Major developments for the week

- Bitcoin continues ATH trajectory, hitting $72.8K before correcting

- Ethereum Dencun upgrade goes live: Arbitrum introduces the Atlas upgrade, incorporating support for Dencun and adding blob capabilities

- Dubai Police launches pilot project for criminal investigation data security using Cardano blockchain

- Bitcoin ETF products saw net inflows of $2.78B, with record-breaking $1B in a day

- Grayscale submits amended Form 19b-4 filing for Grayscale Ethereum Trust

- MakerDAO releases project Endgame details

- CRV has introduced its lending platform, LlamaLend

- IMX will undergo a $104.62 million unlock on March 22nd, 2024

- Patient Capital Management has submitted a filing to invest up to 15% of its $1.4 billion Opportunity Trust in Spot Bitcoin ETFs

- USDT to launch on CELO blockchain

Bitcoin hits $72.8K pre-correction; ETFs see record-breaking day of $1B net inflow

Bitcoin saw a continued trajectory of all-time highs last week, hitting $72.8K before correcting back down. Despite this, Bitcoin ETF products continue to show impressive inflows, recording $2.78B last week, including a record breaking day on March 12 that saw more than $1B in net inflows.

A significant contribution came from BlackRock, which attracted an impressive $850 million.

Past performance is not an indication of future results

As the landscape of Bitcoin investment evolves with the SEC’s historic approval of various spot Bitcoin ETFs, a significant ripple effect is anticipated across the entire Bitcoin value chain, benefiting everyone from miners to custodians. eToro’s @BitcoinWorldWide Smart Portfolio emerges as an ideal solution, offering a comprehensive investment option that aligns with the growing potential of the entire Bitcoin value chain.

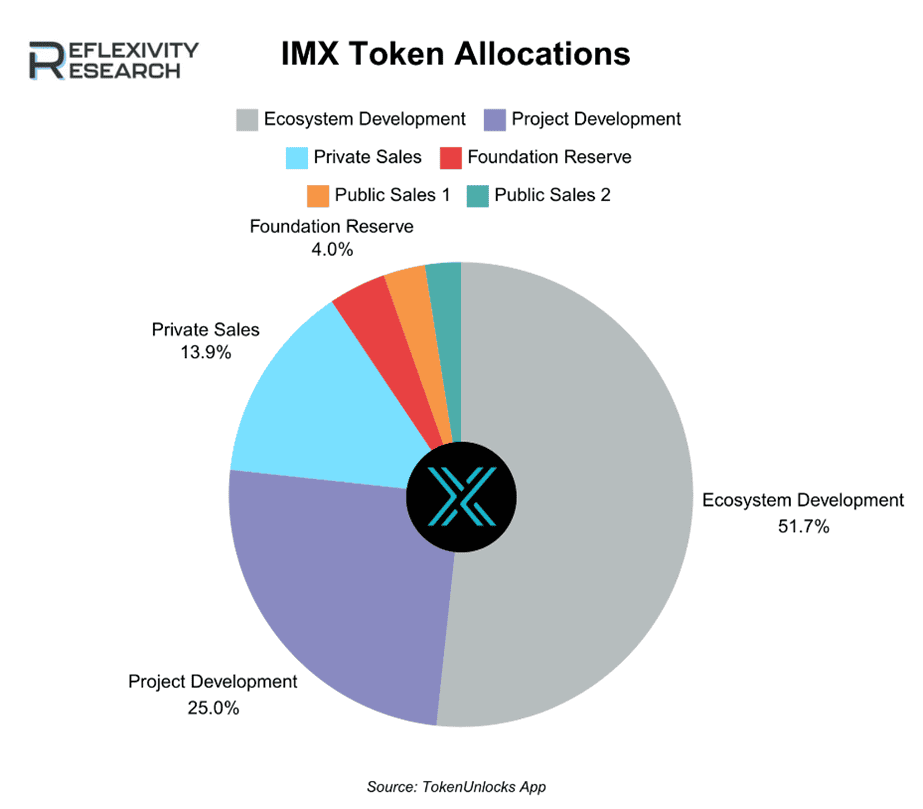

IMX will undergo a $104.62 million unlock on March 22, 2024

The primary unlock event this week features IMX. Scheduled for March 22, IMX plans to release 2.46% of its circulating supply. This comprises $26.5 million for Private Sales, $48.7 million for Ecosystem Development, $29.42 million for Project Development. $IMX’s vesting schedule is estimated to reach completion by January 29th, 2026.

Past performance is not an indication of future results

Our @Scalable-Crypto Portfolio, featuring IMX and other Layer 2 assets, is designed for those looking to harness the growth of the blockchain ecosystem. By including IMX, known for its commitment to ecosystem and project development, this portfolio offers a diversified passive investment strategy, tapping into the potential of emerging technologies while mitigating risks.

Dubai Police Launches Cardano Blockchain Pilot for Criminal Investigations

Dubai Police unveiled a groundbreaking pilot program at the World Police Summit, integrating Cardano blockchain to safeguard sensitive data from criminal investigations. Alexander E. Brunner, Principal of Brunner Digital, highlighted the initiative, emphasising its role in securely sharing data with international authorities like Interpol. Bullet scans conducted by advanced scanners are stored on the Cardano blockchain, ensuring data integrity and traceability among stakeholders.

Chris O, founder of ADA Ghost Fund, hailed the move as significant for Cardano and blockchain adoption, citing real-world applications in data security across various industries. The project signifies a crucial step in blockchain’s role in law enforcement, setting a precedent for global adoption.

USDT to debut on Celo blockchain

Last week Tether announced that it is gearing up to debut its USDT token on the Celo blockchain. Celo is compatible with the Ethereum Virtual Machine and is in the process of transitioning to an Ethereum Layer 2 network.

A Tether spokesperson has indicated that the USDT launch on Celo is imminent, though the exact date has yet to be announced.

Launched in 2020, Celo’s primary goal is to streamline mobile payments by associating phone numbers with cryptocurrency wallet addresses and minimising transaction fees. Rene Reinsberg, a co-founder of Celo, expressed that USDT’s forthcoming integration into Celo is expected to diversify payment methods and enhance the utility of stablecoins for users worldwide.

Tether’s inclusion will strengthen Celo’s portfolio of stable assets, paving the way for a variety of financial operations such as remittances and lending. Additionally, there are plans to advocate for USDT’s use as a gas currency to support seamless transactions across decentralised applications within the Celo ecosystem.