Major developments for the week:

- Bitcoin ETF products saw a net inflow of $1.19 billion last week

- Global investment firm Franklin Templeton Investments files for Ethereum ETF

- On February 17th, ApeCoin will unlock 2.61% of its supply; a $22.47 million equivalent

- Ethereum’s upcoming network upgrade, Dencun, is set to launch on the mainnet on March 13

- Solana’s Saga phone secured 100,000 orders ($45m) in just over one month

Bitcoin ETFs experience $1.19 billion net inflows last week

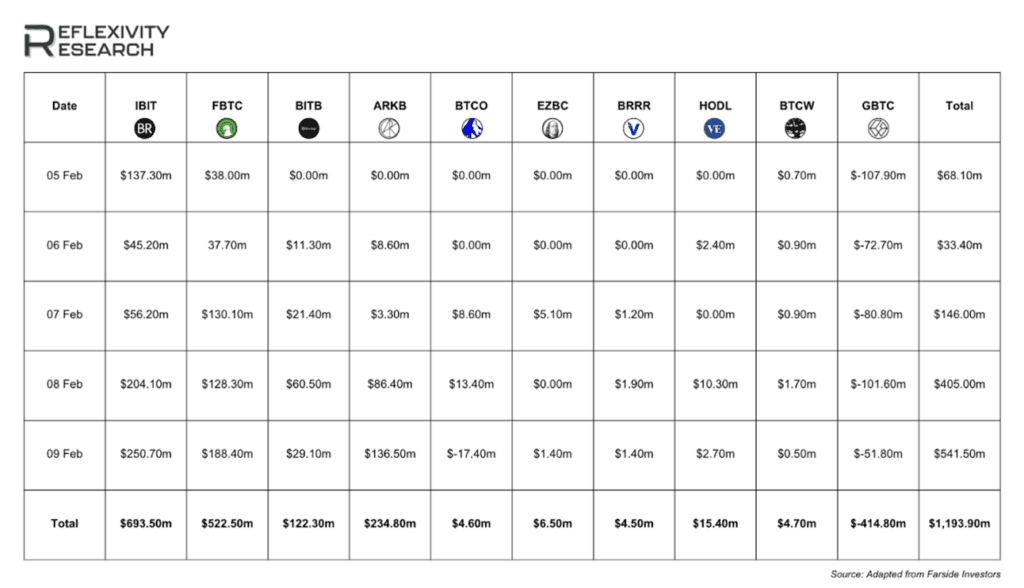

Last week, the trend of decreasing Bitcoin outflows from Grayscale persisted, with the total outflows for the 7-day period reaching -$414.8 million, marking a 50% reduction compared to the previous week. Despite these outflows, BTC ETF products experienced net inflows of approximately $1.2 billion, nearly doubling the net inflows from the week before.

Past performance is not an indication of future results

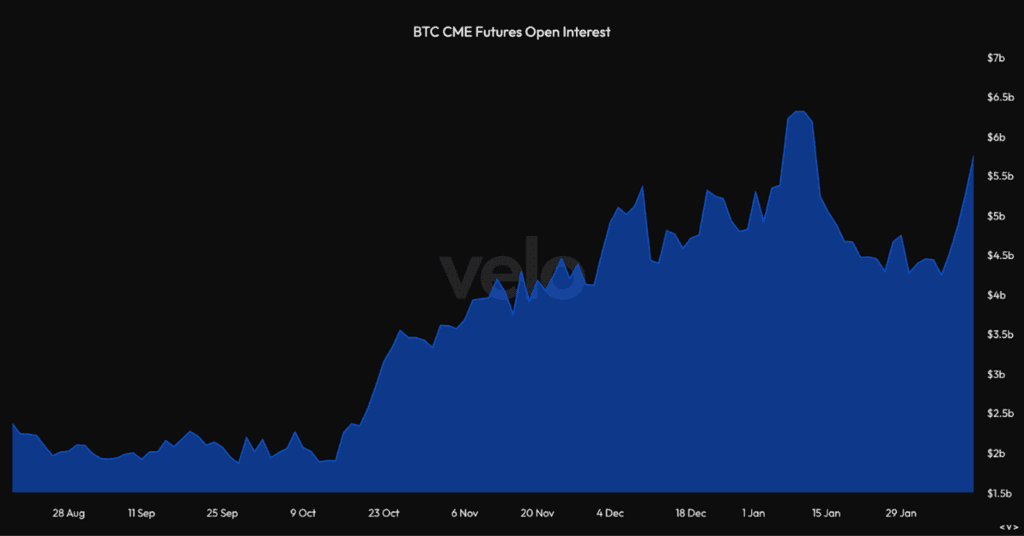

During this period, there’s been a significant increase of approximately $1.5 billion in BTC CME futures open interest, a trend reminiscent of the weeks leading up to the official ETF approval.

With the SEC’s groundbreaking approval of multiple spot Bitcoin ETFs, the Bitcoin investment scene is set for a transformative shift, expected to positively impact the entire Bitcoin ecosystem, from miners to custodians. eToro’s @BitcoinWorldWide Smart Portfolio presents an investment opportunity, providing a holistic approach that taps into the expanding potential across the Bitcoin value chain.

Past performance is not an indication of future results

Franklin Templeton Investments files for Ethereum ETF

Trillion dollar assets manager and global investments firm Franklin Templeton Investments became the ninth applicant overall to file for a spot Ethereum ETF on Feb 12.

The SEC needs to approve or deny VanEck’s Ethereum ETF application by May, without further delays. It’s also expected to address similar applications concurrently.

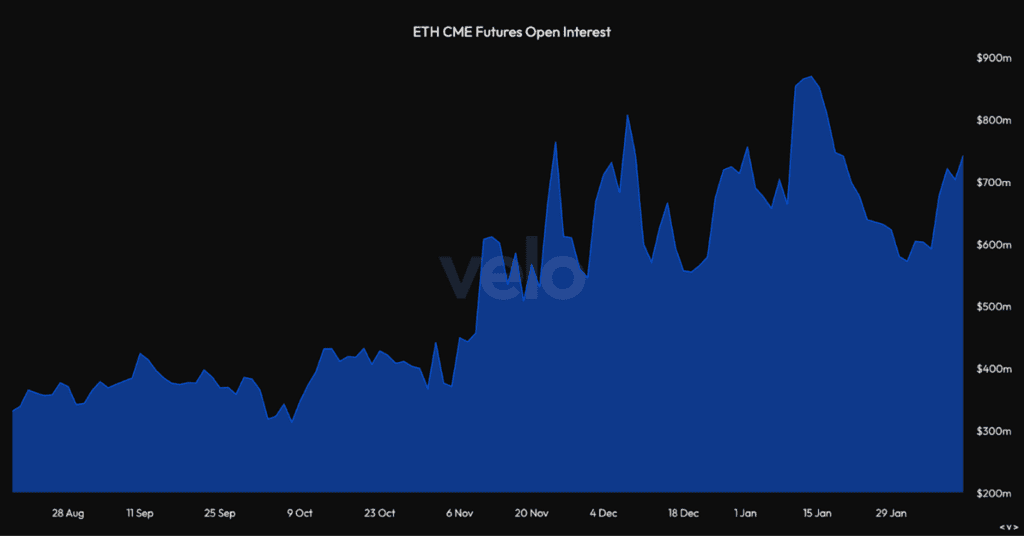

Additionally, ETH CME futures open interest saw an increase of roughly $200 million. Monitoring this metric for ETH in the weeks leading up to the ETF deadline will be intriguing, in anticipation of a similar rise in open interest as observed with BTC in the weeks before its approval.

As the pivotal deadlines for the Ethereum ETF draw near, our @Crypto-Currency portfolio delivers investors a strategic, balanced exposure to the two foremost crypto assets, ideally positioned to capitalize on both the present dynamics and upcoming advancements.

Past performance is not an indication of future results

On an unrelated note, Ethereum’s upcoming network upgrade, Dencun, is set to launch on the mainnet on March 13.

ApeCoin will undergo a $22.47 million unlock on February 17th, 2024

ApeCoin has seen some recent and significant movement, up 8.65% this past week. It’s quite possible that this is all part of the lead up to ApeCoin’s upcoming unlock event.

Scheduled for February 17th, $APE plans to release 2.61% of its circulating supply. This comprises $10.58 million for Treasury, $6 million for Yuga Labs, $3.2 million for Yuga Labs founder, $2.29 million for Launch Contributors and $400k for Charity. $APE’s vesting schedule is estimated to reach completion by June 17th, 2026.

Our @MetaverseLife portfolio is meticulously curated to capture the growth and dynamism of metaverse tokens like ApeCoin, ensuring our investors are well-placed to benefit from both immediate impacts and long-term advancements within the digital realm.

The content in this post was created exclusively for eToro by Reflexivity Research.