Major developments for the week

- Bitcoin hits $66K, BTC ETF products saw net inflows of $1.77B last week

- MEME sector sees a growth of approximately 16%, bringing its market value to over $52 billion #SHIB #DOGE

- Uniswap adds three new features

- Total Value Locked (TVL) on Arbitrum reached an all-time high of $4.125 billion

- Ethereum’s Dencun upgrade is scheduled to activate on the Ethereum mainnet at epoch 269568, set for March 13th 2024 at 13:55 UTC.

- On March 3rd, the trading volume in the Bitcoin Ordinals market hit $51.14 million, marking its highest point since December 18th 2023

- Friend Tech, a Web3 social platform, announced via Twitter that following recent discussions, its investors have consented to relinquish their rights to sell tokens to users, ensuring that token control remains with the users

Memecoins boast market outperformance

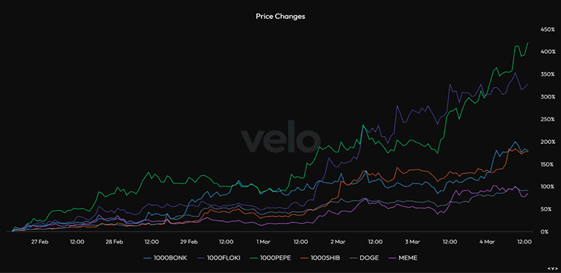

Last week, the memecoin sector witnessed a notable surge in interest, yielding a remarkable sectoral performance as depicted in the chart below:

Past performance is not an indication of future results

This trend continued over the past 24 hours, with the memecoin sector experiencing a significant increase of approximately 16%, pushing its market value to over $52 billion. An example of this can be seen with the popular memecoins DOGE and SHIB, which both recorded gains exceeding 18%.

Bitcoin hits $66K; BTC ETF products saw net inflows of $1.77 billion last week

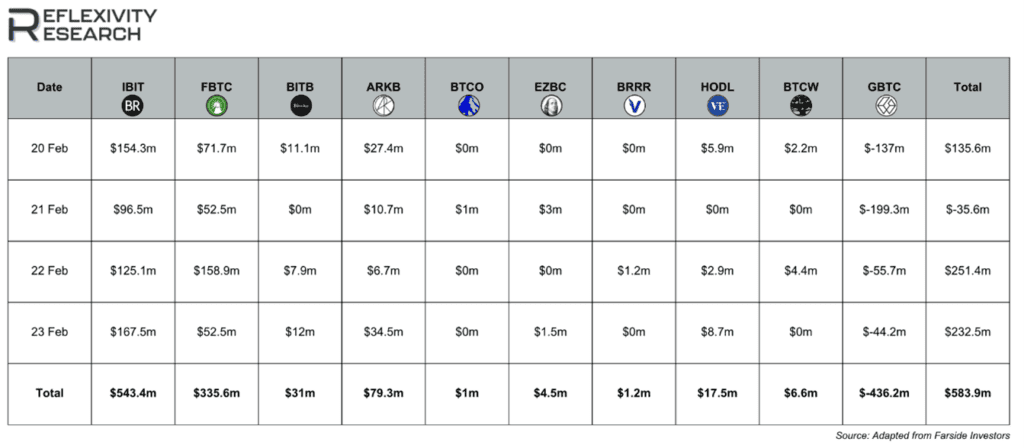

Following a week where Bitcoin hit $66K, nearing its existing all-time high, Bitcoin ETF products saw net inflows amounting to $1.77 billion, marking the second-largest weekly inflows since these ETFs started trading in early January. As a whole, the trading volumes of investment products reached a record high of $30 billion.

Past performance is not an indication of future results

Additionally, Ethereum recorded its highest weekly inflows since mid-July 2022, totalling $85 million.

Furthermore, according to Velo Data and CoinGlass, the annualised funding rate for Bitcoin perpetual futures on a leading exchange exceeded 100% for the first time in over a year last week. This indicates excitement in the futures market, as the price of perpetual futures contracts trade marginally higher than the underlying spot market.

Our BTC and ETH-focused @Crypto-Currency Smart Portfolio capitalises on recent market trends, including record inflows into Bitcoin ETFs and Ethereum’s significant investment surge, highlighting a bullish sentiment. Designed to leverage growth in the cryptocurrency market, it offers investors a streamlined avenue to the potential of the leading digital assets, positioning itself as a dynamic and strategic investment choice in the evolving digital asset landscape.

Uniswap adds three new features

Last week we discussed Uniswap’s fee switch proposal and the impact it had on other protocols that had the capacity to follow suit.

Since then, Uniswap has introduced three new features to enhance its platform: the Uniswap Extension, Limit Orders, and Data & Insights.

The platform has evolved since its launch, with the Uniswap Protocol enabling nearly $2 trillion in swap volume and supporting millions of users in on-chain swaps through its web and mobile app. These latest developments are part of Uniswap’s continuous effort to improve user experience by offering tools for more efficient and informed swapping.

The Uniswap Extension is a new wallet extension designed to reside in the browser’s sidebar, allowing users to swap, sign transactions and manage crypto without disrupting their web browsing experience.

Limit Orders, now active on the Uniswap web app, enable users to set specific prices for buying or selling tokens, applicable for any token on Ethereum, with durations of up to a year. This function facilitates automated trade execution at predetermined prices, eliminating the need for continuous market observation. Notably, Limit Orders are facilitated by UniswapX and are executed without incurring gas fees.

Data & Insights have been expanded through the introduction of updated Token Detail Pages and new Pool Detail Pages, integrated directly into the web app. These features offer real-time charts, transaction logs, pool data and project information, enriching the user’s research and swapping process. This integration supports a seamless transition from research to trade execution within the platform.

Together, these enhancements aim to provide a comprehensive and integrated experience for Uniswap users, reflecting the platform’s commitment to facilitating smarter and more accessible swapping.

Uniswap is essential to our @DeFiPortfolio for its role in decentralising finance, offering automated, direct token exchanges, and new features like in-browser swaps and gas-free limit orders. Its innovations enhance user experience and align with DeFi’s goals of accessibility and financial independence, making it a key investment in the DeFi landscape.

Blast’s anticipated Mainnet went live

Following its move to the mainnet, Blast has experienced an impressive retention of TVL. On February 28th last week, over 10,000 individuals deposited Ethereum, contributing to the approximate total of 100,000 ETH deposited throughout February. This retention of deposits can be attributed to several key factors. Despite the introduction of a withdrawal feature, Blast has continued to implement its points system. Moreover, early engagement within the Blast Ecosystem is incentivised with extra points, anticipated to result in future token airdrops from projects built on Blast.

This prospect has garnered significant interest, particularly as Blast positions itself to become the third-largest Layer 2 network, only surpassed by Optimism and Arbitrum.

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.