Major Developments for the Week

- Fed Chair hints at rate cuts, Bitcoin and markets react positively

- Bitcoin poised for breakout, could it meet resistance at $65K?

- Long-term holding signals boost Bitcoin’s price outlook

- Gold hits record highs, but Bitcoin lags: what’s behind the divergence?

- Web3 Watch: Sony unveils Soneium, its Ethereum-based blockchain

- RFK Jr. suspends campaign and backs Trump in crypto-friendly move

- Crypto-friendly Wyoming to launch crypto stablecoin

- Shiba Inu launches DAO for community governance

- Blockchain Association, DeFi Education Fund warn of privacy concerns

Bitcoin

Fed chair hints at rate cuts, Bitcoin and markets react positively

Bitcoin surged past $61,000 after Federal Reserve Chair Jerome Powell expressed optimism that U.S. inflation is on track to return to 2%, hinting at potential interest rate cuts in the near future. During the Jackson Hole symposium, Powell emphasized that the timing and pace of these cuts would depend on incoming economic data and how the overall outlook evolves. His comments have boosted market confidence, sparking gains in both the crypto and stock markets. As a result, Bitcoin led the charge in the cryptocurrency sector, driving its market cap up to a near ATH of 1.3 trillion, and the overall market capitalization up to an all time high of $2.28 trillion with a 0.6% rise on Monday.

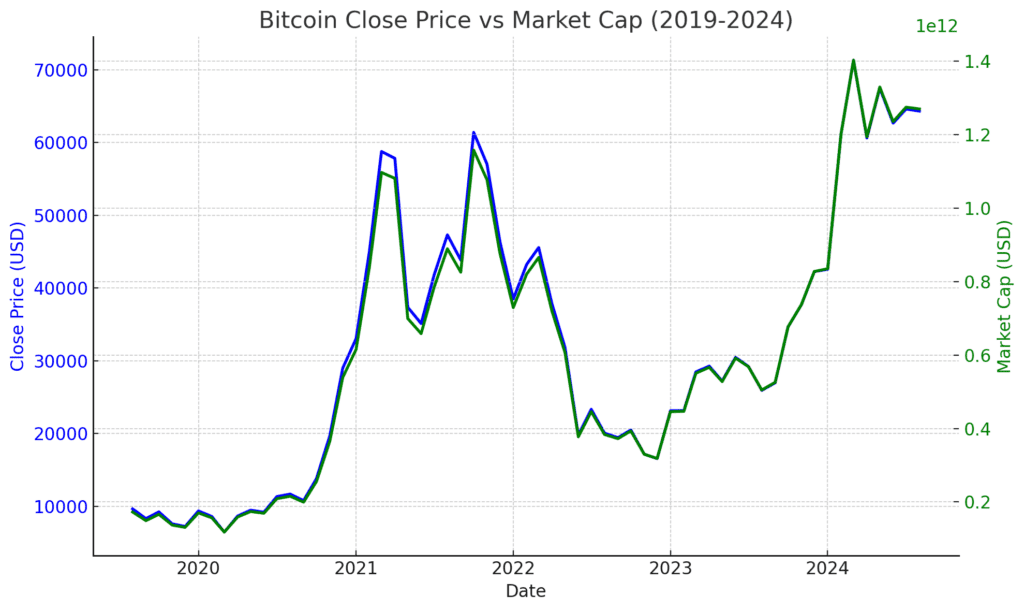

The above chart presents Bitcoin’s price against its Market Cap, on a monthly basis between 2019 and 2024

Past performance is not an indication of future results

In addition to the crypto market surge, traditional markets also reacted positively to Powell’s remarks. The Dow Jones Industrial Average rose by 417 points, while the S&P 500 gained 1.2%, and the Nasdaq Composite advanced by 1.8%. The CME FedWatch tool now reflects a 67.5% probability of a 25 basis point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting in September, and a 32.5% chance of a 50 basis point cut.

Bitcoin’s price spike also coincided with a substantial inflow into Bitcoin exchange-traded funds (ETFs), with U.S. investors pouring $252 million into these funds on Friday alone. The Bitcoin ETF category recorded a total of $506 million in inflows for the week, reflecting investor sensitivity to interest rate expectations following Powell’s “dovish” comments.

Powell’s comments are seen as a key indicator for future market movements, with both stock and crypto investors keeping a close eye on the economic outlook and upcoming data. The anticipation of lower interest rates has further fueled confidence across financial markets, pushing Bitcoin higher alongside traditional stocks.

These developments, along with the high Bitcoin ETF inflows, demonstrate a growing optimism among investors in both the crypto and traditional markets. As interest rate expectations shift, Bitcoin continues to hold strong, up 8.5% over the past week, despite minor dips.

Bitcoin poised for breakout, could it meet resistance at $65K?

Bitcoin is nearing a potential breakout, facing resistance around $65,000 as market expectations rise for interest rate cuts. With U.S. money market funds at an all-time high of $6.2 trillion, demand for Bitcoin could increase, especially among institutional investors.

Analysts believe Bitcoin could surge past $68,000 if rate cuts are confirmed, and potentially reach $95,000. However, Bitcoin must first overcome the $65,000 barrier, which could trigger the liquidation of leveraged short positions, paving the way for new record highs.

Long-Term Holding Signals Boost Bitcoin’s Price Outlook

Bitcoin remains strong above $62,000 as exchange reserves fall to a multi-year low, signaling a trend toward long-term holding. With Bitcoin reserves dropping 3% in the last 30 days, the supply limitation could drive prices higher, especially as Bitcoin has gained over 40% this year.

In the derivatives market, bullish sentiment is reflected in high open interest for $100,000 and $105,000 call options, suggesting Bitcoin’s price may continue to rise.

The combination of falling Bitcoin reserves, growing investor confidence, and strong derivatives data points to the potential for Bitcoin’s price to rise even further in the coming months.

Gold hits record highs, but Bitcoin lags: What’s behind the divergence?

Gold has hit a record high of $2,500 per ounce, driven by expectations of lower U.S. interest rates and a weaker dollar, while Bitcoin lags behind.

Bitcoin, despite its scarcity and inflation-proof nature, remains closely tied to tech market fluctuations, and would likely fall alongside tech stocks in the event of a crash. Gold, in contrast, retains its reputation as a stable, long-term investment, even if it doesn’t offer the same growth potential.

Over time, cryptoassets like Bitcoin may develop into more secure investments, akin to gold, but for now, the volatility of the tech sector clouds Bitcoin’s future as a safe-haven asset.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

Web3

Web3 Watch: Sony Unveils Soneium, its Ethereum-Based Blockchain

Sony has introduced Soneium, its Ethereum Layer 2 solution, which will launch on a testnet soon. The blockchain is designed to address concerns about inefficiencies in the crypto market and will focus on protecting creators’ rights and sharing profits with creators and fans. Sony’s move signals its commitment to supporting the creator economy through blockchain innovation.

The @Web3Applications Smart Portfolio by eToro is ideally positioned to benefit from this surge in Web3 user engagement. It offers investors a tailored investment strategy that aligns with the burgeoning growth and adoption rates of DApps and related technologies.

Other Crypto Updates

RFK Jr. Suspends Campaign and Backs Trump in Crypto-Friendly Move

Robert F. Kennedy Jr. has suspended his presidential campaign and endorsed Donald Trump, particularly in key battleground states. Both Kennedy and Trump are pro-Bitcoin, with Trump promising to support Bitcoin miners and Kennedy backing the idea of the U.S. holding Bitcoin as a strategic reserve. Kennedy’s decision may impact Kamala Harris’ chances and strengthen the relationship between the crypto industry and Trump.

Shiba Inu Launches DAO for Community Governance

Shiba Inu is launching a DAO to give SHIB holders a say in the project’s direction. The DAO will have two councils focused on community initiatives and preserving the ecosystem’s culture. This move follows the migration of ShibaSwap to the Shibarium blockchain, enhancing SHIB’s utility and empowering its community.

Crypto-Friendly Wyoming to Launch Crypto Stablecoin for Faster, Cheaper Payments

Wyoming plans to launch the Wyoming Stable Token, a US dollar-backed stablecoin, in early 2025. The goal is to facilitate faster, cheaper transactions and create new revenue streams for the state. The stablecoin will be backed by short-term U.S. Treasuries, and operate on public blockchains like Ethereum and Solana, ensuring transparency and privacy.