Major developments this week

- Bitcoin poised for volatility ahead of the Fed’s rate cut decision

- Bitcoin up 16% since Sept. 6; is a new all-time high within reach?

- Declining market share and staker revenue: Can ETH bounce back?

- Bitcoin miners face revenue squeeze as fees dwindle

- Fantom (FTM) surges 40% in the last month

- Analysts foresee a 3-month Bitcoin rally, with targets up to $92K

- Bitcoin ETFs pull in $250 million ahead of an expected rate cut

- Ethereum hits a 42-month low vs. Bitcoin—analysts debate if it’s the bottom

- BlackRock’s Bitcoin Trust sees its first inflows in weeks as spot ETFs attract $12.8 million

- Canada’s DeFi Technologies eyes a Nasdaq listing after bolstering its Bitcoin holdings

- Bhutan, with a $3B GDP, reportedly holds over $780 million in Bitcoin

Will Bitcoin break through $60K? All eyes on the Fed’s next move

Bitcoin is currently in a holding pattern, trading around the $58-59K mark as the market braces for an important U.S. Federal Reserve decision on interest rates.

The Fed’s upcoming decision on whether to cut interest rates by 25 or 50 basis points is expected to be a major factor in shaping Bitcoin’s price movement. Many market participants are divided on the outcome, which adds to the uncertainty.

Experts have identified a key resistance zone between $60,500 and $61,000, which has been a major hurdle for the cryptocurrency since March. This level is important because it represents a price range where Bitcoin has struggled to break through in the past.

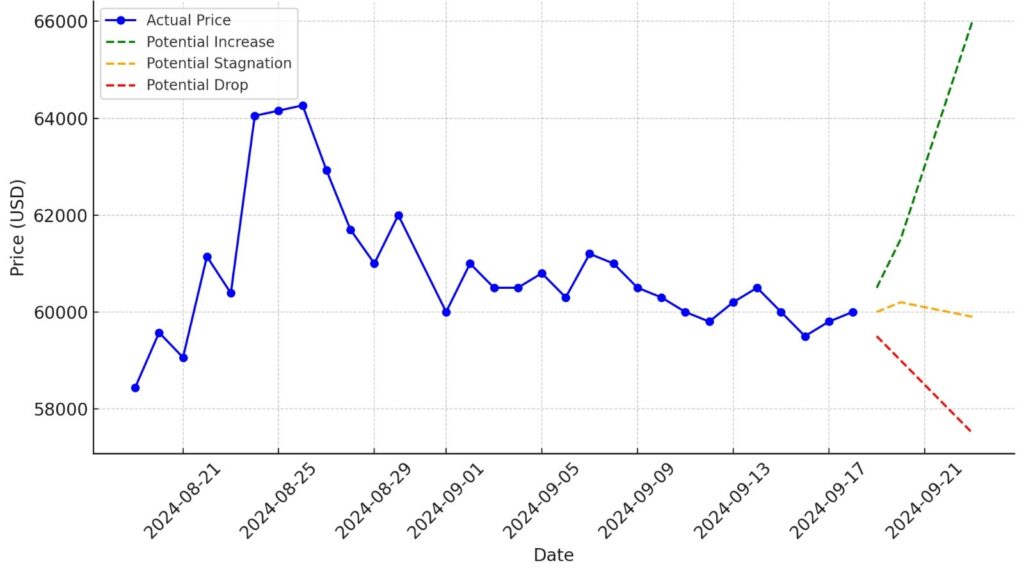

Bitcoin prices and potential outcomes

Past performance is not an indication of future results.

Rate cuts could trigger more investment, but risks remain

If the Fed cuts rates more aggressively, it could stimulate more investment in risk assets like Bitcoin. However, if the market sentiment turns cautious, especially following the Federal Open Market Committee (FOMC) decision, Bitcoin could face increased downside risk, with a potential drop to a critical support level at $49,300. A fall to this level could indicate a longer-term bearish trend.

Bullish months ahead: could Bitcoin hit $92K by year-end?

Bitcoin briefly climbed above the $60,000 mark on Sept. 14, only to fall back below that key level the same day. Historically, October through December are bullish months for Bitcoin. Some analysts believe that a favorable interest rate environment could propel Bitcoin into a three-month rally, potentially pushing prices beyond $92,000.

Bitcoin’s market momentum signals potential for record highs

Bitcoin’s price recently rebounded 16% from the local low of $52,546 on Sept 6, sparking optimism that it could be on the path to a new all-time high. The price surge has broken through significant resistance levels, suggesting a bullish momentum shift. Bitcoin’s price closed above key September highs, which analysts view as a strong sign of market resilience. There is now potential for the price to break past $65,000, which would clear the way for new highs, despite some resistance near the $60,000 range, where many Bitcoin addresses previously bought at those levels.

Analysts also highlight that Bitcoin is hovering around the middle of a descending parallel channel at $57,902, making this a crucial zone for further upward movement. With recent gains pushing the price over key exponential moving averages, Bitcoin could see more substantial moves if it maintains momentum, especially as it challenges supplier congestion zones around $60,000. This area, where over 1.5 million addresses hold 604,760 BTC, remains a critical resistance point before the next potential surge.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

Fantom soars 40% in a month: What’s driving the rally?

Fantom has surged 40% in the last month, rising from a low of $0.26 in early August to an intraday high of $0.53 by mid-September. This impressive rally comes amid a broader market decline, making Fantom one of the top performers among the largest cryptocurrencies. The price increase has been driven by positive technical indicators and growing anticipation for upcoming developments on the network. These include the much-anticipated Sonic upgrade, which is expected to vastly improve the blockchain’s performance by increasing transaction speeds to over 2,000 per second.

Bitcoin gains, Ethereum struggles: Can ETH bounce back?

Bitcoin’s dominance in the market has surged to 58%, pushing Ethereum to a 42-month low against the leading cryptocurrency. This shift is partly fueled by significant outflows from Ether exchange-traded funds (ETFs), with Grayscale’s Ether ETF alone seeing $2.7 billion in withdrawals. As Bitcoin gains more market share, analysts are split on whether this marks a longer-term weakening for Ethereum or a potential local bottom.Historically, similar lows in Ether have been followed by recoveries, but uncertainty looms over whether this trend will repeat.

In parallel, Ethereum’s staking ecosystem is also facing challenges. Staker revenue has dropped significantly, with the 7-day moving average falling to $5.44 million as of September 12, 2024, the lowest point in over six months. The decrease in staking rewards is driven by lower transaction fees and reduced on-chain activity, with Ethereum’s transaction count and volume down sharply from their March highs. Whether Ethereum can recover both its staking rewards and its position relative to Bitcoin will depend on how these factors evolve in the coming months.

Bitcoin miners face revenue squeeze as fees dwindle

Bitcoin miners are facing a challenging period as the majority of their revenue now comes from block subsidies, with transaction fees contributing only 1.6% of their income. This marks a significant shift from earlier times when transaction fees made up over 40% of miner revenue. The reduced profitability is further strained by the recent Bitcoin halving, which cut block rewards to 3.125 BTC. The cooling off of once-popular trends like Ordinals and Runes, which had temporarily boosted on-chain activity and transaction fees, has also played a role in this revenue decline.

As block rewards continue to halve every four years, miners’ reliance on transaction fees will increase, raising concerns about Bitcoin’s long-term security model. Some suggest increasing block sizes to allow more transactions, while others believe layer-2 solutions could bring more settlement transactions back to the main chain. The future of Bitcoin mining and the network’s overall health will depend on how well these proposals are adopted as miners adapt to the evolving economic landscape.

The @Web3Applications Smart Portfolio by eToro is ideally positioned to benefit from this surge in Web3 user engagement. It offers investors a tailored investment strategy that aligns with the burgeoning growth and adoption rates of DApps and related technologies.