Major crypto developments for the week

- eToro receives approval to operate as a broker for securities, derivatives, and cryptoassets in the UAE

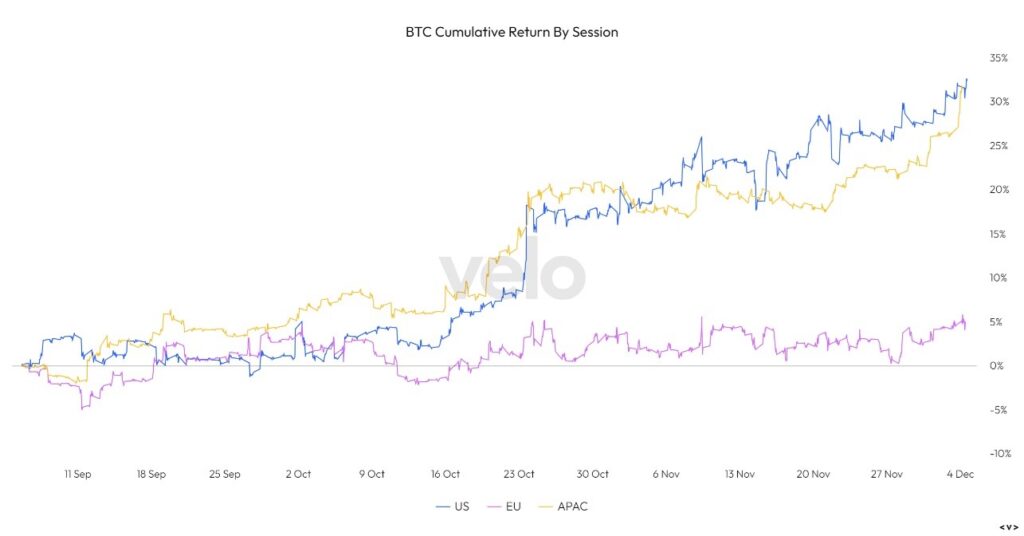

- US and APAC trading sessions diverge from EU

- Blackrock and Bitwise file S-1 amendments, solidifying speculation of the SEC communicating with potential issuers

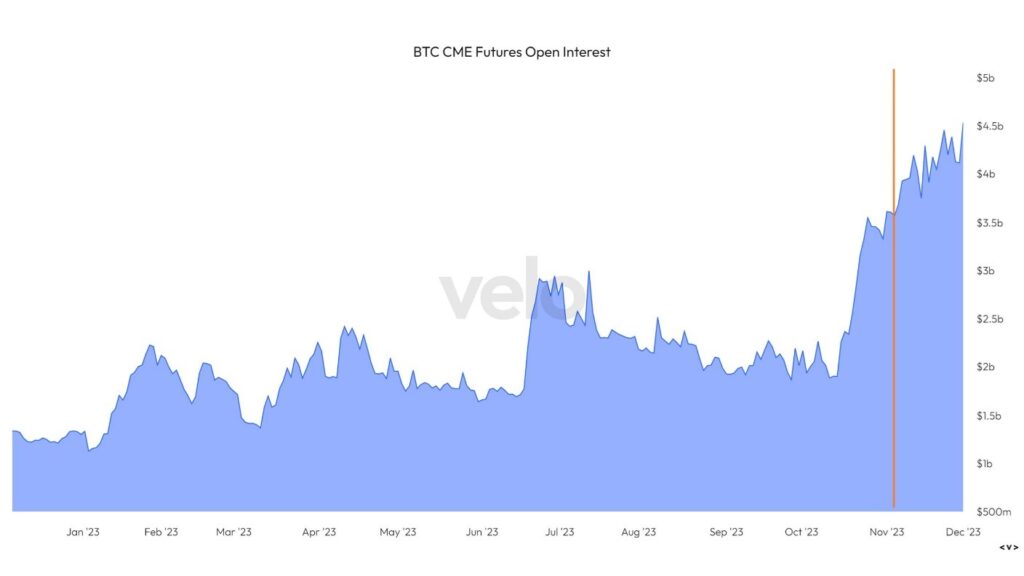

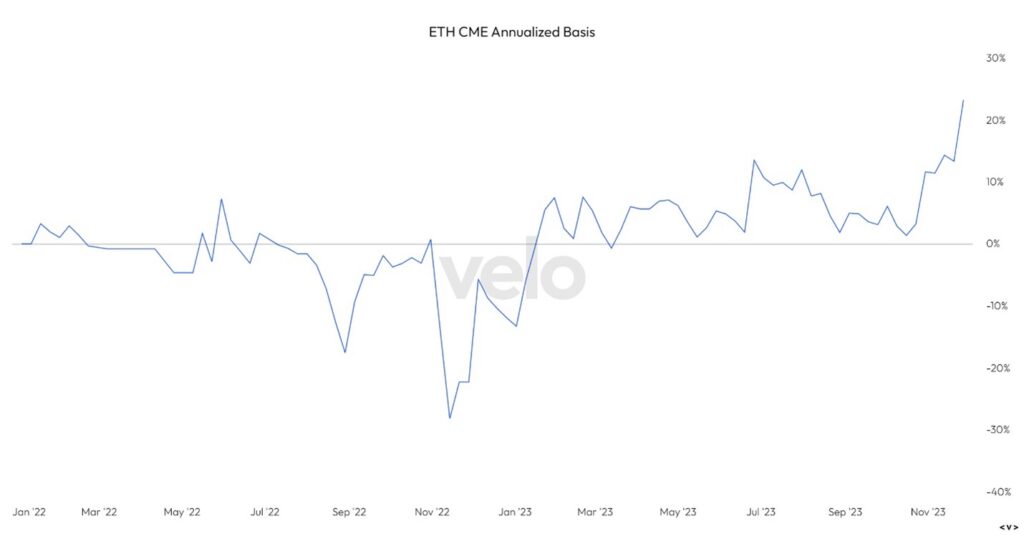

- Ethereum’s CME futures basis now trading at 5% premium to Bitcoin, signaling potential rotation into ETH from “tradfi”

- Microstrategy now up over $2 billion on Bitcoin investment

- Cross-chain messaging protocol Wormhole raised $225M, at a valuation of $2.5B

- El Salvador is now in the green on their Bitcoin investment

- dYdX has launched trading on their dYdX Chain featuring an incentive program

US and APAC trading sessions divergence from EU

Looking at cumulative returns by geographic trading sessions for both Bitcoin and Ethereum, we can see a clear divergence, with EU trading hours lagging strongly behind US and APAC trading sessions. This leads us to conclude that the crypto rally over the last few months has been led by the US and Asia, while Europe has lagged behind.

Blackrock and Bitwise file ETF S-1 amendments, solidifying speculation of the SEC communicating with potential issuers

According to Bloomberg ETF analyst James Seyffart, one piece of news that came out overnight was that Blackrock and Bitwise had both filed addendums to their Bitcoin ETF fillings. This solidifies speculation that the SEC has been communicating with prospective issuers and gives increased hope of seeing potential approval by the January 10th deadline that everyone is watching closely.

Microstrategy now up over $2 billion on Bitcoin bet

After announcing Bitcoin purchases of 16,130 BTC for ~$593.3 million, Michael Saylor’s Microstrategy now holds 174,530 Bitcoin acquired for ~$5.28 billion at an average price of $30,252 per bitcoin. In addition, they have filed to issue up to $750 million in equity, presumably to purchase more Bitcoin. It can be presumed that Microstrategy will likely continue to issue more equity whenever their stock trades above the underlying book value of their Bitcoin, allowing them to use the proceeds to purchase more Bitcoin. In a period of strong price performance for Bitcoin, this could become reflexive as MSTR issues more equity, purchases Bitcoin with the proceeds, which theoretically purchases up the price of Bitcoin, providing a premium to their equity once more. We will see if this premium persists once there is an ETF as an alternative way to gain exposure to Bitcoin.

Ethereum’s CME futures basis now trading at 5% premium to Bitcoin, signaling potential rotation into ETH from “tradfi”

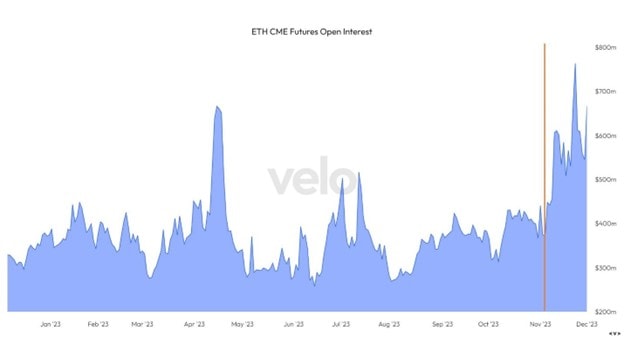

Open interest on CME for Bitcoin has continued to rise, a trend which began two months back, and has now breached $4.5 billion. However, there is an interesting trend that may be forming comparing CME activity to that of Ethereum.

The futures basis, (which represents the difference between the spot and futures price) for Ethereum on CME is now trading at a 5% premium to that of Bitcoin, now over 20%. In addition, we can see that open interest for ETH on the CME has now started to rise, after lagging the initial move up from Bitcoin. It may be too early to definitely say, but it appears “tradfi” may be beginning to rotate into the ETH ETF trade after two months. This is something to continue monitoring for early signs of the market beginning to front run a potential ETH ETF.

Exploring causes behind Bitcoin’s soaring value – the latest BTC etc podcast is live!

Listen to Pomp and Will discussing how Bitcoin is more scarce than gold and how “more suits than hoodies” now best describes Bitcoin investors.

The content in this post was created exclusively for eToro by Reflexivity Research.