Major Developments for the Week

- Gold hits record high as central banks stockpile, yet Bitcoin outshines

- Bitcoin slides below $58,000 as crypto market sees weekend slump

- Traders brace for Fed-induced Bitcoin volatility

- Cardano’s Chang hard fork goes live, introducing On-Chain Governance

- Trump gains crypto voters as RFK Jr. endorses his campaign

- Bitcoin holdings of publicly listed firms increased to $20B in one year

- Scientific paper argues Bitcoin mining can reduce methane emissions

- El Salvador’s Bukele Says Bitcoin Strategy a ‘Net Positive,’ but Adoption Lags

- BlackRock launches ETH ETF in Brazil

- ETFs News: BTC ETFs log monthly loss, ETH ETFs ignored after outflow streak

- Canadian court orders $1.2M Bitcoin loan repayment

- To prevent “industrial farming”, Ethereum gaming network made members-only

- Babylon Labs: Native BTC staking coming to Bitcoin Layer-2 networks

Bitcoin

Central Banks Boost Gold Reserves, But Bitcoin Still Leads in 2024

In the first half of 2024, global net gold purchases by central banks reached a record-breaking 483 tonnes, surpassing the previous year’s record of 460 tonnes by 5%. This surge, driven by the National Bank of Poland, the Reserve Bank of India, and the Central Bank of Turkey, reflects a broader shift toward traditional store-of-value assets amid geopolitical and economic uncertainties.

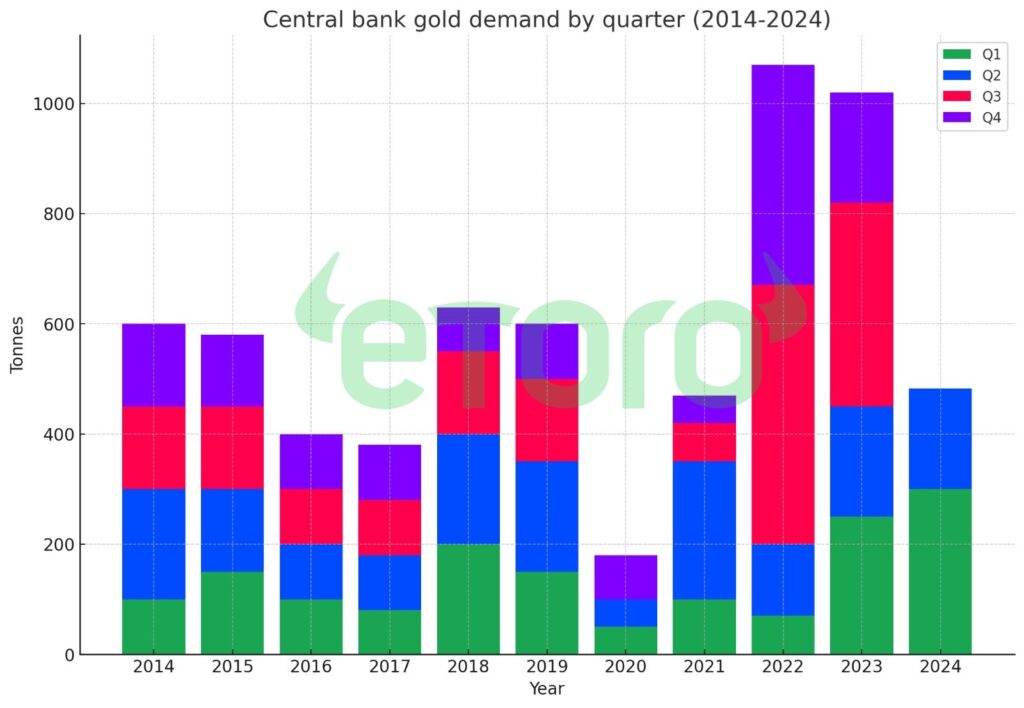

In the second quarter alone, central banks bought 183 tonnes of gold, marking a 6% increase compared to the same period in 2023, though this was a significant 39% decrease from the 300 tonnes purchased in the first quarter of 2024. Despite gold’s strong performance, reaching an all-time high of $2,525 per ounce, Bitcoin has still outperformed gold in 2024, with a 37% year-to-date gain compared to gold’s 23%. The image below illustrates this trend, approximately highlighting the historical and ongoing surge in central bank gold demand.

Past performance is not an indication of future results

While some investors view gold as a more stable reserve asset, concerns about Western reserve assets have led countries like China, India, and Saudi Arabia to increase their gold holdings. However, Bitcoin’s strong performance, despite a 22% decline from its March peak, highlights its growing appeal as a digital store of value. Despite ongoing skepticism from some traditional finance figures, Bitcoin continues to outshine gold in 2024, although central banks remain cautious about embracing the relatively new asset class.

Bearish Sentiment Grows as Bitcoin Dips Below $58K

The cryptocurrency market faced a downturn over the weekend, with Bitcoin dropping to $57,500, marking a 1.5% decrease in the past day and nearly a 10% decline over the past week. Ethereum also saw a decline, trading at $2,440 with an 11% drop over the week. The market experienced significant liquidations, with over $162 million in total, mostly from long positions, as traders turned bearish. Additionally, Bitcoin spot ETFs in the U.S. saw $276 million in net outflows last week, contributing to the negative sentiment.

Past performance is not an indication of future results

Bitcoin futures funding rates have turned negative across derivatives exchanges, further indicating a bearish outlook among traders. Miners’ revenue in August reached a new low for the year, with only $851 million generated, of which just $20 million came from on-chain fees. This slump highlights growing challenges in the cryptocurrency market, reflecting broader investor caution and market volatility.

Traders Brace for Fed-Induced Bitcoin Volatility

Bitcoin has struggled to maintain momentum, failing to close above $62,000 since early August, and has decoupled from the S&P 500, which has seen modest gains. Investors are closely watching the Federal Reserve’s upcoming September FOMC meeting, where a potential 0.50% interest rate cut could serve as a bullish catalyst for Bitcoin and other risk markets. However, the market’s response remains uncertain, with traders wary of potential forced liquidations due to unexpected price swings. As a result, many professional traders are hedging their positions using BTC options to maximize gains while minimizing risks.

The cryptocurrency market’s cautious outlook is further exacerbated by negative sentiment within the sector, including regulatory pressures and high-profile legal setbacks like the recent ruling against Kraken by the US District Court. Despite these challenges, some traders remain optimistic, with the CME FedWatch tool indicating a 25% chance of a rate cut, which could trigger a rally in risk-on markets. However, the overall market remains on edge as traders prepare for possible volatility around the Fed’s decision.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

More crypto updates

Cardano’s Chang Hard Fork Kicks Off New Era of Decentralized Governance

Cardano has successfully initiated the first phase of its Chang hard fork, marking a significant shift toward decentralized governance by transferring control of the $13 billion blockchain to ADA token holders. This move is part of the Voltaire era, which aims to give every ADA holder a say in the network’s evolution through a decentralized governance system. Unlike traditional DAOs, which have faced criticism for being controlled by a few powerful stakeholders, Cardano’s governance model introduces community spokespeople (DReps) and a tricameral legislative system to ensure balanced decision-making.

While this transition represents a major step forward for Cardano, challenges remain. The blockchain has faced issues like the Unspent Transaction Output (UTXO) problem, which limits scalability by allowing only one user at a time to interact with certain DeFi protocols. Despite these hurdles, the upgrade positions Cardano as a competitor in the decentralized finance (DeFi) space, even as it works to fully implement its new governance system later this year.

eToro’s @Scalable-Crypto Smart Portfolio provides an opportunity to invest in leading smart contract platforms that are at the forefront of blockchain interoperability and scalability solutions.

Trump Gains Crypto Voters as RFK Jr. Endorses His Campaign

Former President Donald Trump is gaining traction among crypto voters, according to a recent poll showing him leading Vice President Kamala Harris by 12 points among likely crypto-owning voters. Trump’s shift towards embracing the crypto community, including promoting crypto projects and addressing major Bitcoin conferences, appears to be resonating with this voter base. His commitment to maintaining a strategic national Bitcoin stockpile has further bolstered his appeal. Despite earlier criticisms of crypto, Trump’s outreach seems to be paying off, especially as Harris has not addressed the issue significantly.

In a significant development, Robert F. Kennedy Jr., who had been a strong contender for the crypto vote, has endorsed Trump and suspended his own presidential campaign. Kennedy’s support could consolidate the crypto vote for Trump, potentially giving him an edge in the tight race against Harris. As Trump continues to advocate for pro-crypto policies, the endorsement from Kennedy may help sway undecided crypto voters, further solidifying Trump’s position in the upcoming election. This alignment could be crucial in an election where every vote counts, particularly in swing states.