Major Developments for the Week

- BTC soars past $89K, weekend super-surge paves way to new all-time highs

- ETH surges past $3.2K, overtakes Bank of America in market cap

- ADA jumps 30% on Cardano founder-Trump collaboration buzz

- Solana passes $210, breaks $100B milestone, highest in nearly three years

- Analyst PlanB predicts Bitcoin to top $250K in coming years

- Bitcoin flips silver, now the 8th largest asset by market cap

- Raoul Pal: SUI set to outperform ETH & SOL this cycle

- DOGE surges 100% with Musk’s strong ties to President-Elect Trump

- ImmutableX unveils in-game signing for Web3 gaming

- Lawyer says SEC’s Mark Uyeda likely next chair

- Ethereum pumps nearly $500M into ecosystem projects in 2022–23

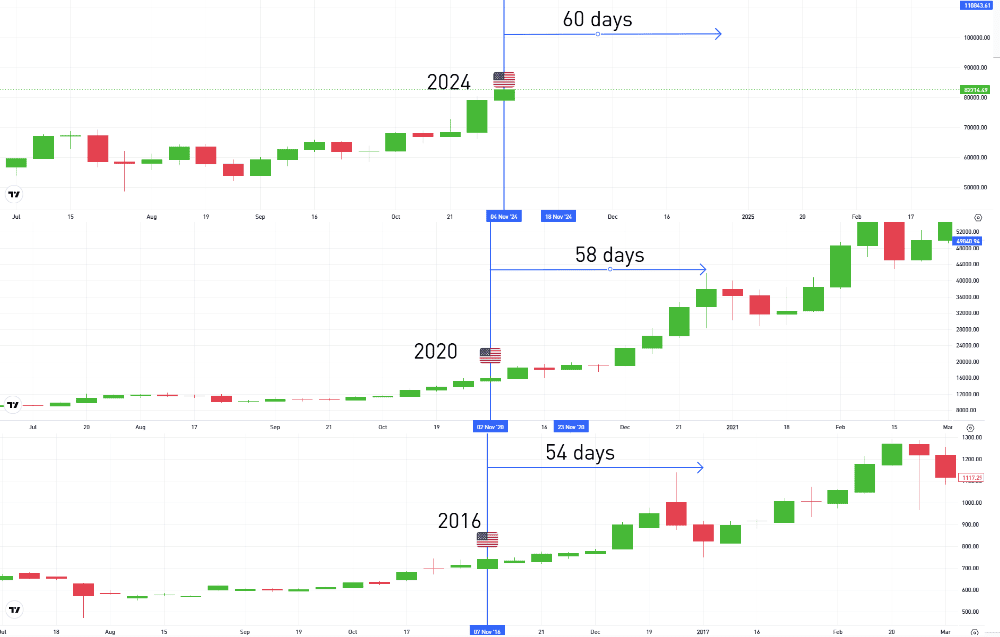

A comparative look at the behaviour of Bitcoin at this stage post-Halving.

Will this bull run continue with the same pattern as before?

Past performance is not an indication of future results

Crypto Market Roars: Trump Win and Fed Rate Cut Spark Massive Rally

The post-election rally has injected fresh optimism into the crypto sector, with Trump’s pro-crypto market stance and the Fed’s supportive conditions creating fertile ground for further growth.

Investors are speculating on possible regulatory relief, invigorating the market and driving impressive gains across major altcoins, with Ethereum, Cardano, and Solana being pushed into the spotlight. Analysts are eyeing what they call the “banana zone,” a phase of rapid gains across major tokens, with a potential path toward a $10 trillion crypto market cap by 2026.

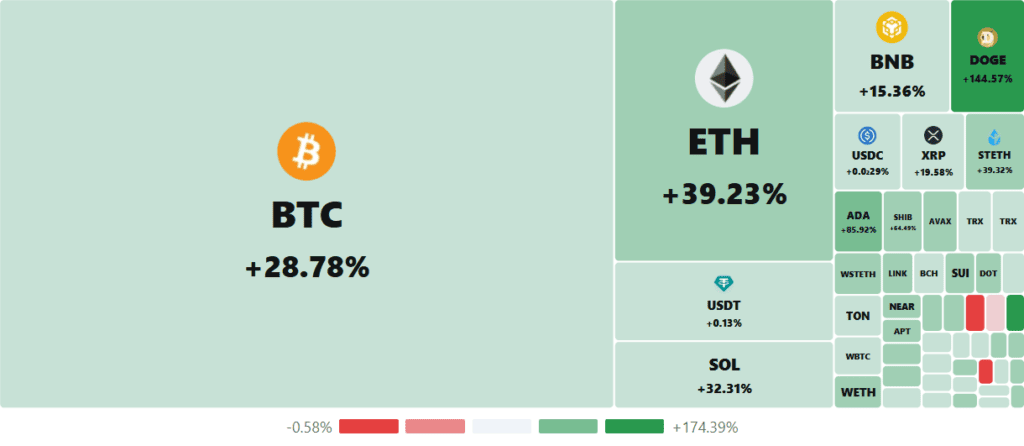

A heat map indicating the crypto market surges over the past week

Past performance is not an indication of future results

From Crisis to Comeback: Bitcoin Soars

Two years to the day after the collapse of FTX, Bitcoin has soared past $89,000 (at time of writing) — a dramatic rise few could have predicted. From fears of collapse to an industry-wide resurgence, Bitcoin’s recovery underscores the resilience of crypto since that fateful November in 2022.

Ethereum’s Rally and the “Digital Bond” Appeal

Ethereum has surged over 23%, surpassing $3,000—the highest since August. Investors are drawn to Ethereum’s yield potential, especially with the Fed’s rate cut narrowing the gap between traditional and crypto returns, making ETH an attractive “digital bond” through staking. This spike reflects the market’s excitement around the potential for crypto-friendly policies from the Trump administration, which could support the decentralized finance (DeFi) sector where Ethereum has established itself as a dominant player.

Solana Joins the Elite $100B Club, Speculated to Challenge Ethereum

Solana has made headlines by crossing the $100 billion valuation mark, joining Bitcoin and Ethereum among the most valuable cryptocurrencies. Following a 34% rally, SOL reached $214, not far from its all-time high of $260 from the 2021 crypto bull run. Known for its active DeFi and memecoin ecosystem, Solana’s comeback post-FTX has gained traction among retail investors, who see it as a strong contender in the crypto landscape. As Solana’s ecosystem expands, some believe it could challenge Ethereum’s dominance, signalling a potential shake-up in the DeFi market.

Cardano’s Surge on Speculation of a Trump Connection

Cardano saw a remarkable 30% spike, fueled by rumours of founder Charles Hoskinson potentially collaborating with the Trump administration on crypto policy. Although Hoskinson clarified that no formal role has been discussed, the market’s reaction highlights its speculative nature. Cardano’s resurgence comes after a challenging period, and if current support levels hold, analysts predict ADA could double in value by early 2025. This momentum has positioned ADA as one of the more volatile but potentially rewarding assets in the current rally.

Crypto Expert Raoul Pal: SUI to Lead This Cycle

Raoul Pal, CEO of Real Vision, predicts SUI could outperform both Ethereum and Solana in this crypto cycle. While he expects Ethereum to outpace Bitcoin as the market enters a “risk-taking phase,” Pal believes Solana’s growth will surpass Ethereum’s—yet Sui may well outperform them all due to its strong early-stage adoption.

Bitcoin’s $250K Potential: Key Drivers to Watch

Recent market developments and political shifts are aligning in a way that could propel Bitcoin (BTC) to new heights, with some analysts projecting a future price of over $250,000. Here’s a look at the main factors fueling the optimism around Bitcoin’s next potential bull run.

Bitcoin’s Leadership and the Path to $100,000

Bitcoin has once again surpassed its all-time high, trading at around $89K at time of writing. Analysts project it could reach $100,000 by the end of 2024. Standard Chartered’s Geoff Kendrick even forecasts BTC to hit $125,000 by Trump’s inauguration in January, signaling strong confidence in Bitcoin’s continued ascent. As Bitcoin rises, it may drive up other major assets, such as Ethereum, Solana, and Cardano, through a “rising tide” effect that could lift the entire crypto market.

PlanB’s Bold Prediction

Quant analyst PlanB, known for his Stock-to-Flow (S2F) model, predicts Bitcoin could surpass $250,000 within the next few years. The S2F model links scarcity to price, and Bitcoin’s upcoming “halving” events – when mining rewards are reduced, making the asset scarcer – historically trigger bull runs. PlanB also points to institutional moves, such as Michael Saylor’s planned $42 billion Bitcoin acquisition, as major price boosters.

Retail Investors Driving Weekend Gains

Bitcoin recent all-time high of $79,000 over the weekend (since surpassed), a traditionally quieter period in the crypto market suggests smaller, retail investors are buying in, a positive indicator as it shows widespread interest. Alongside this, $280 million in bearish bets were liquidated, marking a high level of activity and a strong shift in market sentiment toward bullish.

Pro-Crypto and Bitcoin Potential presidential Policy Prospects

The election result could well mean friendlier crypto regulations. Should the Bitcoin Act be passed, it would position Bitcoin as a strategic reserve asset similar to gold, by paving the way for institutional acceptance, and driving more capital into Bitcoin. If the new administration reconfigures the SEC, including the possible replacement of SEC Chair Gary Gensler, it could also lead to more flexible regulations. If the campaign promise of a U.S. Bitcoin reserve comes to fruition, it would consolidate 200,000 confiscated bitcoins, signalling government confidence in Bitcoin and potentially boosting its market value. Other promises include positioning the U.S. as a hub for Bitcoin mining, with a focus on using domestic energy sources, and providing regulatory clarity within 100 days. Such moves could foster innovation and give the market the stability it needs.