Major crypto developments for the week

- Second biggest returning month of 2023 in October for Bitcoin

- 15-year anniversary of the Bitcoin whitepaper

- Altcoin open interest relative to Bitcoin open interest climbs, signaling potential froth in the market

- Stablecoin 90-day change appears to be on the verge of flipping positive, signaling liquidity may be returning on-chain

- HODL waves illustrate strong belief from Bitcoin’s holder base

- US and Asia lead the way for bidding BTC as EU slows behind, shown by trading session premiums

- Bitcoin put/call skew reaches lowest level of 2023

- FTX co-founder SBF found guilty on all 7 counts

- Circle to stop stablecoin minting for individual accounts

- Celestia, a modular data availability network, has gone live

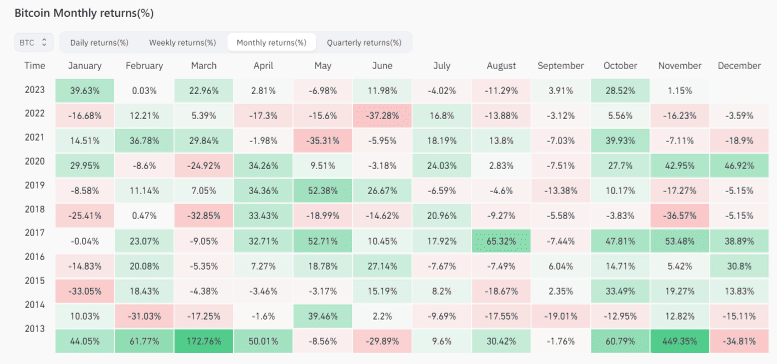

Bitcoin posts second largest returning month of 2023 in October

While history doesn’t always repeat, it often rhymes. The seasonality that we described in our first weekly report of October ended up coming to fruition, with October being the second best performing month of 2023 for Bitcoin, returning investors 28.52% over the 30 day stretch.

15-year anniversary of the Bitcoin whitepaper

While it may not be relevant to price action, October 31st marked a significant event for the Bitcoin and digital asset industry broadly, with the 15 year anniversary of the Bitcoin whitepaper. The Bitcoin Whitepaper, written by anonymous Bitcoin creator Satoshi Nakamoto, titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, described the technical functionality of the Bitcoin blockchain and laid out the framework for how to think about the open source project. Fast forward 15 years, the whitepaper has encapsulated the minds of hundreds of millions of individuals around the world and marks a shift in the mental framework for digital scarcity and the potential evolution of the monetary system forever. For this, we say thank you Satoshi!

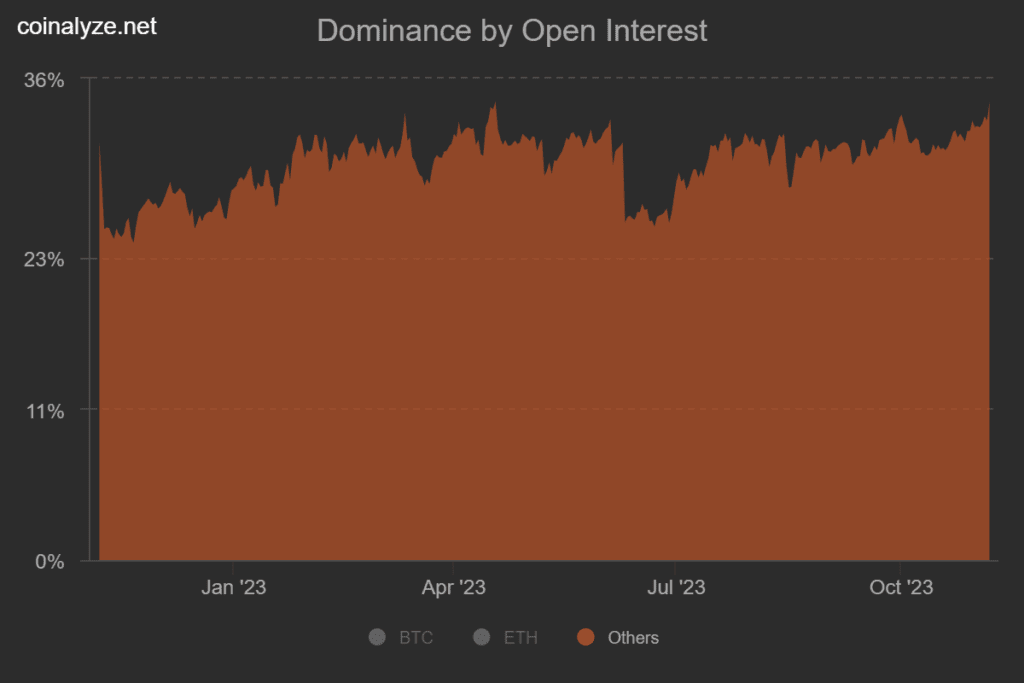

Altcoin open interest relative to Bitcoin open interest climbs, signaling potential froth in the market

One interesting metric to keep an eye on is the percentage of crypto futures open interest made up by altcoins relative to BTC and ETH. This has recently set 2023 highs over the last week, meaning there is more speculation on altcoins relative to the two leading digital assets in the futures market. While this time could be different, it is worth keeping in mind that this could potentially signal froth locally in the crypto market overall and specifically for alts.

Past performance is not an indication of future results.

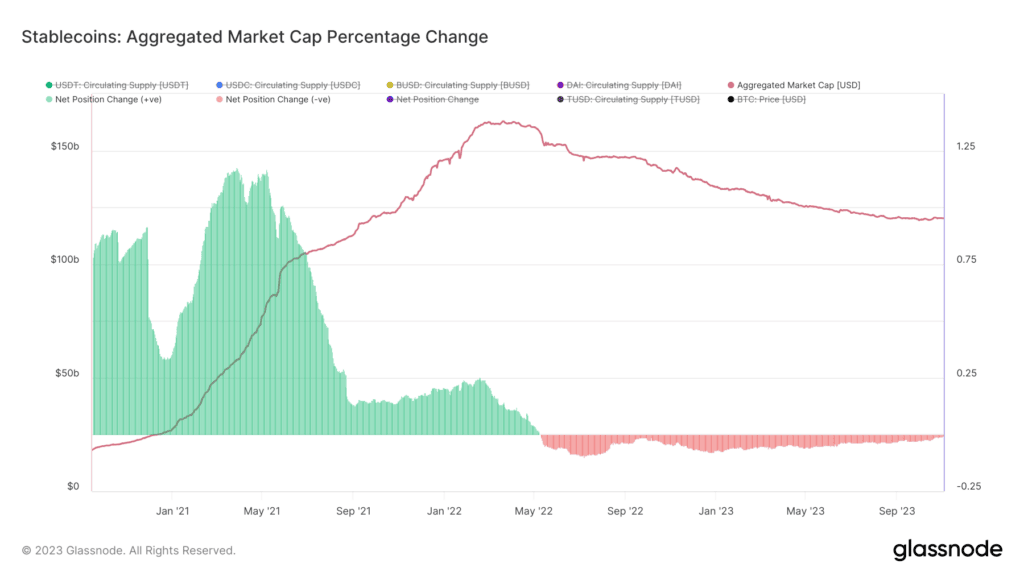

Liquidity may soon re-enter crypto on-chain through stablecoins

One interesting piece of data for longer term-oriented market participants is to look at the aggregated stablecoin supplies in crypto. The chart below totals the amount of stablecoins across all major issuers and then calculates the 90-day percentage change in that aggregated measure. As you can see, this has been creeping higher throughout the year and is on the verge of flipping positive, an indication that liquidity may soon reenter crypto on-chain through stablecoins. This will be confirmed by the metric flipping positive, which would show a net increase of stablecoins over the trailing 90 days.

Past performance is not an indication of future results.

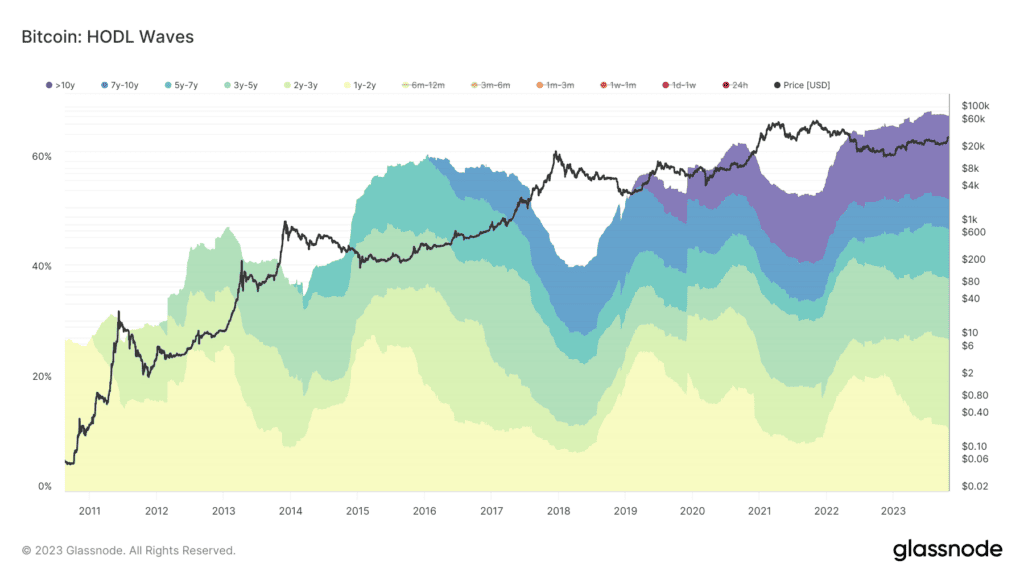

HODL waves indicate strong belief from Bitcoin’s holder base

One interesting data point to monitor is Bitcoin’s HODL waves, which visualize the amount of Bitcoin supply that hasn’t moved in set cohorts of time. Nearly 70% of Bitcoin’s supply has remained untouched in at least a year, which sits near all-time highs as over 88% has remained untouched in at least 3 months. While higher prices would incentivize new sellers, as shown during bull markets in the chart below, for the time being it doesn’t appear current price levels are enticing enough for the majority of Bitcoin’s holder base.

Past performance is not an indication of future results.

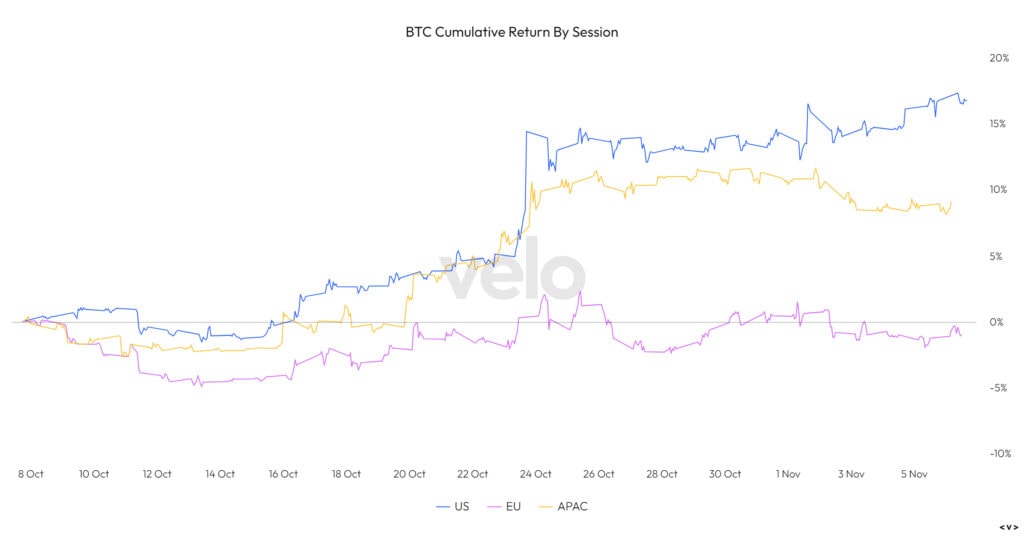

US and Asia lead the way for bidding BTC as EU slows behind, shown by trading session premiums

One interesting phenomenon that we’ve been observing over the last two weeks is by looking at cumulative returns for Bitcoin during different trading sessions. As shown in the chart below, the US has once again been leading the charge followed slightly behind by Asia. However, you can see there is a major delta between those two sessions at the EU, which has been drastically lagging behind. While this data point is not actionable alone, it gives some color as to where flows have been derived globally.

Past performance is not an indication of future results.

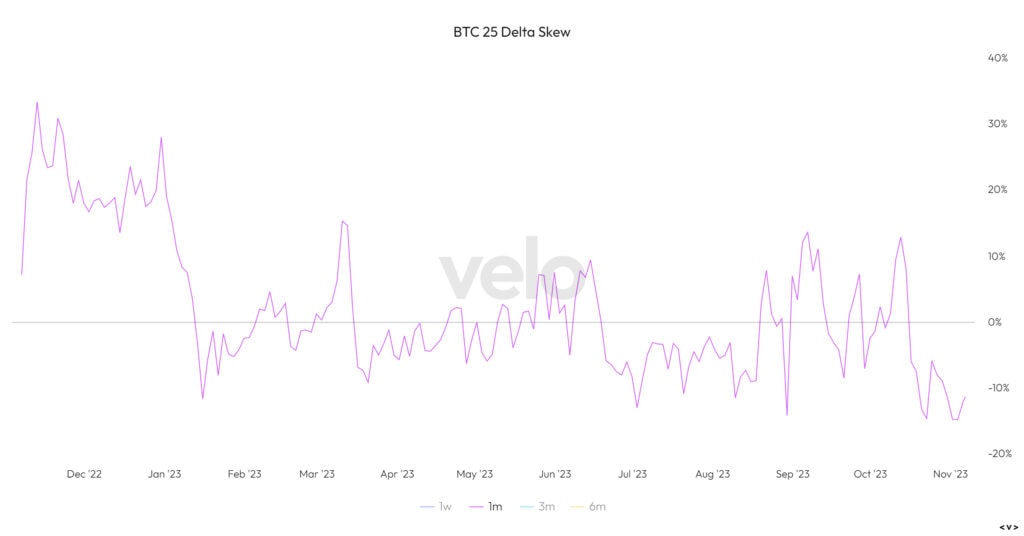

Bitcoin put/call skew reaches lowest level of 2023

Looking over at the options market we can see that the 25-delta skew for Bitcoin has reached its lowest for the entirety of 2023. This means that call options are the priciest relative to put options that they’ve been all year. This signals that market sentiment has shifted towards the bullish, and/or market participants that are positioned bearishly are hedging their positioning. This is one piece of data from the derivatives market worth keeping an eye on that locally the market may be getting overly excited in the short term.

Past performance is not an indication of future results.

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.