dip to $1,350, ETH has now recovered to break above the range around $1,600

Ethereum fell to its lowest point in almost two months on Friday, hitting $1,350 before fully recovering to make 3% weekly gains.

The volatility came on fresh uncertainty around the asset’s legal classification. In a lawsuit against a popular crypto exchange, New York Attorney General Letitia James alleged that ETH is a security, and that the accused exchange breached securities laws by offering the cryptoasset without registering as a securities broker-dealer.

Yet despite the allegations, Ethereum’s regulatory status remains far from resolved. Only last week, the chairman of the Commodities and Futures Trading Commission (CFTC), Rostin Benham, chimed in with a different view on the matter; asserting that Ethereum is in fact a commodity, belonging to the same category as Bitcoin.

This uncertainty may damage market sentiment in the coming days and weeks, but could ultimately lead to the kind of regulatory clarity that will help open the doors to traditional institutional investors.