Major Developments for the Week

- Bitcoin set for 400% gains over gold? Analysts predict record highs

- Ethereum soars 16% after Fed cut, but can the rally last?

- As hashrate climbs, will Bitcoin’s price follow?

- Crypto in election spotlight: Harris and Trump compete for industry support

- Bitcoin hovers below $65K, but key market-changing factors are in play

- Solana reveals its second ‘Web3 phone’

- Satoshi-era miner moves Bitcoin for the first time in 15 years

- MicroStrategy adds 7,420 Bitcoin, bringing its total to 252,220 BTC

- Divergence between Bitcoin price and hashrate hints at a potential rally

- Solana braces for a major move after defending $120 support

- Altcoins soar past Bitcoin and Ether following the Fed’s rate cut

- Former President Donald Trump buys burgers with Bitcoin at a New York bar

Bitcoin Set for 400% Gains Over Gold: Analysts See Record Highs Ahead

Bitcoin is on the cusp of a potential breakout, with analysts forecasting a new all-time high in the near future. Kevin Svenson suggests that market indicators, such as the inverse head-and-shoulders pattern, point to a sharp price increase, with October being a key time for a breakout. Svenson emphasizes Bitcoin’s current momentum, building toward a significant upward move as it consolidates around critical price levels.

Past performance is not an indication of future results.

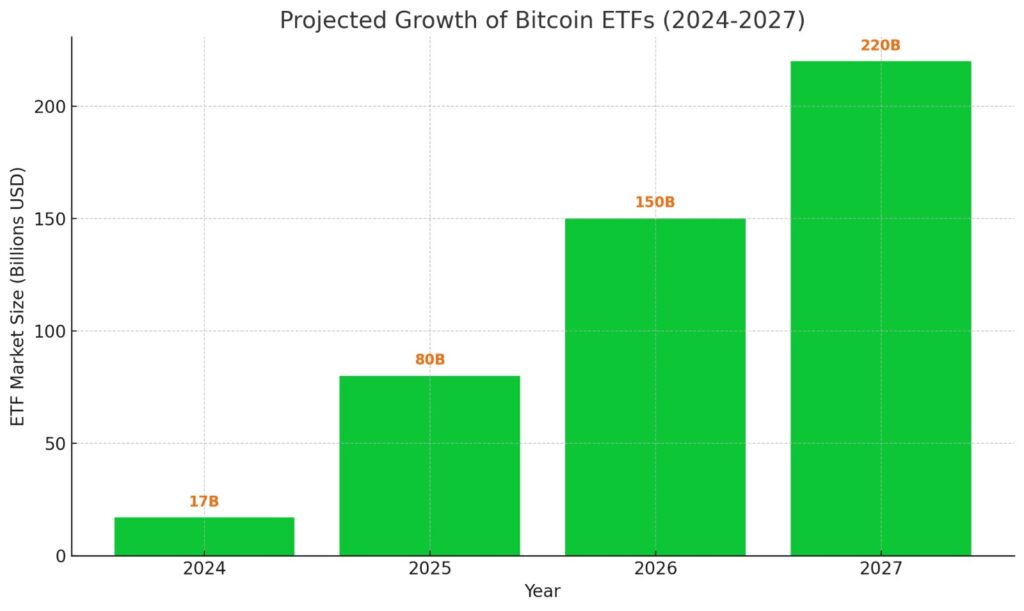

Similarly, Michaël van de Poppe highlights Bitcoin’s correlation with other macroeconomic factors. He points to the upcoming Bitcoin ETF approval as a potential catalyst, along with ongoing market liquidity improvements. He suggests that if Bitcoin can sustain its position, and remain above the $30,000 mark, it may signal the next leg up, potentially reaching new highs within a matter of weeks. Both analysts agree that October is a crucial time for Bitcoin’s trajectory, as it could either consolidate further or explode into a price rally.

Past performance is not an indication of future results.

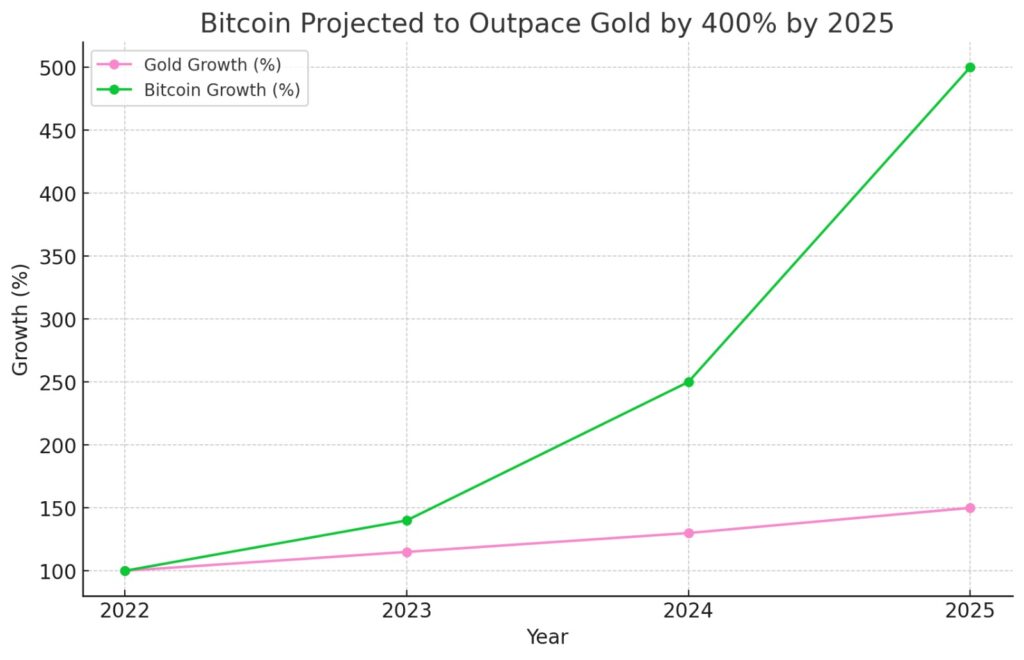

Adding to the bullish sentiment, a third perspective considers Bitcoin’s performance relative to gold. With institutional interest increasing and Bitcoin being seen as a store of value, some analysts project that Bitcoin could outpace gold’s growth by 400% by 2025. This comparison positions Bitcoin as a hedge against traditional financial markets, making it increasingly attractive to investors looking for alternative assets in uncertain times.

Ethereum Soars 16% After Fed Cut, But Can the Rally Last?

Ethereum has taken the spotlight after the recent U.S. Federal Reserve rate cut, soaring over 16%, easily outpacing Bitcoin’s modest 6% gain. This rapid rise reflects a wave of bullish sentiment, with investors betting big on ether by increasing their long positions in the derivatives market. A key indicator, Ethereum’s perpetual futures funding rate, has flipped positive, signaling strong market demand. While the optimism around Ethereum is building, experts warn that the hype could lead to market volatility if sentiment becomes too extreme or external conditions shift.

Ethereum’s surge is part of a broader rally in altcoins, which have been gaining momentum after months of being undervalued. With open interest in Ethereum futures surpassing $11.48 billion, the highest since August, this rapid uptick is a double-edged sword. On one hand, it shows growing confidence, but on the other, it sets the stage for possible market turbulence. As altcoins heat up, the risk of sharp fluctuations is something investors need to watch closely.

As hashrate climbs, will Bitcoin’s price follow?

Bitcoin’s recent divergence between its price and hashrate could be setting the stage for a potential rally, a pattern observed a few times over the past three years. Historically, when Bitcoin’s hashrate rises while its price remains stagnant, it has often led to price recoveries as the market catches up. Since July, the hashrate has reached record levels, hitting 693 exahashes per second (EH/s) by early September, despite Bitcoin’s price until recently staying around the $54,000 mark. This increase in hashrate, driven largely by well-capitalized, publicly traded mining companies, signals growing miner confidence in the network’s long-term potential.

A significant factor behind this rise in hashrate is the increasing market share of publicly traded miners, which now account for 23% of Bitcoin’s production, the highest level since early 2023. These companies have been boosting their computing power, pushing the hashrate back to pre-halving levels. As a result, Bitcoin has already gained 15% since reaching a local bottom on September 6. If historical patterns hold, the market may soon adjust to this increased network strength, potentially driving a more significant price rally in the coming months.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

Crypto in the Spotlight: Harris and Trump Vie for Industry Support

U.S. Vice President Kamala Harris has expressed her intention to support the growth of the crypto industry, alongside AI, while ensuring consumer protection. During a fundraising event in New York, Harris highlighted her focus on fostering innovation, particularly in emerging technologies, and creating a business-friendly environment by streamlining regulations. Although she hasn’t provided detailed plans, her stance marks a shift towards a more crypto-friendly approach in the Democratic party. This aligns her campaign with her broader economic goals of promoting competitiveness and job creation.

Former President Donald Trump, her Republican opponent, has also attracted crypto industry support, though with more aggressive promises, including rolling back regulations and expanding crypto leadership in the U.S. Both candidates are vying for the support of the growing crypto sector as they outline their differing approaches to regulation and economic innovation.