Major Developments for the Week:

- Bitcoin on the up following Trump assassination attempt

- Price dip sees Whales acquire 71,000 BTC

- Liquid staking on Solana hits an all-time high

- BlackRock interested in MakerDAO’s Grand Prix

- StarkNet proposes staking for its ecosystem.

- MicroStrategy plans a 10:1 stock split amid the Bitcoin rally.

- API3 has launched the OEV Network, a layer two platform

- Cardano introduces new releases in preparation for Chang upgrade

Join our exclusive crypto webinar on July 22, with Anthony (Pomp) Pompliano and Will Clemente. Register now!

Bitcoin

Bitcoin Surges Amid Trump Assassination Attempt

Bitcoin surged to a two-week high, nearing $65K at one point, following the attempted assassination of U.S. presidential candidate Donald Trump. This incident has increased the likelihood that Trump, who has consistently positioned himself as a cryptocurrency proponent, will win the upcoming election. The market’s reaction highlights the influence of political events on Bitcoin’s price movements, further indicating a bullish sentiment among investors who anticipate favorable regulatory developments under a pro-crypto administration.

Bitcoin Whales Scoop Up 71,000 BTC During Price Dip

Before the surge in Bitcoin’s price, whale investors purchased a substantial amount of Bitcoin, totaling 71,000 BTC. This accumulation occurred as Bitcoin prices declined, suggesting that large holders are capitalizing on lower prices to increase their positions. Retail investors have also significantly increased their activity in Bitcoin ETFs, with over $300 million in net inflows. This marks their highest buying activity since early June, when the cryptocurrency traded over $70,00

As the landscape of Bitcoin investment evolves with significant inflows and whale accumulations, a ripple effect is anticipated across the Bitcoin value chain. eToro’s @BitcoinWorldWide Smart Portfolio offers a comprehensive investment option aligned with Bitcoin’s growing potential.

Smart Contract Platforms

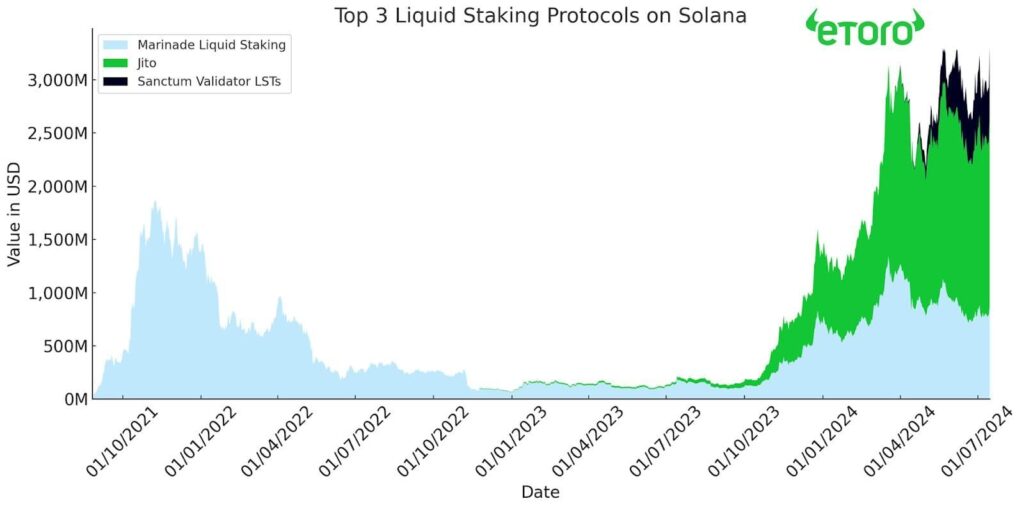

Liquid Staking on Solana Soars to All-Time High

Solana‘s liquid staking has reached unprecedented levels, hitting an all-time high with Jito leading the chart. The increased staking activity reflects Solana’s growing popularity and the platform’s efficient staking mechanisms.

Past performance is not an indication of future results

Liquid staking allows users to stake their tokens while maintaining liquidity, offering a balance between earning rewards and having accessible funds. This surge indicates confidence in Solana’s network and its scalability solutions.

StarkNet Introduces Staking Proposal to its Ecosystem

Layer-2 Scaling Solution StarkNet has introduced a staking proposal aiming to enhance its ecosystem’s security and participation incentives. The proposal outlines a framework for users to stake their tokens, contributing to network security while earning rewards. This initiative is part of StarkNet’s broader strategy to build a robust, scalable infrastructure for Ethereum-based applications.

The rising activity in Solana’s staking underscores the scalability and efficiency of smart contract platforms. eToro’s @Scalable-Crypto Smart Portfolio provides exposure to scalable blockchain solutions like Solana.

DeFi and TradFi

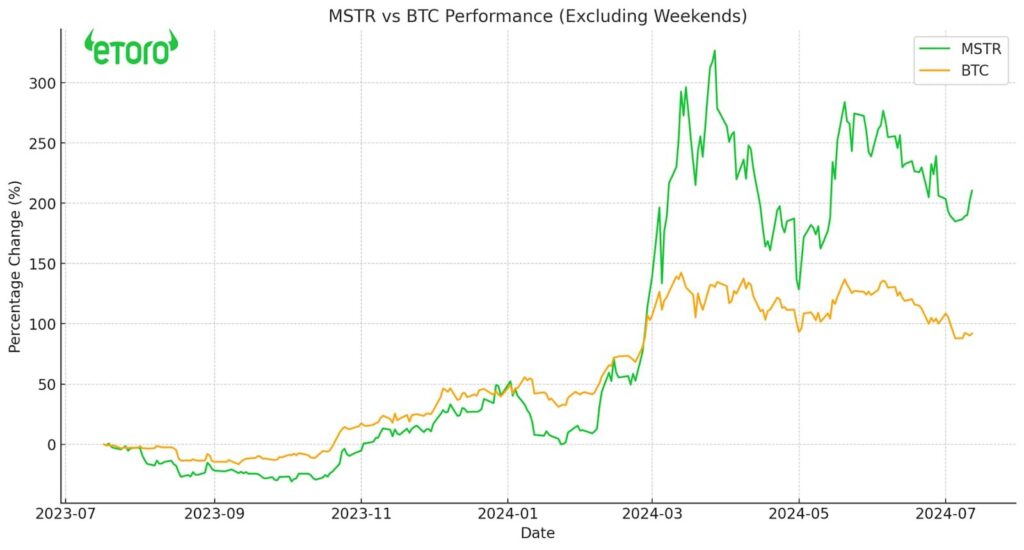

MicroStrategy Announces 10-for-1 Stock Split to Make MSTR More Accessible to Investors

MicroStrategy has announced a 10-for-1 stock split to increase the accessibility of its stock to a broader range of investors. This move follows a significant rise in its share price, driven by the company’s substantial Bitcoin holdings. The stock split is expected to improve liquidity and attract more investors, further enhancing MicroStrategy’s market presence and commitment to its Bitcoin strategy.

Past performance is not an indication of future results

BlackRock Shows Interest in MakerDAO’s Grand Prix

BlackRock has expressed interest in participating in MakerDAO‘s Grand Prix, a strategic initiative to enhance the protocol’s stability and growth by offering a competition aimed at tokenizing $1 billion worth of real-world assets (RWA) and integrating them into MakerDAO. This potential involvement by one of the world’s largest asset managers underscores the growing intersection between TradFi and DeFi. BlackRock’s interest could bring substantial credibility and investment into the DeFi space, fostering further integration between the two financial ecosystems.

The convergence of DeFi and TradFi continues to evolve with significant developments like BlackRock’s interest and StarkNet’s staking proposal. eToro’s @DeFiPortfolio offers diversified exposure to leading DeFi projects and protocols.

Web3

Storj Acquires Cloud Computing Firm Valdi

Storj, a decentralized storage platform, has acquired cloud computing firm Valdi. The terms of the deal were not disclosed, but this acquisition is expected to enhance Storj’s service offerings by integrating cloud computing capabilities. This move positions Storj to better compete in the cloud services market, leveraging decentralized technology to offer innovative solutions.

The advancements in Web3, including strategic moves by companies like MicroStrategy and Storj, highlight the transformative potential of decentralized technologies. eToro’s @Web3Applications Smart Portfolio provides exposure to pioneering Web3 projects.