What’s been trending in crypto this week?

– BTC breaks $70K, and speculation heats up

– Why Dogecoin’s price spiked again

– Three signs Ethereum is poised for a rebound to $6K

– Solana sets new record for daily transaction fees

– Analyst: 60% chance Bitcoin hits $170K this cycle

– Standard Chartered bank: BTC could reclaim ATH by election day, & hit 6-figures if Trump wins

– Bitcoin forecasted to reach $200K by end of 2025

– Top analyst: Bitcoin gearing up for ‘monstrous’ breakout

– Michael Saylor reverses stance, calls self-custody ‘a right for all’

– Denmark proposes tax on unrealized crypto gains

– Dutch tax authority seeks feedback on crypto firm reporting rules

Is the Bitcoin Bull Run Here? BTC Breaks $70K, and Speculation Heats Up

Discover what this milestone could mean, and learn about the potential impact with insights from eToro’s Sam North.

Bitcoin just passed $70,000, sparking fresh speculation about a potential bull run. Investors are wondering: is this the start of a major rally? Key indicators, including rising institutional interest with futures open interest at $32.9 billion, suggest strong momentum.

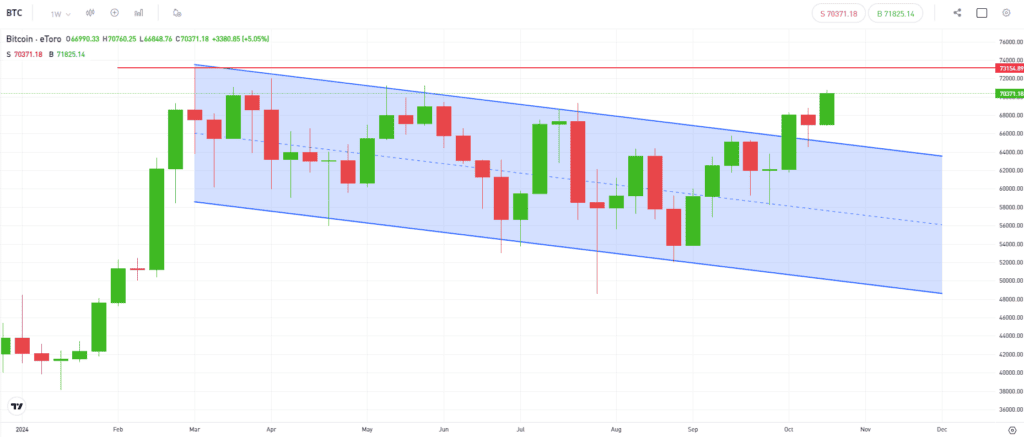

The image above shows the sideways shift since March’s all-time high, and this week’s breakout past $70,000.

Past performance is not an indication of future results

The upcoming U.S. election could also play a role, with some analysts predicting a Trump win might push BTC to $80,000 and beyond, possibly hitting $125,000 by year-end. Bitcoin’s popularity over Ethereum among institutions is growing, as seen in ETF inflows.

Bitcoin’s rise marks a shift in finance, where decentralized assets are gaining ground. Outperforming gold and the S&P 500 over multiple timeframes, BTC is increasingly viewed as a digital store of value. With central banks potentially showing interest down the line, Bitcoin could be on the edge of a transformative bull run.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

Ethereum Eyes $6,000 Rebound as Key Support Holds

Ethereum (ETH) is showing signs of a potential rebound after a recent decline, currently holding above a key support level around $2,400. This support has historically led to sharp recoveries, including a 160% surge between October 2023 and March 2024. If this level holds, ETH could target the upper boundary of its ascending channel, near $6,000, in the coming months.

Adding to the bullish outlook, Ethereum’s weekly relative strength index (RSI) has bounced off a historical support zone, reinforcing the possibility of a price recovery. Despite recent competition from other smart contract platforms and a lukewarm market response to Ethereum-based spot ETFs, these indicators suggest ETH may be gearing up for a strong comeback.

Got ETH? Did you opt in to ETH staking yet?

Dogecoin Price Gains as Bullish Signal Emerges

Dogecoin (DOGE) has surged 7% to $0.145 after Elon Musk once again mentioned “D.O.G.E.” at a Trump rally at Madison Square Garden in New York, sparking renewed buying interest. The rally is also supported by a “golden cross,” a bullish signal where the 50-day EMA crossed above the 200-day EMA, indicating potential upward momentum. Currently, Dogecoin holds above $0.141, with targets at $0.156 and $0.171 if the trend continues.

Adding to the optimism, crypto analyst Bluntz has labeled Dogecoin as “turbo strong,” suggesting it could skyrocket by nearly 60% to $0.22. Bluntz sees Dogecoin emerging as a new large-cap market leader, reinforcing the potential for further gains. The convergence of bullish technical signals and analyst confidence points to a positive outlook for DOGE in the near term.