Next stop $50K, claims Real Vision CEO Raoul Pal

Optimism has taken hold across the crypto market, with prices remaining buoyant even as the ongoing banking crisis sparks fears about the global economic outlook.

Amidst this uncertainty, Bitcoin is inching higher on big predictions from the likes of Raoul Pal, while Litecoin has been lifted 10% by investors with high hopes for the upcoming halving. The standout performer, however, is Ripple’s XRP, which surged 20% last week on fresh legal developments.

Read more after the jump.

This week’s focus

– Bitcoin inches higher — next stop $50K?

– Litecoin outperforms ahead of halving — can it break $100?

– XRP up 20% on hopes of legal clarity

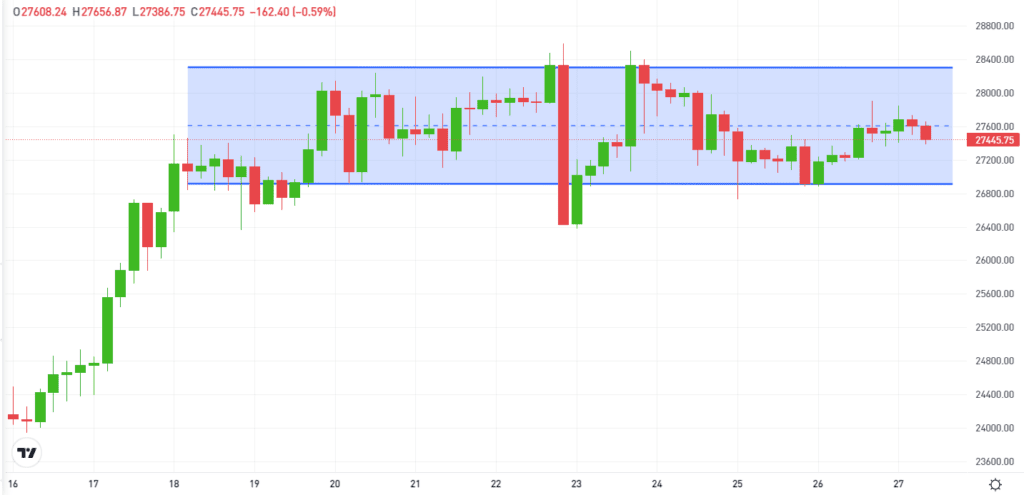

Bitcoin inches higher — next stop $50K?

After finding support at $27K, BTC is reaching towards $28K

Having shrugged off a rate hike in the US and ongoing concerns about the fragility of the banking sector, Bitcoin is holding steady just below $28K.

These uncertain economic conditions are causing what trading firm GSR’s Benoit Bosc has called a “flight to quality”. This is when investors choose to allocate funds to Bitcoin, leading it to outperform traditional markets and most other cryptoassets.

This trend, argues American investor and entrepreneur Balaji Srinivasan, could lead Bitcoin to hit $1 million in 90 days if economic conditions in the US deteriorate.

Other analysts, including Real Vision CEO Raoul Pal, have made more tempered predictions. He claims that Bitcoin could reach $50K within a year.

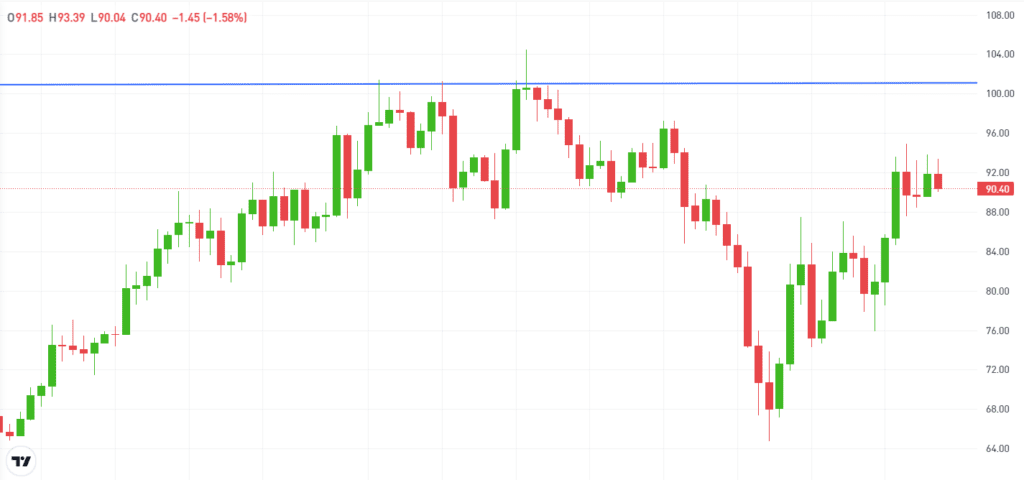

Litecoin outperforms ahead of halving — can it break $100?

LTC is climbing towards $100 on a diagonal trendline

As most of the crypto market makes small gains, Litecoin is up 10% in a display of relative strength.

This could be due to the cryptoasset’s upcoming halving, expected to happen in August, which will see the rewards for mining new blocks on the network get cut in half.

Historically, halving events have preceded extended bull runs for both Litecoin and Bitcoin, and many expect something similar to play out again. That includes independent market analyst Rekt Capital, who noted on Twitter that anticipation of the Litecoin halving could be helping to attract investors.

This view is supported by data from blockchain analytics firm IntoTheBlock, which shows that the average size of LTC transactions has increased by over 600% in March 2023 — suggesting larger players could be positioning themselves for such a halving rally.

Before any further upside can be realized, however, the resurgent cryptoasset must breach the key psychological threshold of $100.

XRP up more than 20% on hopes of legal clarity

XRP jumped more than 20% on Wednesday, coming within reach of $0.5

Ripple’s XRP surged over 20% on Wednesday, following reports that the company could be well-placed to win a landmark legal case with the US Securities and Exchange Commission (SEC).

The SEC sued Ripple in 2020 for allegedly breaching securities laws by selling XRP without first registering it with the regulator, but this was contested by Ripple, who maintained that XRP should be considered a digital currency rather than a security.

On Tuesday, the situation turned in Ripple’s favor, as a judge in another case rejected the SEC’s claim that a token similar to XRP was a security.

Shortly afterwards, Ripple president Monica Long told CNBC that she was “very hopeful” about achieving a positive resolution to the legal case.

If Ripple does win, the resulting legal clarity could not only lead to increased demand for XRP, but also boost demand for other cryptoassets facing regulatory uncertainty. That includes XRP’s closest cousin Stellar Lumens, which is up 5% on the week.