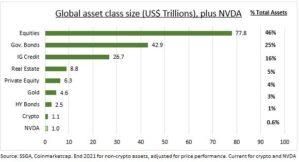

ON OWN: Crypto surged again, with Bitcoin (BTC) back to $30,000 and up 80% this year. Bitcoin led as the SEC crackdown on altcoin ‘securities’ drove a performance wedge through the asset class and took its market cap dominance to a two-year high near 50%. With a $1 trillion market cap crypto is by far the world’s smallest asset class (see chart) but has led all this year. The correlation with tech stocks has recently collapsed, making the latest gains all crypto. Driven by institutional adoption hope, with BlackRock’s spot ETF application, and new exchange from TradFi heavyweights. This is positive after 2022’s ‘winter’ and ahead of next’s bitcoin halving and coming regulatory clarity, including EU’s MiCA implementation. @CryptoPortfolio

HEADWINDS: Crypto has seen off double headwinds from the SEC and the tech rally. The SEC regulatory crackdown against the two leading exchanges Binance and Coinbase (COIN), and naming of big altcoins like Solana (SOL) and Cardano (ADA) as securities, drove a performance wedge through the asset class and counter-intuitively opened door to more institutional involvement. 2) Whilst the tech stock and AI rally sucked oxygen from the asset class, for those looking for growth, risk, or tech exposure. NVIDIA’ $1 trillion market cap rivals that of all crypto.

INSTITUTIONS: The latest rally was driven by returning institutional interest, key to a young asset class dominated by retail investors. 1) The world’s largest asset manager, BlackRock (BLK) filed to launch the first spot Bitcoin ETF, to add to its $2 trillion ETF assets. If anyone can get this SEC approved it is seen as them, and it could be a key on-ramp for institutional and retail investors. 2) TradFi stalwarts Citadel, Fidelity, Schwab (SCHW) launched a new exchange called EDX, to give an institutional-friendly venue after incumbents were forced to pull back. Whilst Deutsche Bank filed to provide digital custody services in Germany, in a further signal.

All data, figures & charts are valid as of 26/06/2023.