Major developments for the week

- Bitcoin ETF products saw net inflows of $583.9 million last week

- Reddit adds Bitcoin, Ethereum and Polygon to its balance sheet

- Uniswap Foundation proposed a fee switch to share fees with UNI holders

- Matic’s remaining tokens have entered circulation, rendering the token fully vested

- DYDX will undergo a $117.67 million unlock on March 1st, 2024, and has announced protocol 4.0 upgrade details

- Between February 15th and 25th, MicroStrategy acquired 3,000 BTC at an average price of $51,813. As of February 25th 2024, the company owns 193,000 BTC at an average price of $31,544

- Ondo Finance announces a strategic partnership with Aptos Foundation

- The liquid restaking niche has surpassed 3.5 billion in total value locked

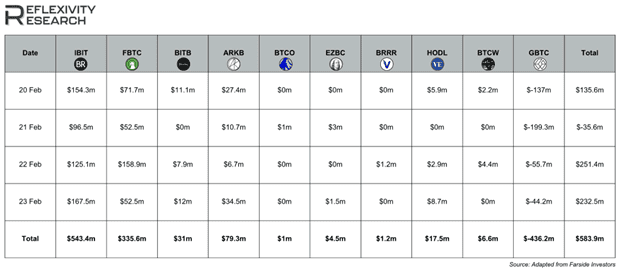

Bitcoin ETF products saw net inflows of $583.9 million last week

Past performance is not an indication of future results

Last week, Bitcoin ETF products experienced net inflows of $583.9 million, marking the fourth consecutive week of such gains. Since the ETF launch on January 11th, Grayscale has seen net outflows amounting to $7 billion. Despite this, the cumulative net inflows have exceeded $5 billion. BlackRock holds the title for the highest average daily inflows, with $197 million.

As the landscape of Bitcoin investment evolves with the SEC’s historic approval of various spot Bitcoin ETFs, a significant ripple effect is anticipated across the entire Bitcoin value chain, benefiting everyone from miners to custodians. eToro’s @BitcoinWorldWide Smart Portfolio emerges as an ideal solution, offering a comprehensive investment option that aligns with the growing potential of the entire Bitcoin value chain.

Reddit adds Bitcoin, Ethereum and Matic to its balance sheet

Reddit announced post-IPO filing that it has added Bitcoin, Ethereum and Polygon to its balance sheet, signalling potential further investments in these assets. It is also noteworthy that Matic has completed its vesting schedule, meaning there is no further overhead supply to be added into circulation. This move aligns Reddit with companies like MicroStrategy, which recently acquired an additional 3,000 Bitcoins between February 15th and 25th at an average price of $51,813.

Uniswap Foundation proposes sharing fees with UNI holders

One of the major developments of the week stemmed from the Uniswap Foundation’s proposal.

The proposal outlines a strategy to improve Uniswap’s governance by incentivising UNI token holders to actively participate in its delegation process. It suggests modifying the protocol to reward those who delegate and stake their tokens with a portion of the protocol fees. The aim is to address issues such as voter apathy and the low usage of voting rights, which pose risks to the protocol’s future viability. Over the last year, various initiatives have been undertaken to enhance the experience for delegates, including the development of platforms to facilitate decision-making and the organisation of events to promote governance participation. Despite these efforts, active engagement remains a challenge.

To counteract this, the proposal introduces a fee-based incentive for active delegation, alongside the requirement for existing delegators to re-delegate their tokens for staking. This is expected to redirect support towards delegates who are actively contributing to the protocol’s governance. Part of the proposal involves funding the creation of new smart contracts designed to manage the collection and distribution of protocol fees to engaged delegators. A governance vote is proposed to bring these changes into effect, which will be supported by an audit contest and a bug bounty program to maintain security. The initiative is a collaborative effort aimed at strengthening Uniswap’s governance structure, with support from various community stakeholders.

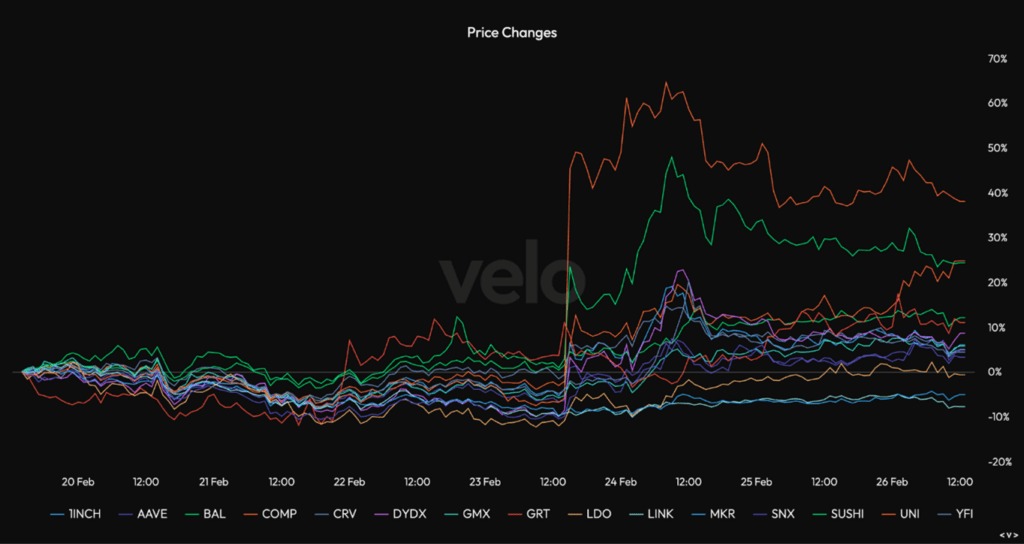

Following the announcement of this proposal, there was a notable positive impact on the broader DeFi market, largely due to traders speculating on the increased likelihood of other DeFi assets implementing similar strategic moves after Uniswap established the precedent.

Past performance is not an indication of future results

eToro’s DeFi Smart Portfolio capitalizes on the evolving DeFi landscape, particularly with initiatives like Uniswap’s governance rewards, offering investors a diversified entry into assets benefiting from enhanced governance and fee-sharing. It aligns with the latest DeFi innovations, promising value from the sector’s growth.

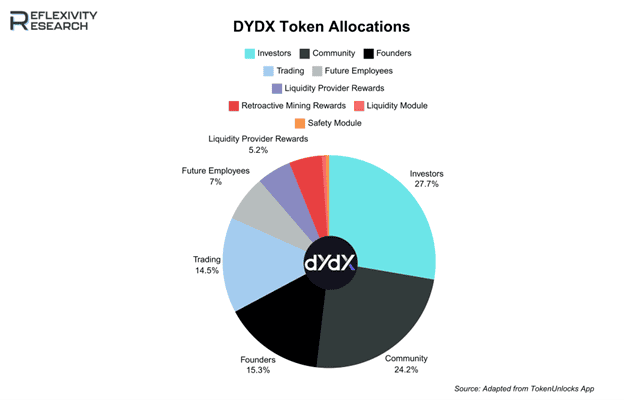

DYDX will undergo a $117.67 million unlock on March 1

The primary unlock event this week features dYdX. Scheduled for March 1st, $DYDX plans to release 11.09% of its circulating supply. This comprises $65.26 million for Team, $34.94 million for Founders, Employees, Advisors and Consultants and $16.47 million for Future Employees. $DYDX’s vesting schedule is estimated to reach completion by December 1st, 2026.

Past performance is not an indication of future results

Ondo Finance announced a strategic partnership with Aptos Foundation

Another interesting development this week came from Ondo Finance and the fact that it has formed a strategic partnership with the Aptos Foundation.

The partnership begins with the integration of Ondo’s tokenized US Treasuries, $USDY, into the Aptos blockchain. This step is the first in a series aimed at developing financial products that utilise the capabilities of both entities. $USDY is currently available on Ethereum, Solana and Mantle.

Ondo plans to explore solutions on Aptos that combine on-chain and real-world asset yields. This includes creating new staking and re-staking processes to improve the utility and efficiency of tokenized assets.

The collaboration between Ondo and the Aptos Foundation extends beyond technical integration, forming a strategic alliance aimed at combining traditional finance’s stability with blockchain technology’s efficiency. The effort focuses on developing solutions that integrate on-chain and real-world asset yields, utilising the finance and blockchain technology expertise of both organisations.