Major crypto developments for the week

- BlackRock files for ETH ETF trust structure in the state of Delaware

- Bitcoin’s Weekly RSI reaches “overbought” territory for the first time since April 2021

- The number of Bitcoin addresses with over $1 million has passed 80,000

- Stablecoin 90-day change flips positive for first time in 1.5 years as divergence between USDC and USDT grows

- Bitcoin transaction fees reach the highest level since May

- Microstrategy’s Bitcoin position breaches $1 billion in unrealized profit

- NEAR’s “NEARCON” conference takes place in Lisbon, Portugal

- Ava Labs has laid off 12% of its workforce

BlackRock files for ETH ETF trust structure in the state of Delaware

One of the biggest developments of this week came as BlackRock, the largest asset manager in the world, registered for an iShares Ethereum Trust in the state of Delaware on Thursday. In addition, Nasdaq filed a proposal to list and trade the Ethereum trust. This provides a stamp of institutional legitimacy for the second largest crypto asset by market and if approved, will enable investors from around the world to get access to Ethereum exposure in their portfolio in a traditional brokerage account

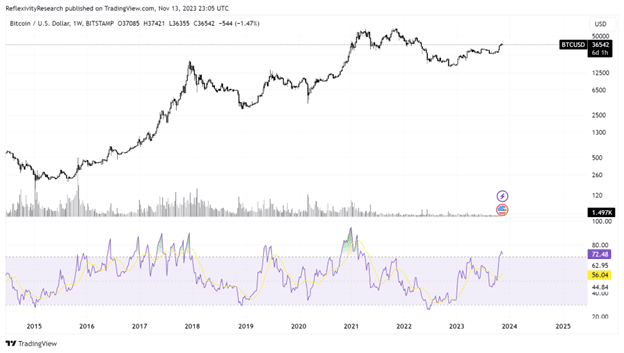

Bitcoin’s Weekly RSI reaches “overbought” territory for the first time since April of 2021

Bitcoin’s weekly RSI (relative strength index) just entered “overbought territory” for the first time since April 2021. The RSI is a momentum-based indicator that measures the magnitude of relative price changes. While the RSI reaching levels above 70 may not be ideal for bulls to see in the short term, this could also be seen as a positive long-term sign that the market has shown this level of strength for the first time in 2.5 years.

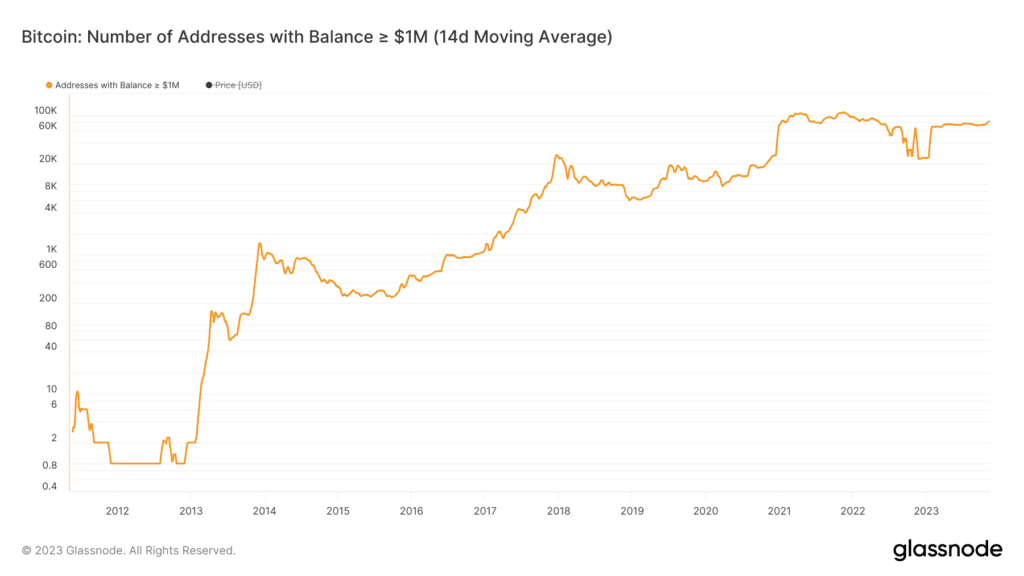

The number of Bitcoin addresses with over $1 million has breached 80,000

This week the number of Bitcoin addresses with over $1 million breached 80,000. While many of these addresses can be attributed to the same entity, Satoshi has arguably created more millionaires than any other person in history.

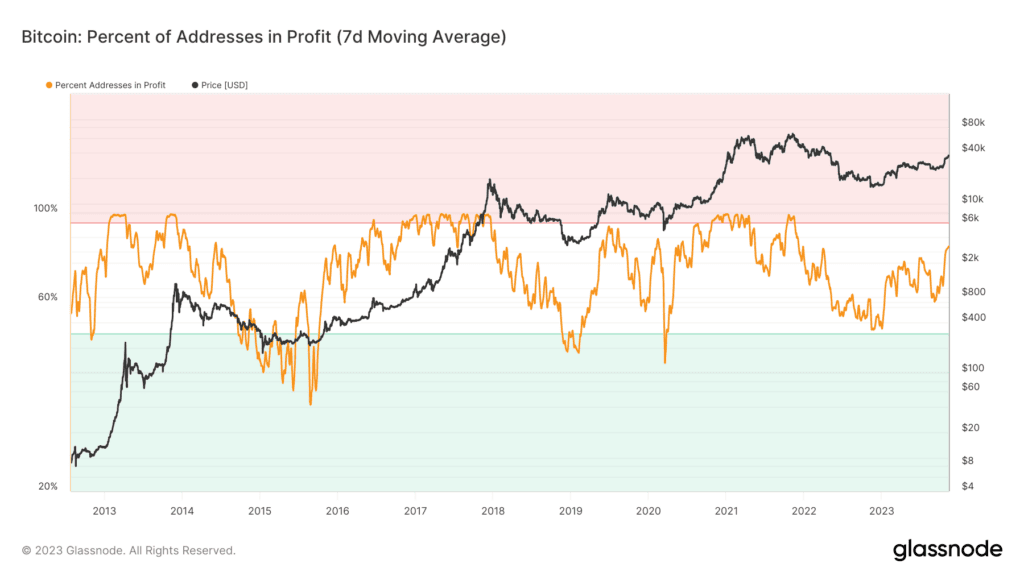

On a similar note, after this recent rally the percentage of Bitcoin addresses in profit now sits at 80%.

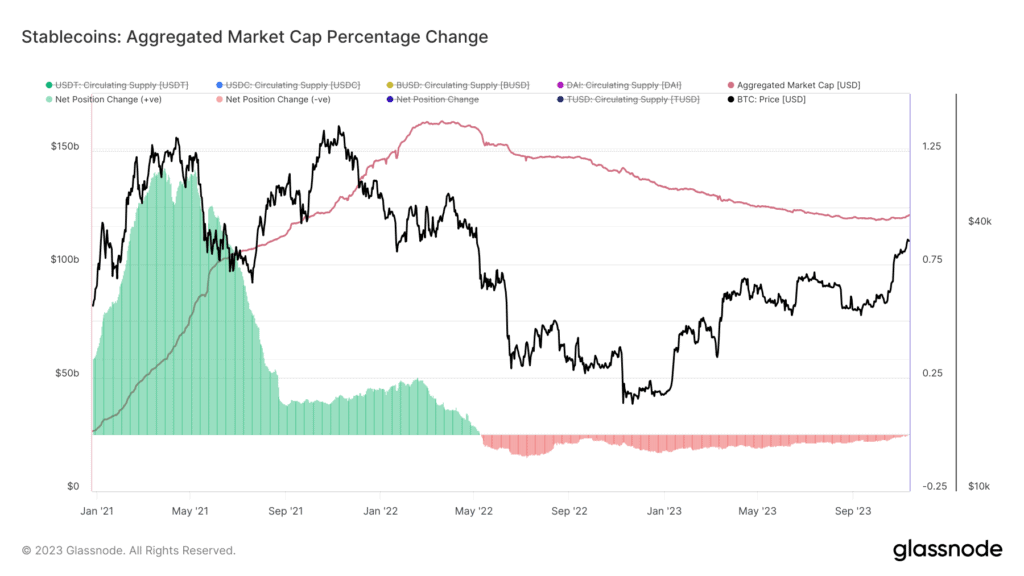

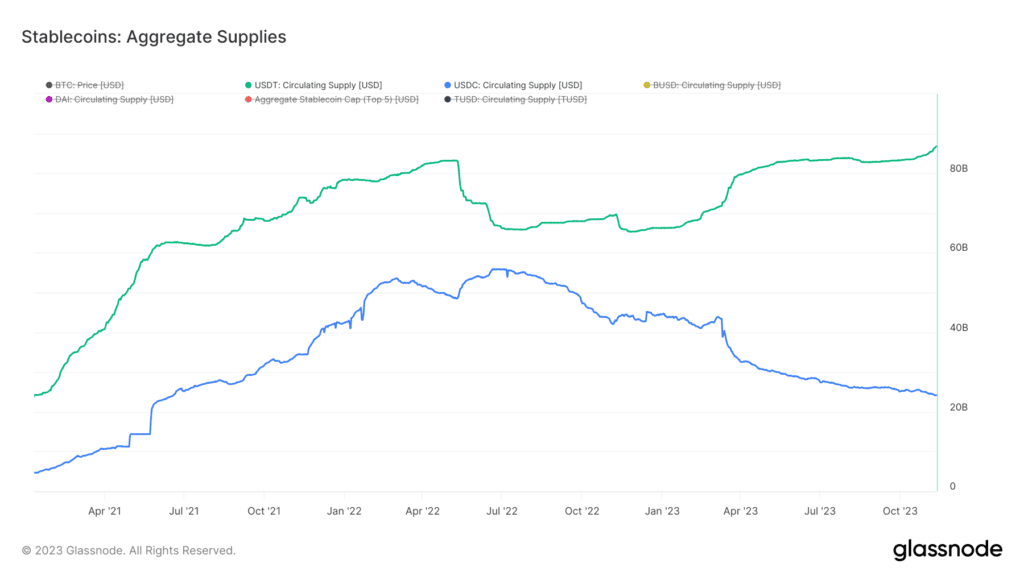

Stablecoin 90-day change flips positive for first time in 1.5 years as divergence between USDC and USDT grows

This week the 90-day change in aggregated stablecoin supplies flipped positive for the first time in 1.5 years. This signals increased liquidity on-chain expressed through stablecoins and can be perceived as a sign of capital inflows.

Meanwhile, looking at the total supplies of the two largest stablecoins, USDT and USDC, we can see a clear divergence. It is not clear exactly what has been driving this. With the divergence beginning after USDC briefly de-pegged during the collapse of Silicon Valley Bank, concerns around counterparty risk may be driving the decline in USDC. There are also theories that USDT is being swapped for USDC for redemptions, as Circle may be easier/more compliant for US based funds to redeem amidst regulatory uncertainty. While we can only theorize, the divergence is striking and deserves continued attention.

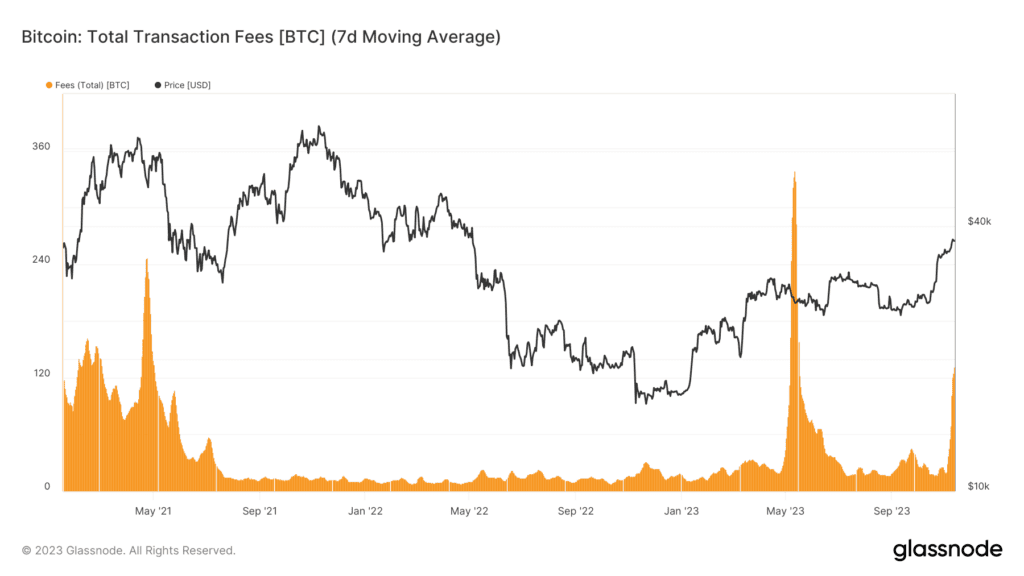

Bitcoin transaction fees reach the highest level since Ordinals excitement

Transaction fees on the Bitcoin network are now the highest that they’ve been since the ordinals excitement back in May. This signals renewed interest and demand to utilize Bitcoin’s blockspace, with network users needing to increase the fees that they are willing to pay miners to get their transactions included in blocks. While marginally higher fees are not ideal for those conducting transactions, higher fees incentivize mining, and ultimately the security of the network.

The content in this post was created exclusively for eToro by Reflexivity Research.