Market Structure

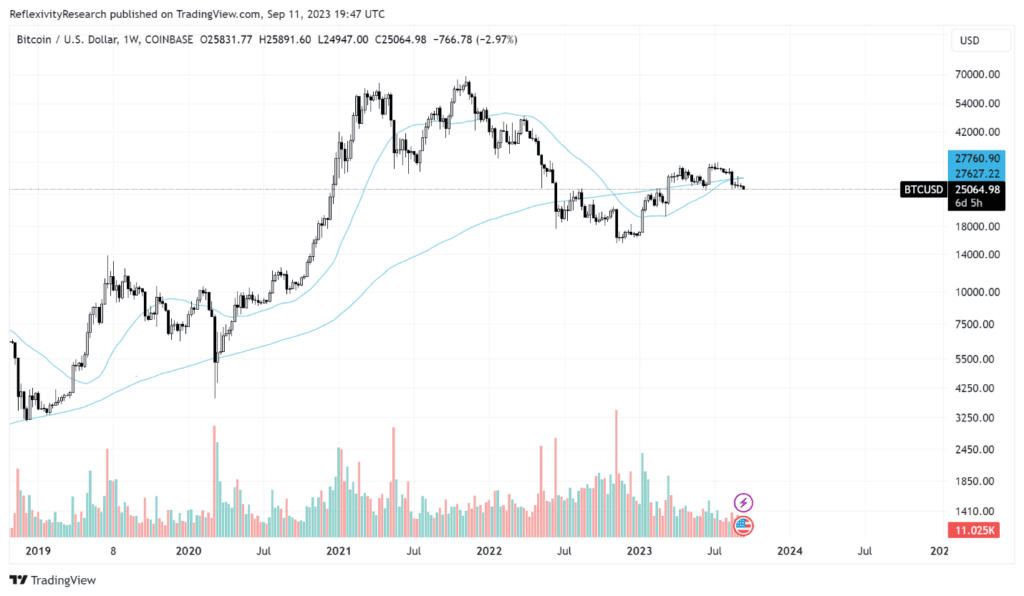

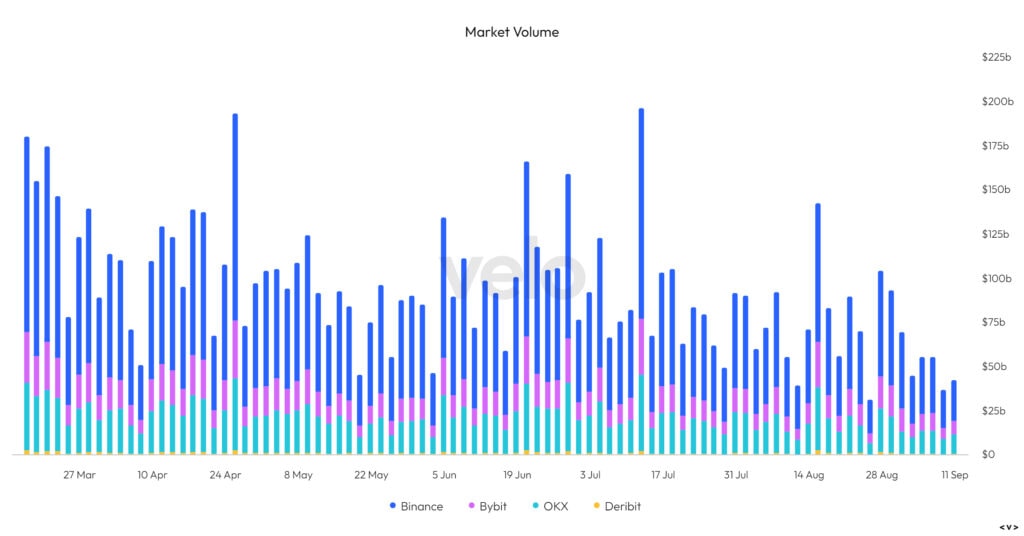

Now that we’ve taken a look at a few of the most interesting developments of the week, let’s take a look at crypto market structure and where things stand broadly. Trading volume has declined again this week, a continuation of the market apathy and time capitulation that we described in last week’s report.

Past performance is not an indication of future results.

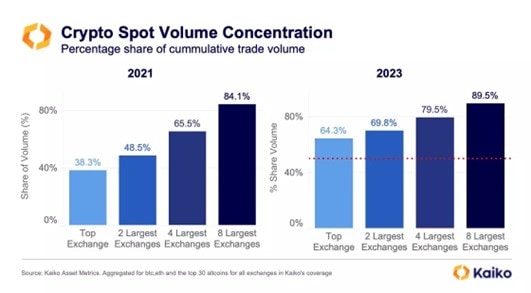

Kaiko data released an interesting report on volume and liquidity in crypto markets this week, with one of the most interesting findings throughout their report being the chart below. This shows the concentration of spot trading volume in the crypto market from 2021 to today.

In 2021, the largest exchange globally took up 38% of all global trading volume, compared to 64% today. Looking at the top 2, 4, and 8 largest exchanges all show the same trends of concentration. Why does this matter? The more volume concentrated into a few venues means a higher amount of concentration risk for the industry should those few venues undergo any existential regulatory or security issues.

For end users in any industry, more competition ensures constant innovation to stay ahead of other firms. However, the other argument would be that more competition in the exchange landscape fragments liquidity, meaning traders must execute across multiple venues to minimize price impact.

Past performance is not an indication of future results.

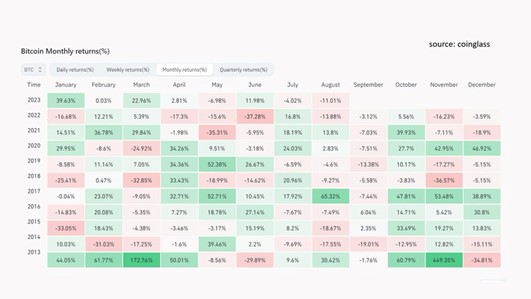

Recently, we highlighted the unfavorable seasonality of September, being the worst month for Bitcoin historically by far. This September has been no different thus far, with Bitcoin down 3.6% 11 days into the month.

Past performance is not an indication of future results.

Bitcoin has now lost both its 200 day and 200 week moving averages, two price levels that bulls would like to see reclaimed to signal any medium-term price reversal.

Past performance is not an indication of future results

We hope you enjoyed this week’s crypto market update and look forward to touching base again next week! Thanks for reading.