Major developments for the week

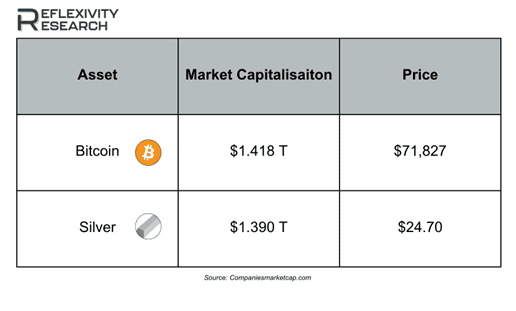

- Bitcoin reaches new all-time high, surpasses Silver in Market Cap

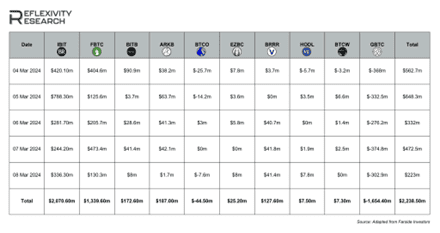

- Bitcoin ETF products saw net inflows of $1.77 billion

- Ethereum Dencun upgrade to take place on March 13

- Optimism sells 19.5M $OP tokens to private investor, subject to lock-up period

- Pantera to raise funds to purchase $250M of discounted, locked $SOL

- Arkham Intelligence identifies Tesla and SpaceX Bitcoin holdings

- MicroStrategy acquires 12,000 BTC for $821.7 million

- Aptos to undergo $329.16M unlock

- BlackRock submits a filing to acquire Bitcoin spot ETFs for its Global Allocation Fund

Bitcoin passes all-time high, ETFs see net inflows of $2.23B

Bitcoin passed its previous all-time high several times this week, and at time of writing is continuing this upwards trajectory, surpassing Silver in market cap.

Past performance is not an indication of future results

Last week Bitcoin ETF products saw a net inflow of $2.23B. A further announcement was made regarding MicroStrategy, who acquired approximately 12,000 BTC between February 26 and March 10 of this year, spending approximately $821.7M.

Past performance is not an indication of future results

In other Bitcoin related news, Arkham has disclosed the supposed BTC holdings of Tesla and SpaceX, marking the first public identification of these assets on-chain. Tesla is estimated to hold 11.51K BTC across 68 addresses, while SpaceX’s holdings amount to 8.29K BTC distributed across 28 addresses.

Ethereum Dencun upgrade to take place on March 13

Ethereum will undergo an uncontested network upgrade (hard fork) named Dencun (combining the names of the upgrade elements Deneb + Cancun) on March 13, 2024, at approximately 13:55 UTC, at epoch 2,695,682 on the Beacon Chain. The upgrade includes several changes, most notably the introduction of ephemeral data blobs with EIP-4844, also known as “protodanksharding“, which will help reduce Layer 2 transaction fees. The Dencun upgrade combines changes to both Ethereum’s consensus and execution layers.

Optimism sells 19.5M $OP to private investor

The Optimsm Foundation announced on their governance forum that it has conducted a private sale of approximately 19.5M $OP, which are under a two-year lockup period. During this lockup, the purchaser has the option to delegate these tokens to third parties not affiliated with them for governance participation.

These tokens originate from the Unallocated section of the OP Token treasury and constitute part of the Foundation’s initial working budget, which accounts for 30% of the initial OP token supply.

$250M of discounted, locked $SOL to be acquired by Pantera Capital

According to reports, Pantera Capital, a cryptocurrency-focused asset management firm, is actively raising funds to acquire discounted $SOL from the bankrupt FTX exchange, according to a Bloomberg report dated March 7, 2024.

To facilitate this acquisition, Pantera has initiated the Pantera Solana Fund, targeting up to $250 million worth of the $SOL. The strategy includes purchasing SOL at a 39% discount, with the price pegged at approximately $59.95, based on a 30-day average price.

Investors participating in this venture must agree to a holding period of up to four years. During this time, Pantera will levy a management fee of 0.75% and a performance fee of 10%.

Although the fundraising round was initially expected to conclude by the end of February, Pantera has successfully secured a portion of the desired funds. The exact amount raised remains undisclosed, based on information from a confidential source cited in the Bloomberg report.