Major crypto developments for the week

- Bitcoin Spot ETF is historically approved on January 10th

- CEO of BlackRock, Larry Fink, says he sees value in having an Ethereum ETF

- Bitcoin CME open interest rolls over after BTC ETFs begin trading

- Digital assets experience an inflow of $1.18 billion over last 7 days, subject to a trade date plus two days (T+2) settlement period

- Sotheby’s opens bidding for a curated selection of 19 Bitcoin Ordinals

- ApeCoin to release 4.2% of circulating supply on Jan 17, equiv. to $22.7M

Last week marked an historic moment for digital assets with the successful approval of the Bitcoin ETF. The period preceding this development was marked by turmoil and uncertainty, primarily due to security issues involving the SEC’s official Twitter (X) account.

🎧 Don’t miss the BTC etc emergency podcast! “Bitcoin Spot ETF approval”!

SEC officially approves Bitcoin Spot ETF on January 10th

On January 10th, the Securities and Exchange Commission marked a significant policy shift by approving the listing and trading of various spot Bitcoin Exchange-Traded Funds (ETFs). This decision came after a history of disapproving similar products, with more than 20 rejections since 2018 under Chair Jay Clayton. The change in stance followed a critical review by the U.S. Court of Appeals for the District of Columbia, which questioned the SEC’s reasoning in previously disapproving Grayscale’s proposed ETF.

The SEC underscored its merit-neutral approach, emphasizing adherence to the Securities Act, Exchange Act and its regulations, rather than expressing preference for specific investments or companies. However, it’s important to note that this approval specifically pertains to bitcoin ETFs and doesn’t extend to other crypto asset securities or imply a stance on the legal status of other crypto assets.

Key investor protections accompany this approval. These include mandatory comprehensive disclosures about the ETFs, their listing and trading on regulated national securities exchanges with strict rules against fraud and the application of existing purchase and sale standards.

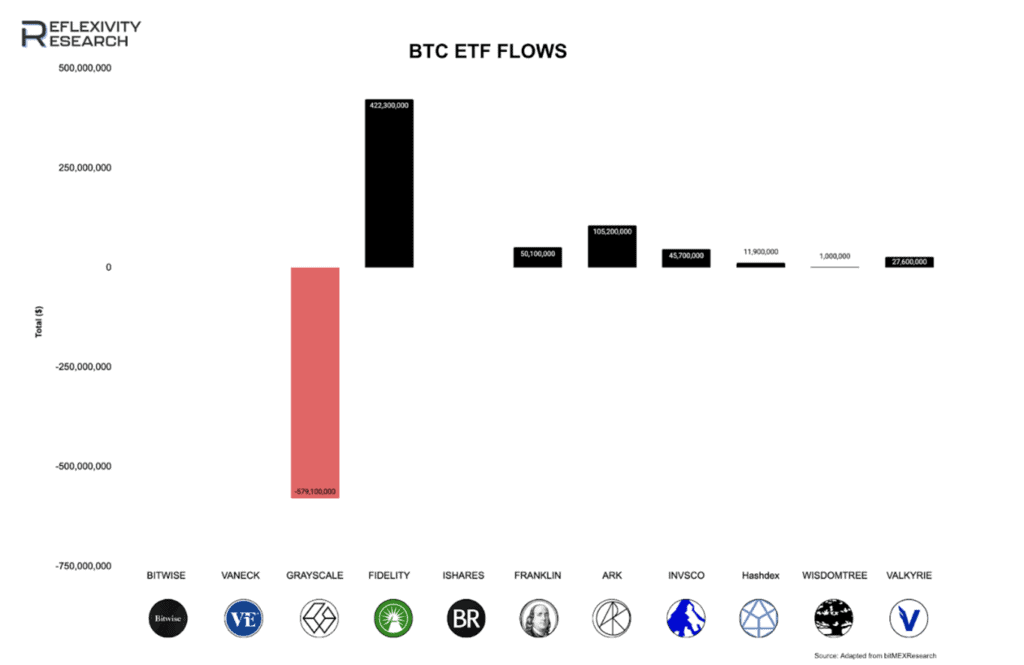

The chart below highlights flows for Bitcoin ETFs thus far and pertains to data available from January 13th, is subject to T+2 days. We have since garnered more light as to the cumulative flows for week one as detailed below. Note: Bitwise led inflows for this week, with data not shown in this graph.

Past performance is not an indication of future results

Source: Bitmex Research

Last week witnessed a notable surge in the digital asset market, with investment products in this sector attracting an impressive US$1.18 billion in inflows. While this figure fell short of the record US$1.5 billion inflow seen during the launch of futures-based Bitcoin ETFs in October 2021, it still marks a significant uptick in investor interest.

The real highlight was in the trading volumes of ETPs. These soared to a record-breaking US$17.5 billion last week, shattering the previous average of around $2 billion per week throughout 2022. This volume accounted for almost 90% of the total daily trading on trusted exchanges last Friday, a substantial increase from the usual 2%-10% range.

This week, the spotlight in the market is expected to remain on Grayscale, especially in the wake of their significant outflows last week.

As the landscape of Bitcoin investment evolves with the SEC’s historic approval of various spot Bitcoin ETFs, a significant ripple effect is anticipated across the entire Bitcoin value chain, benefiting everyone from miners to custodians. eToro’s @BitcoinWorldWide Smart Portfolio emerges as an ideal solution, offering a comprehensive investment option that aligns with the growing potential of the entire Bitcoin value chain.

BlackRock CEO Larry Fink says he “sees value in an Ethereum ETF”

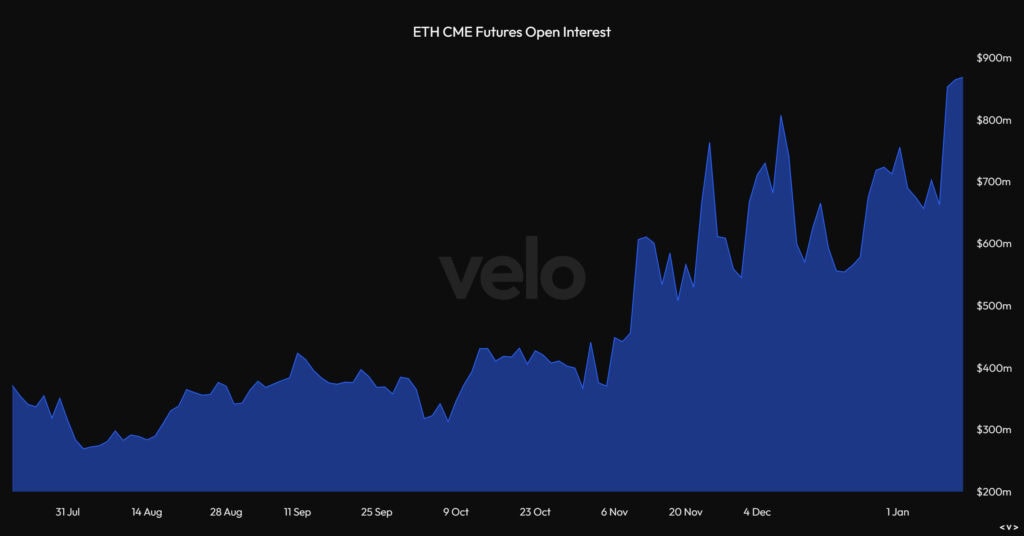

In the lead-up to the VanEck Ethereum ETF decision deadline in May, a key development to observe is the evolving trend in ETH CME futures open interest. This importance is emphasized by Larry Fink’s most recent comments on his CNBC appearance in which he stated that he “sees value in having an Ethereum ETF”.

Since the approval of the Bitcoin spot ETF, ETH CME futures open interest has risen by 31%. This jump marks its highest point since late December 2021.

In our previous reports, we highlighted the importance of keeping a close eye on the ETH/BTC pair around the time of the Bitcoin ETF approval, anticipating a potential short-term reversal from the prevailing downtrend. This forecast has thus far shown to be true, with the pair gaining 25% from its low since January 9th, hinting at a potential end to the 15-month downtrend. As the Ethereum ETF decision deadlines (spanning from May 23 to August 7) draw closer, we will continue to closely track these market movements and relative strength of the pair.

Past performance is not an indication of future results

As we approach the critical decision deadlines for the Ethereum ETF, our @Crypto-Currency portfolio offers investors a well-timed, balanced exposure to the two largest crypto assets, poised to benefit from both the current momentum and future developments.

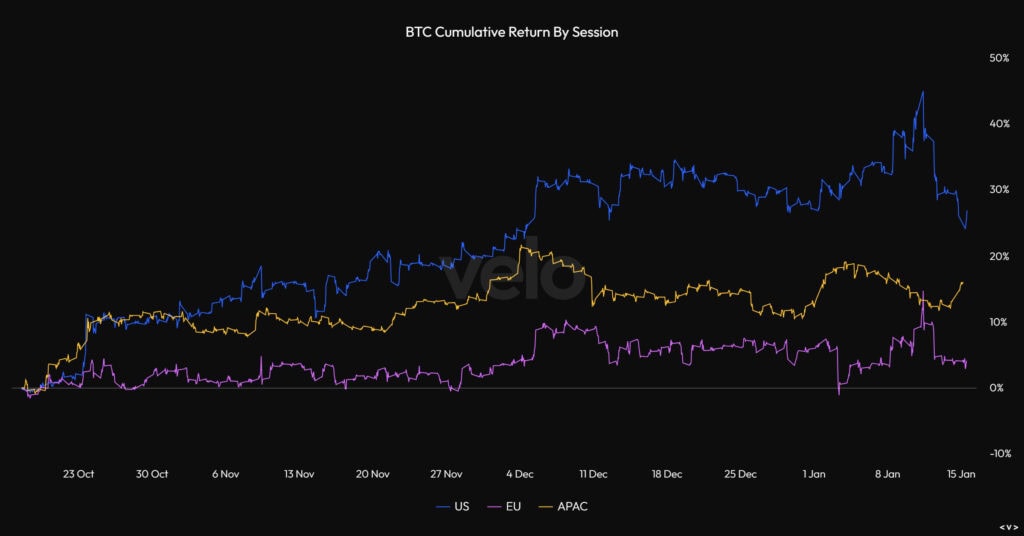

Shift in prior trend of return by session

In the period preceding the approval of the BTC ETF, a distinct trend emerged with the US trading sessions predominantly driving cumulative returns. However, recent weeks have signaled a possible shift in this pattern. This change is likely attributed to outflows from Grayscale.

Source: Velo Data

Past performance is not an indication of future results

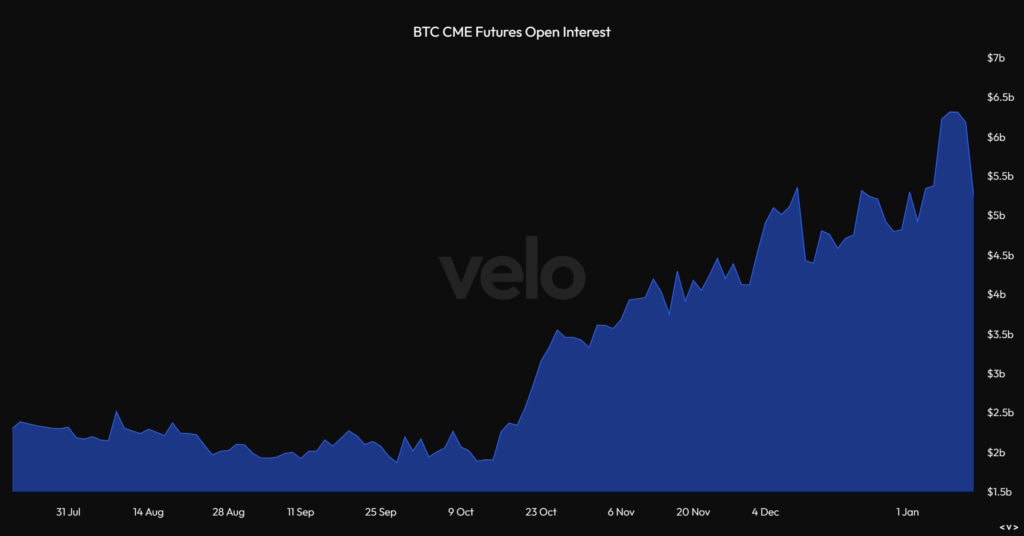

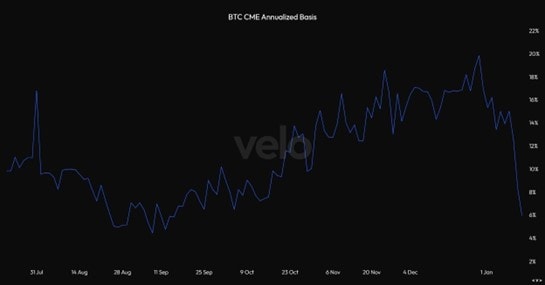

Bitcoin CME open interest rolls over after ETFs begin trading

In last week’s edition we discussed the Bitcoin CME’s open interest having reached two-year highs of $5.38 billion. This open interest continued to climb before reaching a peak at $6.12 billion on the day of the Bitcoin ETF approval. Since it has declined to $5.34 billion, with the annualized basis dropping from 20% to 6%. This reflects “selling the news” as well as funds rotating into BTC ETFs that were using the BITO futures ETF as a liquidity bridging vehicle.

Past performance is not an indication of future results

Source: Velo Data

Past performance is not an indication of future results

Source: Velo Data

🎧 Don’t miss the BTC etc emergency podcast! “Bitcoin Spot ETF approval”!

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.