Major crypto developments for the week:

- Bitcoin’s correlation to gold reaches highest level since March

- Bitcoin scarcity increases: more BTC hasn’t moved in at least 10 years than available BTC

- dYdX chain goes live, bringing new utility to the DYDX token

- Vaneck releases report on Solana with $3,200 bull case

- Bitcoin’s correlation to the Nasdaq reaches 2+ year lows amidst shifts in derivatives landscape

- CME futures dominance reaches all-time highs

- Bitcoin options open interest reaches all time highs, relative to perpetual futures open interest

- Bitcoin implied volatility rises to highest levels since Q1

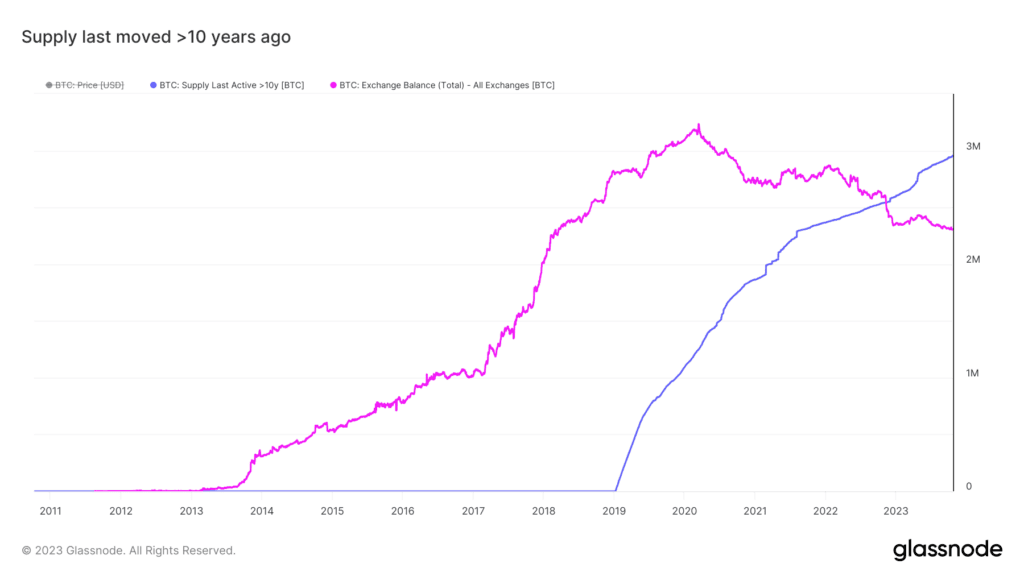

Quantity of HODLed Bitcoin surpasses quantity of Bitcoin on exchanges

Previously, we have described the deep belief in Bitcoin as an asset, and how it is reflected by Bitcoin’s holder base throughout the bear market. An interesting way to illustrate this is to observe the amount of Bitcoin that has been HODLed – i.e., that hasn’t moved – in at least 10 years, relative to the amount of Bitcoin sitting on exchanges. The results are that there are now over 600,000 more HODLed Bitcoin (for at least 10 years) than there currently are on exchanges.

Past performance is not an indication of future results.

Did you know? $BTC is part of eToro’s @CryptoPortfolio, which allows investors to participate in the broader crypto market’s potential for growth.

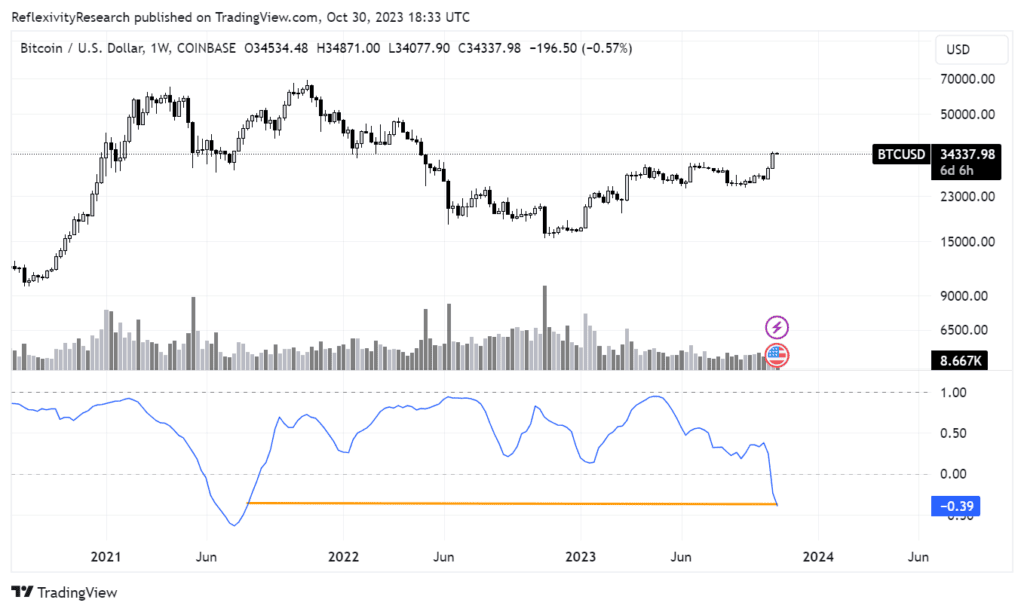

Bitcoin’s correlation to gold reaches highest level since March as correlation to Nasdaq drops

The seasonality that we described in our first weekly report of October has once again continued, with the last month having been the strongest for Bitcoin for the entirety of 2023; a strong divergence from the performance of major equity indices, including the Nasdaq. As shown in the lower pane of the chart below, Bitcoin’s weekly correlation is the lowest that it’s been since August of 2021.

Past performance is not an indication of future results.

Meanwhile, its correlation to gold is the highest that it has been since the banking crisis earlier this year, as shown in the image below. While it’s difficult to make conclusions based on a few weeks of data, it will be interesting to see if this persists and a potential shift in the behavior of Bitcoin as an asset and how it can be viewed within an investor’s portfolio.

Past performance is not an indication of future results.

Did you know? $BTC is also part of eToro’s @BitcoinWorldWide portfolio, designed to provide investors with a diversified exposure to the world of Bitcoin.

dYdX chain goes live

This week was a significant one for dYdX holders, with the launch of the long awaited dYdX chain. This creates new utility for the DYDX token, as it will be staked to secure the network, receive a portion of fees, and be involved with network governance moving forward. According to the dYdX foundation: “This is a significant change from ethDYDX, which is solely a governance token in dYdX v3, to DYDX, a native token powering the dYdX Chain, a standalone PoS blockchain network.”

Vaneck releases report on Solana with $3,200 bull case

An interesting report that came out this week was from VanEck, a multi-billion dollar institutional asset manager, who laid their investment thesis for Solana and its SOL token. The report describes their thesis for Solana’s high performance high throughput technical architecture and areas of market share that it may be able to capture relative to other protocols. Most notably, the report laid out their bear base and bull case for SOL, which included the headline number of a $3,200 bullish case for the asset by the year 2030. The report itself is yet another reflection of continued interest to get involved in crypto by traditional asset managers.

Past performance is not an indication of future results.

Did you know? $SOL is part of eToro’s @Scalable-Crypto portfolio, designed to provide investors with exposure to innovative and scalable blockchain projects.

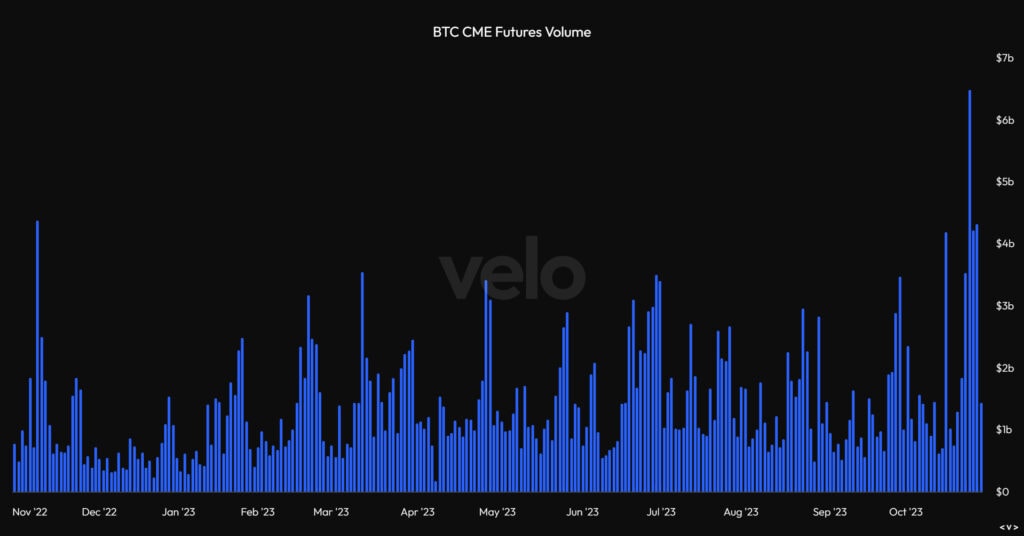

CME futures volumes reach highest level of 2023

Another interesting development came as futures volume on the CME reached the highest single day of trading throughout the entirety of 2023. This is an interesting dynamic to continue to monitor because traditional hedge funds and financial organizations are the types of entities that trade on the CME, as opposed to crypto natives that trade derivatives on crypto native venues such as Binance, OKX, Bybit, etc. This perhaps suggests that some traditional financial players have been dipping their toes in the Bitcoin market, potentially around the expectation of a Bitcoin ETF approval on the horizon.

Past performance is not an indication of future results.

This is also represented in looking at futures open interest in addition to volume, as shown in the image below. This represents the number of futures contracts outstanding as opposed to how many have been traded on a given day.

Past performance is not an indication of future results.

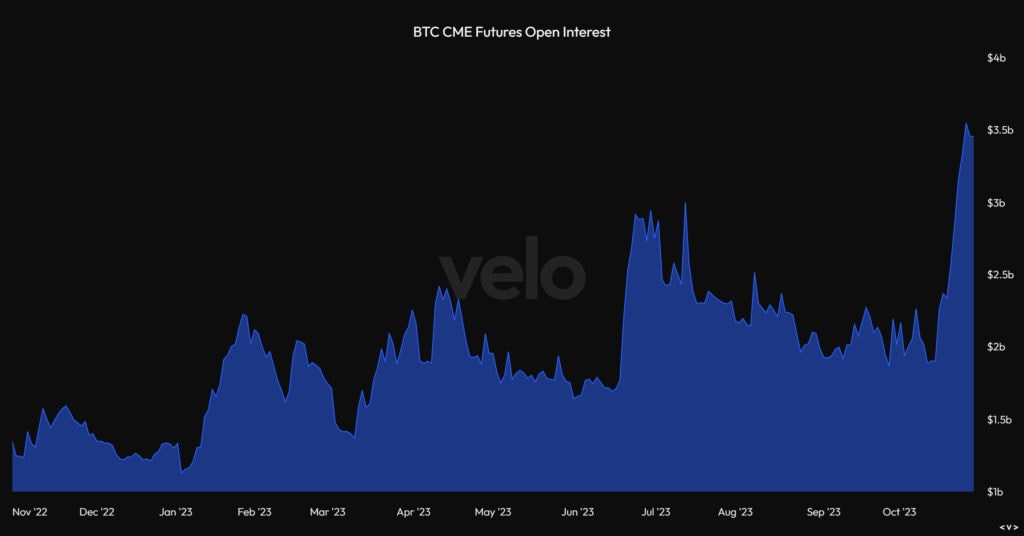

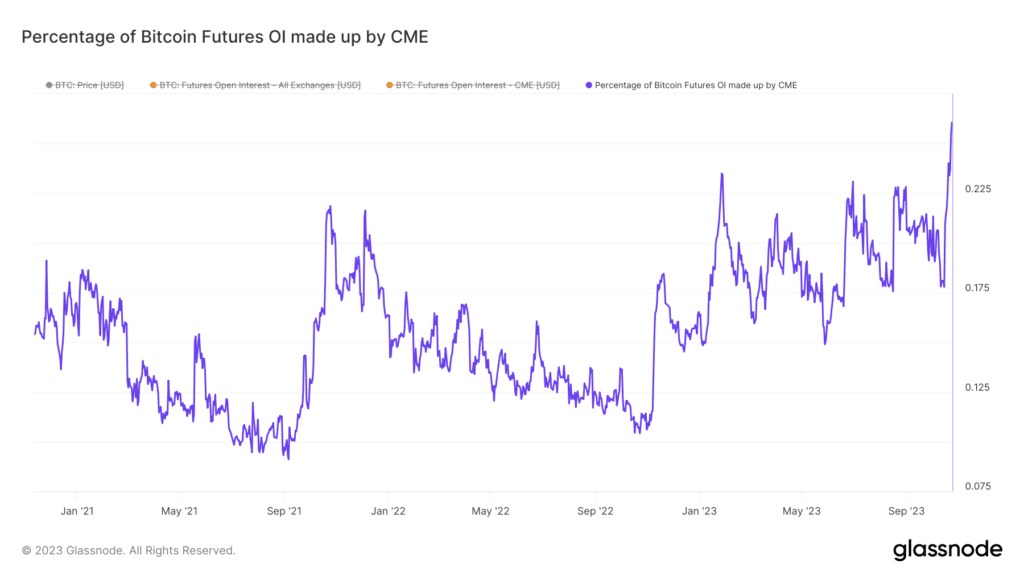

CME futures dominance reaches all-time highs

On a similar note, we can also take this a step further and look at the percentage of Bitcoin’s overall futures open interest derived from CME, as opposed to crypto native venues that have historically dominated the Bitcoin derivatives landscape. We can see in the chart below that the percentage of Bitcoin futures open interest made up by the CME has reached an all time high of over 25%. This hints at a potential shift of market participants in Bitcoin/crypto that we may see as more traditional financial institutions become comfortable allocating/trading the asset class.

Past performance is not an indication of future results.

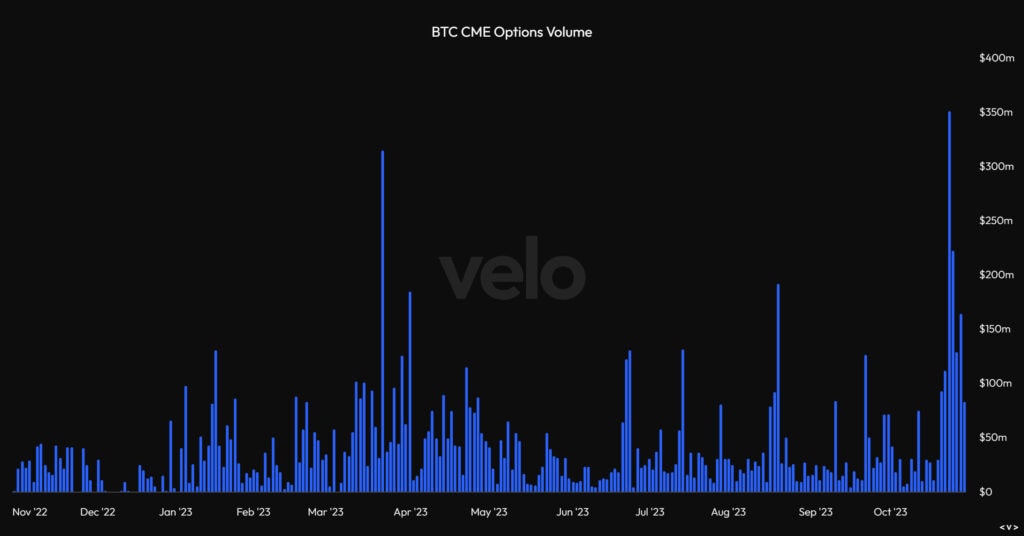

Bitcoin options open interest reaches all time highs relative to perpetual futures open interest

Continuing with a look into the Bitcoin derivatives market, we see a similar spike in options volumes, reaching the highest level of single day trading volume in the whole of 2023, at roughly $350 million.

Past performance is not an indication of future results.

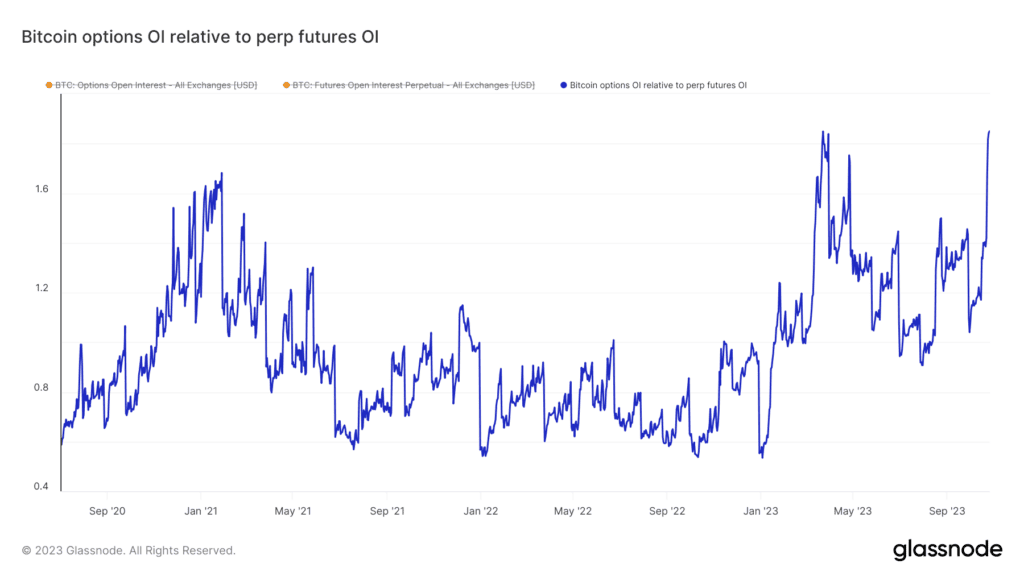

Bitcoin options open interest relative to perpetual futures open interest has reached all time highs this week. This is significant as it represents a market structure shift towards increasing usage of options relative to perpetual futures, which historically have been the most liquid tradable derivatives product in crypto.

Past performance is not an indication of future results.

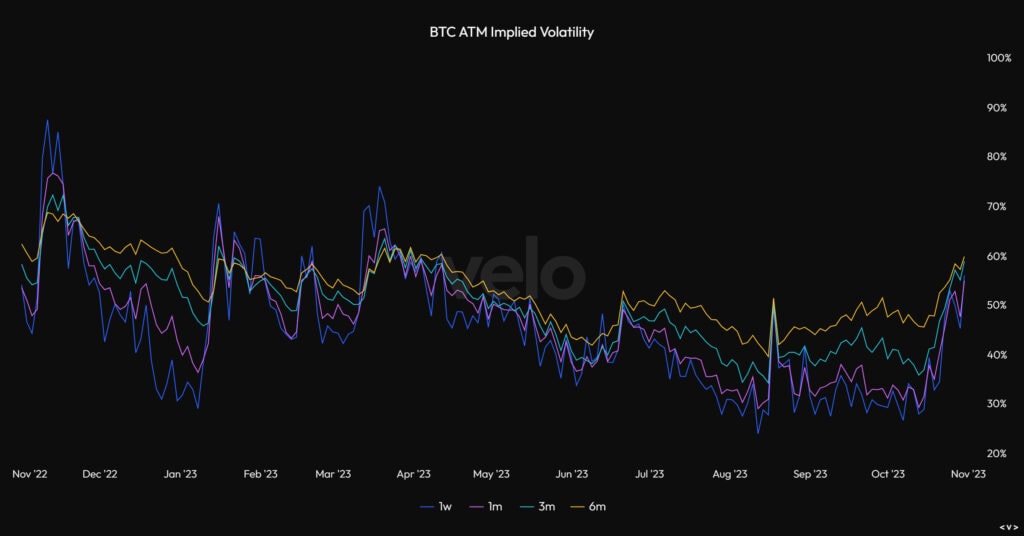

Bitcoin implied volatility rises to highest levels since Q1

Implied volatility, which is the expected future volatility priced in through the options market, has reached the highest levels since the banking crisis earlier this year. After a slow summer with low volume and volatility, we may finally be seeing some volatility come back to the crypto market.

Past performance is not an indication of future results.

The material in this blog post was created exclusively for eToro by Reflexivity Research.