Understanding Bitcoin Corrections in the Wake of the Recent All-Time High

Bitcoin recently reached an impressive new all-time high of $106K (source: eToro) capturing attention and sparking excitement across the crypto market.

Despite this, as we’ve seen in past cycles, record-breaking highs often pave the way for inevitable corrections. Bitcoin has experienced a drawdown of more than 10% in recent days (source: eToro) —a notable decline, but one that’s historically typical during bull markets.

A Familiar Pattern in Bitcoin Bull Markets

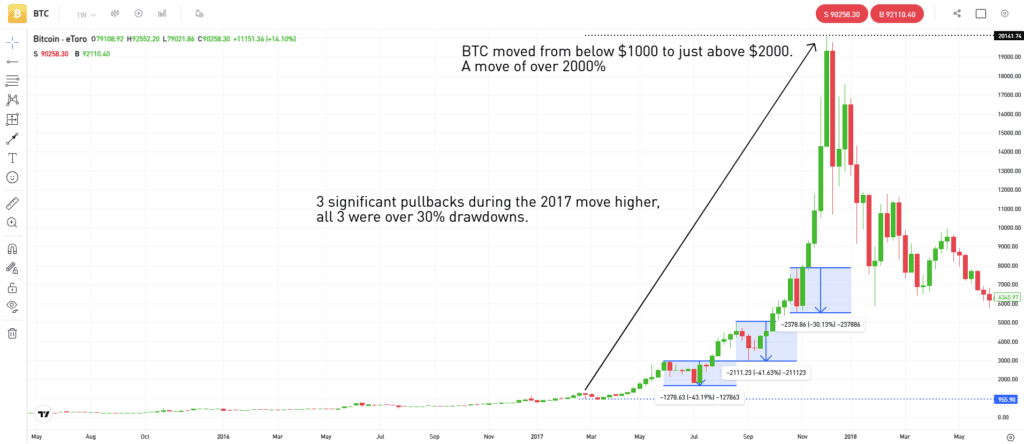

Corrections, especially in volatile assets like Bitcoin, are par for the course. If we look back at the 2017 bull market, there were at least seven drawdowns of 30% or more, each met with initial worry but ultimately leading to higher price levels.

Source: eToro

Image created by Sam North, eToro analyst

Past performance is not an indication of future results.

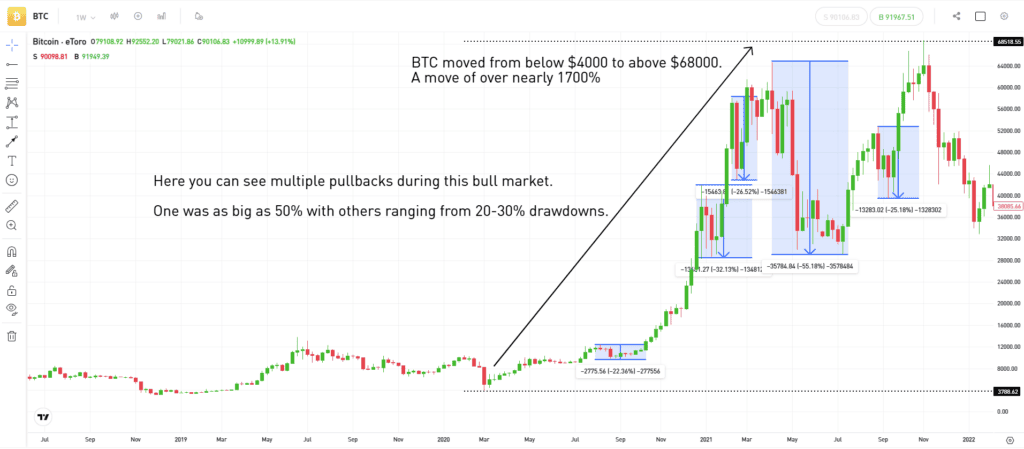

In the 2020-2021 bull market, this pattern repeated with over a dozen 10%+ drawdowns.

Source: eToro

Image created by Sam North, eToro analyst

Past performance is not an indication of future results.

Each drawdown marked moments for the market to breathe, recalibrate, and ultimately set the stage for further growth.

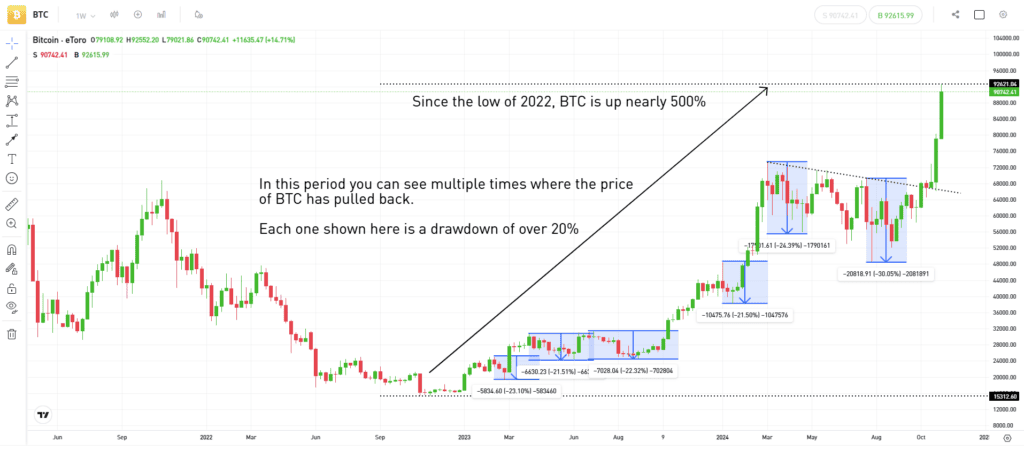

Source: eToro

Image created by Sam North, eToro analyst

Past performance is not an indication of future results.

This year, as Bitcoin rallied toward its recent high, we’ve already seen multiple corrections of 20% or more—reminders that steep price drops are a part of Bitcoin’s growth cycle. The important takeaway? Corrections don’t signify an end to the bull market; they reflect the asset’s maturation and natural response to market dynamics.

Check out eToro analyst Sam North, who has made a very interesting video clip explaining clearly and in detail about the drawdown as an integral part of a bullrun – what it means, what to look for and ways in which you can deal with corrections.

Why Do These Corrections Happen?

Bitcoin’s inherent volatility is often tied to the lack of a standardized valuation model. The price fluctuates significantly as investors and institutions continuously assess Bitcoin’s value, factoring in news, market sentiment, and macroeconomic shifts. In the past, high leverage in Bitcoin futures trading amplified these movements, making both the upswings and downturns sharper.

But the landscape is evolving. Institutional adoption, exemplified by major players like BlackRock and their approved spot Bitcoin ETF, could potentially bring greater liquidity and stabilize some of Bitcoin’s volatility over time. However, corrections remain a crucial part of market dynamics—even in an asset as established as Bitcoin.

The Value of Diversification and Prudent Investment

Bitcoin’s wild price fluctuations underline the importance of a well-diversified portfolio. While Bitcoin is an enticing asset, especially in bull markets, diversification helps investors manage risk across different assets and sectors. Balancing your portfolio with a variety of asset classes can provide a safety net, allowing you to benefit from Bitcoin’s growth potential while reducing exposure to its price swings.

It’s all about embracing both the Ups and the Downs

As we navigate this bull run, it’s essential to remember that Bitcoin’s path to new highs is never a straight line. These corrections are part of its growth story. Investors who recognize this volatility as a natural occurrence, rather than a reason to panic, are better positioned to make the most of Bitcoin’s long-term potential. So, take a deep breath, stay informed, and keep a diversified approach—this journey is just getting started.

Cryptoassets are complex and carry a high risk of volatility and loss. Trading or investing in cryptoassets may not be suitable for all investors.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Germany: Cryptoasset investing is highly volatile and unregulated in some EU countries. The service offered is provided by DLT Finance, a brand of DLT Securities GmbH, which has outsourced the provision of services or parts thereof to eToro (Europe) Ltd. and incorporated in Cyprus into its own service provision. All activities requiring regulatory authorization, especially financial commission business and proprietary trading, including the execution of orders on suitable trading venues or against DLT Securities GmbH itself, such as in market making, are provided by DLT Securities GmbH. DLT Securities GmbH is a German investment firm according to §2 (1) WpIG and is supervised as such by the Federal Financial Supervisory Authority (BaFin). Tax on profits may apply.

ASIC: eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Crypto assets are unregulated and highly speculative. There is no consumer protection. You risk losing all of your capital. Refer to our Terms and Conditions. See full disclaimer

France: Cryptoassets investing and custody are offered by eToro (Europe) Ltd as a digital asset service provider, registered with the AMF. Cryptoasset investing is highly volatile. No consumer protection. Tax on profits may apply.

Spain: Investments in crypto-assets are not regulated. They may not be appropriate for retail investors and the full amount invested may be lost. It is important to read and understand the risks of this investment, which are explained in detail at this link.

EU: Cryptoasset investing is highly volatile and unregulated in some EU countries. Tax on profits may apply.

UAE: Cryptoassets are complex and carry a high risk of volatility and loss. Trading or investing in cryptoassets may not be suitable for all investors.

FSA: Crypto assets are unregulated and highly speculative. There is no consumer protection. You risk losing all of your capital.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.