Major Crypto Developments for the week:

- Ark Invest’s Bitcoin spot ETF gets delayed by the SEC

- Bitcoin held by long term holders now over 75%

- Payment issuer giant PayPal’s stablecoin goes live on Ethereum

- Decentralized casino platform Rollbit announces token buyback program

- Former FTX CEO SBF ordered to jail after judge revokes bail

Market Structure:

As mentioned in previous weekly updates, we have seen a continuation of the volatility compression that Bitcoin has been experiencing for several months now.

Volatility is a measure of how much the price of an asset is moving. Bitcoin’s 30-day realized volatility is now at levels that have previously preceded large price impulses in 2017, 2018, 2019, 2020, and earlier this year.

This decline in volatility has also meant a decline in trading volume and liquidity overall as highlighted in previous weekly updates.

What are the catalysts that could potentially ignite volatility?

The most obvious one seems to be the approval of one of these Bitcoin spot ETFs that would potentially unlock billions of dollars in capital to access Bitcoin spot exposure in an institutional grade investment vehicle.

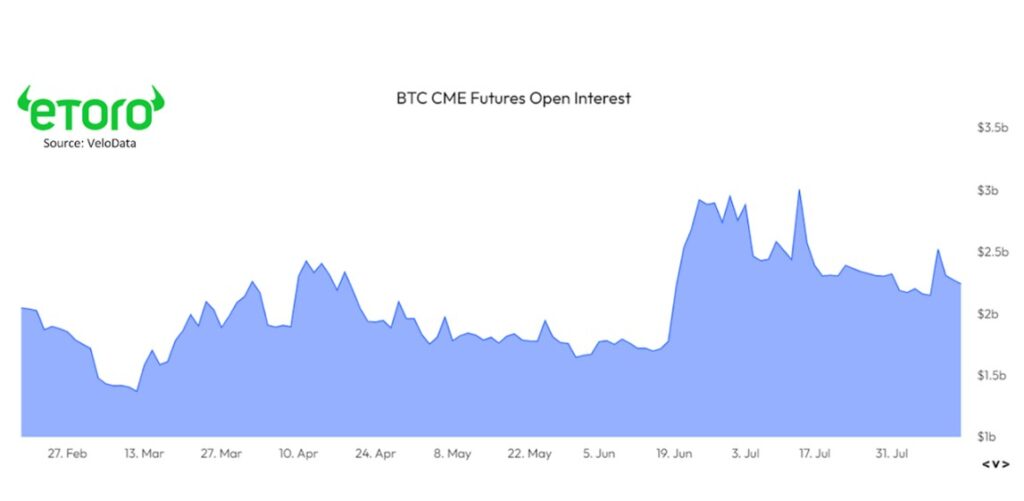

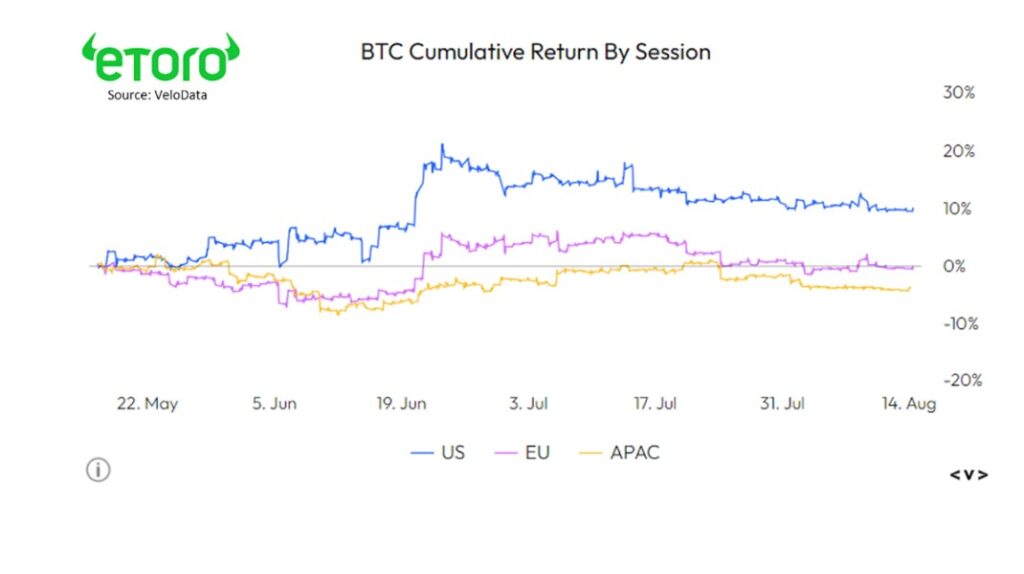

Last week Cathie Wood and Ark Invest’s ETF application was delayed by the SEC, which does not come as a surprise as we’ve seen several measures of ETF front-running flows declining including the drop off in CME futures open interest (primarily utilized by traditional based asset managers) and continued bleed in the US trading hour premium that shot up after the initial Blackrock filing.

Other potential catalysts include dramatic developments in the DOJ situation with a well-known crypto exchange, as well as unexpected macroeconomic shocks.

One important data point to measure capital flows to and from the crypto market is stablecoin supplies, which looks at the total amount of stablecoins in circulation.

An increase in stablecoin supplies suggests capital inflows that will likely be piled into crypto assets. Conversely, a decline in stablecoin supplies suggests capital outflows and less liquidity in the crypto economy overall.

Aggregated stablecoin supplies have declined for over a year now, shown in the pink line in the chart below. One derivative metric of the aggregate stablecoin supply is the 90-day change – which is something we’ll continue to monitor. Once this flips to green it will suggest that we may be seeing a trend shift into net capital inflows for the crypto market.

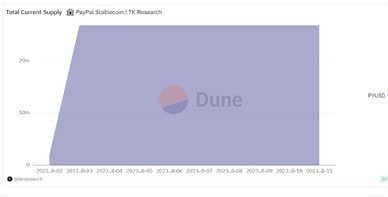

Speaking of stablecoins, Paypal’s offering went live this week and has breached $26 million in circulating supply according to this chart from TK Research. The payment behemoth that boasts 435 million active users has the potential to bridge the traditional payment world into crypto through their offering in a way that no firm has been able to do to date; which is something we will continue to monitor closely.

We hope you enjoyed this week’s crypto market update and look forward to touching base again next week! Thanks for reading.

The material in this blog post was created exclusively for eToro by Reflexivity Research.